PacifiCorp and the California Independent System Operator Corporation (the ISO) will work together to lead the entire western U.S. toward a new energy-sharing market that will smooth the way for more reliability in power delivery and more renewables.

PacifiCorp (PINK:PPWRP), which controls two balancing authorities covering portions of six western states, and the ISO, the regional powerhouse, signed a memorandum of understanding (MOU) “to work toward creating an energy imbalance market by October 2014,” according to MidAmerican Energy Holding Company VP Jonathan Weisgall.

PacifiCorp is a subsidiary of MidAmerican Energy. MidAmerican is one of the dominant U.S. utilities in the ownership of renewables, and is itself a subsidiary of Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A).

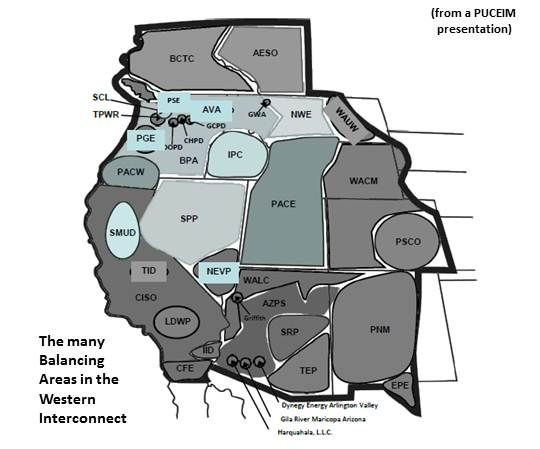

California’s ISO operates the only advanced energy market in the Western Interconnect region. Like much of the Northeast, Midwest and Canada, the ISO’s real-time, IT-optimized market automatically balances electricity deviations every five minutes by choosing the least-cost resources available.

The 39+ other electricity delivery systems in the West, including PacifiCorp, manage deviations with manual dispatches and a system of reserves.

This MOU signals a crucial shift by PacifiCorp toward the ISO’s method that could lead the way to a regional Energy Imbalance Market (EIM). A Public Utility Commission Energy Imbalance Market (PUCEIM) group composed of researchers from the National Renewable Energy Lab, the Western Governors Association, and multiple independent agencies is working on such a plan.

“This is good news for customers, renewables, integration of renewables, reliability and oversupply challenges,” Weisgall said.

Those who don’t understand how renewables are integrated into California’s system argue that their variability threatens reliability.

“If you have wider geographic areas sharing different plants, you can smooth some of that variability,” Interwest Energy Alliance Southwest Representative Amanda Ormond recently told GTM. “An energy imbalance market allows dispatch of the lowest-cost resource to address energy imbalance when a load turns on unexpectedly.”

The West’s many balancing areas are presently relatively inflexible, Ormond said, “because they have only their own reserves to call on for imbalance. They therefore keep large amounts of energy in reserve to meet potential contingencies. And the last generators you turn on are typically the most expensive.”

Without an EIM solution, Ormond said, more renewables will increase variability and the inefficiencies will become more costly. With an EIM, there is more flexibility.

Modernized grid dispatching across interconnected systems using automated tools can more accurately balance a wider array of resources , according to PacifiCorp. By capturing that wider portfolio of resources, an EIM ensures electricity shows up where and when it is needed, cutting costs and enhancing reliability.

Each new EIM participant will have a start-up cost related to the size of its participation. PacifiCorp estimates it will pay $2 million, its press release said, though existing ISO players will pay nothing. Subsequent use of the EIM will be on a pay-as-you-go basis. The ISO and PacifiCorp are working to define additional costs and benefits.

To preserve current balancing authorities’ autonomy, Ormond stressed, the western interconnect EIM would be a voluntary market. “In an EIM, if I am a utility and I have a couple of generators that aren’t running, I could offer them to the system. When someone needs energy, they are going to ask for energy. I can either allow that to be scheduled or not.”

An objection voiced by the American Public Power Association (APPA), a utilities advocate which opposes a Western Interconnect EIM, is that an absence of “critical details” about governance, market monitoring and supervision, and cost raise the concern that an EIM could “quickly evolve into a Regional Transmission Organization (RTO).”

In response to this concern, Ormond clarified that it is a market for balancing energy, not an RTO. Legal opinions suggest “an EIM can have a hard wall to prevent it leading to an RTO. It is a centralized unit for dispatch of balancing energy. It is not for capacity. If you offer a unit, it can be scheduled within the parameters you allow.”

Most importantly, she repeated, it is voluntary. “If I want to go into this market, I can. But if I get into this market and find out it is not cost-effective for me, I can step back out.”

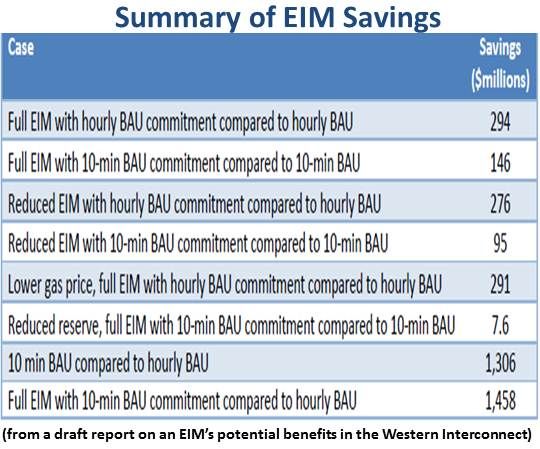

The APPA contends infrastructure and operating costs “could, in some scenarios, outweigh the estimated benefits, with the net costs potentially reaching $1.25 billion in net present value terms over the first ten years.”

The PUCEIM group, Ormond said, has preliminary cost estimates from the Southwest Power Pool (SPP) and California’s ISO suggesting an estimated $3.50 per megawatt-hour cost but further cost-benefit analyses, along with potential market design studies, are under way.

“We’ll be working in the coming weeks with the CAISO to finalize the terms of a more specific agreement,” Weisgall said. “We also continue to support ongoing regional discussions that will eventually lead to much broader, region-wide coordination, and we’re hopeful this initial step will help facilitate these broader efforts.”