Here’s a quick quiz question for grid energy storage watchers: What kind of asset is already deployed in homes around the Northeast U.S., Ireland and other cold-weather markets, just waiting to be networked and controlled?

The answer is thermal electric heaters: systems that use electricity to super-heat ceramic bricks or tanks of water, then slowly release that heat into homes via fans and pipes. About five hours of electric charging provides a full twenty-four hours of home heating -- something that usually happens on a set schedule every day, with little or no value to the grid.

VCharge has a different plan for these electric thermal storage (ETS) units, one that turns them into megawatts of grid energy resource. The Providence, RI-based startup is now tapping hundreds of its SmartBrick systems to both meet grid management needs and save customers on their heating bills. Those include decades-old ceramic heating systems in Pennsylvania, installed to tap nighttime power from the now-shuttered Three Mile Island nuclear power plant, and new systems from manufacturers like Dimplex, Steffes and Stiebel Eltron, in projects from New England to Ireland.

And because these heaters represent “embedded” storage -- that is, loads that aren’t just storing energy, but are using it for their primary purpose -- they can deliver the equivalent function of batteries and other "dedicated storage," at a fraction of the cost, according to CEO George Baker. In Pennsylvania, where the company has access to about 200 of 6,000 ETS heaters installed to absorb power from the defunct Three Mile Island nuclear power plant, VCharge is doing it at a cost of a little more than $15 per kilowatt-hour, compared to thousands of dollars per kilowatt-hour for typical grid battery projects, he said.

Underlying it all is the software, originally developed by co-founder and CTO Jessica Millar to manage electric vehicle charging, that can perform multiple grid functions at once, he said. By aggregating its SmartBricks into megawatt-sized blocks, VCharge can simultaneously deliver frequency regulation and buy and sell energy on regional markets, offer each customer a guaranteed 25 percent drop in heating bills, and still leave room for profit, according to Baker.

“We’re making money on storage right now, and not many other people are,” Baker said in an interview last week.

Take the example of VCharge’s East Stroudsburg, Pennsylvania project, where about 200 homes are enrolled in VCharge’s Aggregated Transactive Load Asset (ATLAS) platform. Each home has about 15 kilowatts worth of ETS heaters -- “literally a stack of ceramic bricks, with a well-insulated housing, and an automated fan,” Baker explained -- that sit in different rooms and serve the same purpose as old-fashioned radiators.

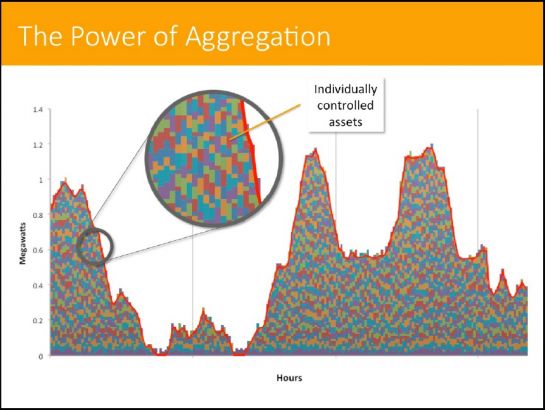

To turn this into a grid resource, VCharge starts with a day-ahead forecast of how much virtual charge-discharge capacity will be available, he said. It then stacks those units in a mosaic of sorts, to see how much of each resource can be available for how long in order to make a smooth delivery of megawatts to grid operators and energy market commitments.

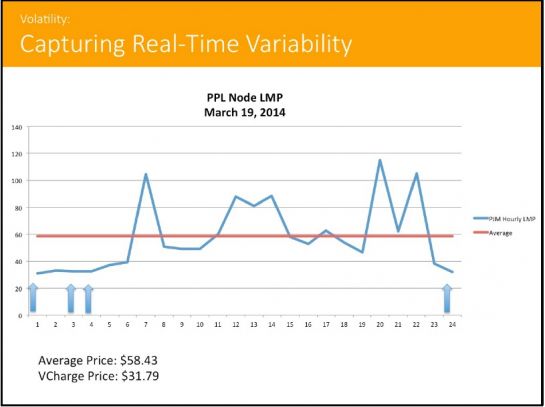

VCharge starts by putting some wiggle room into its day-ahead fleet management plans, so it can play that free capacity into energy markets. The locational marginal pricing of grid energy in PJM and New England can fluctuate wildly from hour to hour, and even go negative when there’s too much supply, giving VCharge an opportunity to get paid to heat up its SmartBricks, he said.

