We carefully monitor and parse every greentech VC investment and we've done that for the last five years. Greentech Media provides those totals to our readers and the market every quarter. Subscibers to the Greentech Innovations Report receive the gory details of that information – every deal, every investor. We also strive to log every greentech VC or PE fundraise.

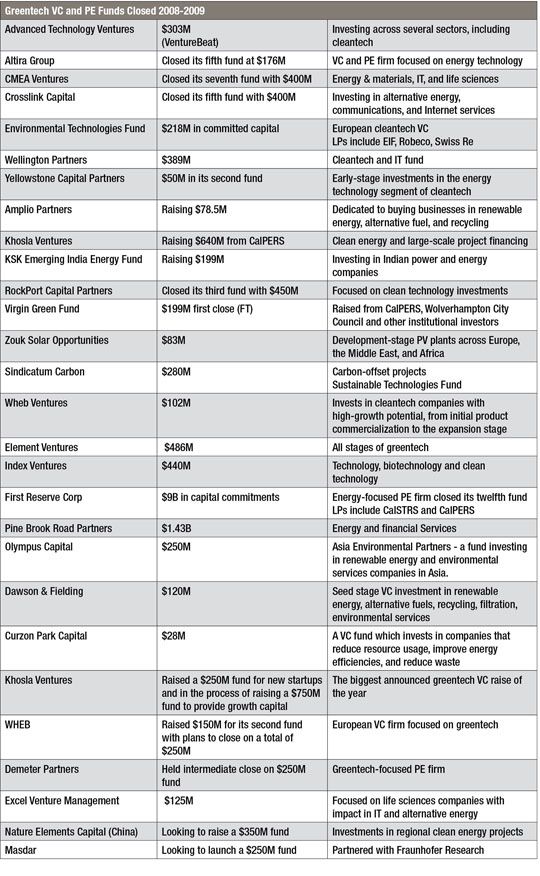

Here's a partial list of the VC and PE firms that have closed or are in the process of closing a fund over the last six quarters. The total is in the neighborhood of $5 billion for venture capital alone.

There are a lot of voices of late sounding the death knell for venture capital. The New York Times dusts this meme off every few years. One just has to have a good memory and ignore the nattering nabobs of negativity. They’re usually wrong.

Here, Michael Kanellos writes about Why VC Funding is Right for Green.

Ira Ehrenpreis, General Partner at Technology Partners had this to say: "The diversity and breadth of cleantech funds which have raised capital in this environment highlights the sustained interest by the Limited Partners to invest in the sector ... even more notable, given the difficulty of the fundraising environment in general."

On the other hand, Fred Wilson of Union Square Ventures has crunched some numbers and claims that “VC doesn’t scale.” He has determined that: “You cannot invest $25 billion per year and generate the kinds of returns investors seek from the asset class,” and that, “The number that the asset class can take on each year is around $15 billion to $17 billion. It's interesting to note that the industry raised $4.3 billion in the first quarter of 2009. That's a good thing. If we can keep it to that level, or less for a while, then we may be able to downsize and get returns back on track.”

Bill Gurley of Benchmark capital discusses the coming shrinkage of VC and gives some background on asset allocation.

There seems to be a consensus from VCs and the NVCA that $500 million IT funds are going to be feeling some pain, that the number of VC firms will dwindle, and that GP salaries might even take a hit.

But we're talking greentech here, not VC in general – and all signs point to a continued optimism in greentech VC investing. Greentech VC funds need to be bigger than an IT practice. And while we might not see $8 billion per year invested as in 2008, a healthy percentage of the total VC asset class will continue to go green. Factor in an economy on the mend and a few successful VC-backed greentech IPOs (A123? Silver Spring Networks? Tesla? EEStor? just kidding about EEstor) and we are off to the races.