“We move in and out of the real-time markets,” whether it’s hourly in PJM or every five minutes in the New England and New York grid operator territories. “Our customers, of course, do not pay real-time prices. But we do, because we are the energy supplier.”

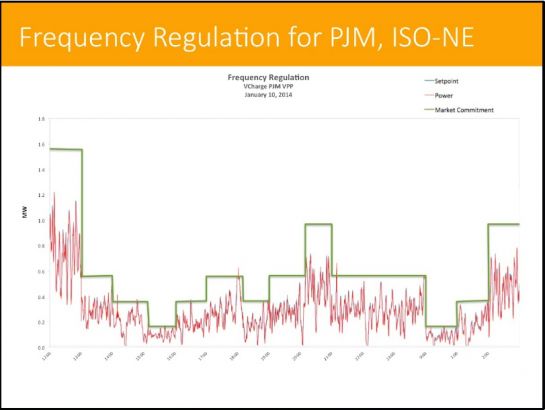

At the same time it’s doing this, VCharge is bidding into PJM and ISO New England’s frequency regulation markets, which pay extra for loads that can reduce or increase their energy consumption within seconds. VCharge has dedicated servers running a complex calculation every two seconds on the price of the bids, the amount of load it has pledged to provide, and the variables for its other energy market commitments, he said.

Because it has lots of heaters to play with, each at a different level of charge, VCharge can turn enough units on and off for about fifteen minutes to capture this extra payment, without disrupting its energy market positions or leaving a customer without heat.

Frequency regulation is traditionally provided by big coal or natural-gas-fired power plants, but demand response, energy storage and variable loads like heaters and cold storage systems can bid it into PJM’s markets -- if they can pull together 100 kilowatts of resource. Companies like Enbala Power Networks, Sequentric, Demansys and Viridity Energy in North America, and Kiwi Power, REstore and Entelios (now part of EnerNOC) in Europe, are using water pumps, cold storage facilities and building HVAC controls in a similar fashion. A few multi-vendor, multi-jurisdictional projects, such as Canada’s PowerShift Atlantic or Denmark's wind-power-to-household-heater balancing projects, are tying them together at a regional scale.

Compared to batteries and other “dedicated storage” assets, these “embedded storage” assets are almost free to instrument and manage, Baker said. But that’s only if they’re absolutely hassle-free for the homeowners and businesses that own them, he added.

“The difference between embedded storage and dedicated storage is that you have to be really smart about how you use it, because you can’t interfere with its primary purpose,” he said. “We also have an opportunity cost -- what this energy cost us, compared to the next cheapest hour we could have bought it instead.”

Beyond its 2.5-megawatt, 15-megawatt-hours of aggregation in East Stroudsburg, VCharge has a 175-kilowatt, 800 kilowatt-hour project with Concord Light in Concord, Massachusetts, and has about 40 customers and growing in Maine, where utility Central Maine Power offered rebates of $1,500 to $4,500 to entice customers to switch over to ETS heaters.

Late last year, VCharge announced its first offshore project, a 300-kilowatt trial of Dimplex heaters in university student housing and apartment buildings in Dundalk, Ireland. Utility Scottish and Southern Energy wants to use this “virtual power plant” to do frequency regulation, and to suck up excess wind power that would otherwise have to be curtailed. Another pilot with Germany-based tankless water heater manufacturer Stiebel Eltron is in the works with a municipal utility outside Dusseldorf, he said.

VCharge is doing with twelve employees what energy market players like NRG Energy, Constellation, EnerNOC and others do with hundreds of traders. The startup has raised about $3.5 million in equity, debt and grant funding, and is looking to raise $4 million to $5 million more in a Series B round this summer to help it expand further in Europe, Baker said.