Utility-scale storage is the Holy Grail to many in the industry. Some would say it is just around the corner, while others argue it is floundering outside of the realm of commercial viability.

During a recent webinar, Utility-Scale Storage: Determining the Best Investment Strategy for Utilities, a group of experts tried to tease out the drivers that are pushing the industry forward, as well as those that are holding it back.

There were varying opinions about what holds the most promise for storage on the grid, but there was also a consensus that it was time to move out of the starting gate and ramp up the real-world learning curve.

“In the past year, a lot of good things have happened,” said Imre Gyuk, program manger for energy storage research at the U.S. Department of Energy. He pointed to the deployment of $185 million in stimulus funds for storage projects and federal and state legislation.

Gyuk also highlighted many of the demonstration projects, from wind firming in California to community battery storage at American Electric Power to flywheel projects with New York Independent System Operator, as examples of technologies making forays into the field.

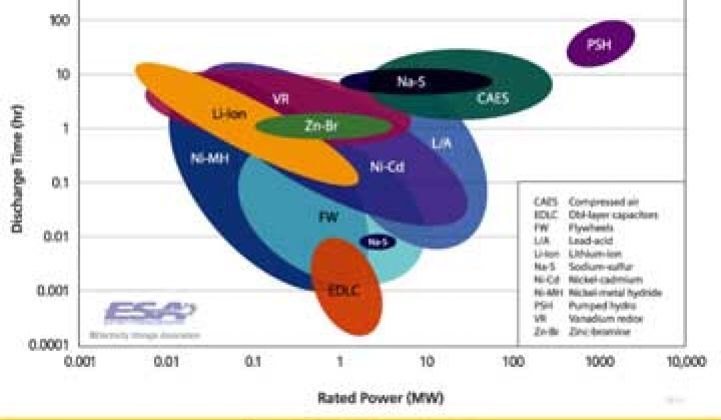

Storage, of course, is not monolithic. Flywheels, like those erected in New York by Beacon Power, only store energy for a few moments: the devices serve to balance power delivery. Batteries -- which sport a chemistry cookbook that includes lithium ion, sodium, zinc, fiberglass and other variants -- store energy for intermediate periods. For persistent power storage, there's a raft of compressed air startups like Bright Energy and SustainX, as well as energy storage via water and gravity. In general, the less time you have to store energy, the more market-ready your technology is at the moment. Further out: ammonia and liquid metals.

The leap out of the lab is significant, but huge challenges remain. The community storage projects, for example, which could someday make use of electric vehicle batteries after their useful lifespan inside the car, have some basic issues. “Are there issues with the transformer and this [battery] sitting next to each other?” asked Melanie Miller, senior project manager at Duke Energy. “It’s easy to put storage in a lab setting. You don’t have to worry about digging up someone’s front yard.”

The logistics of simply finding a suitable site for storage is just one issue. Duke also has battery storage paired with solar projects to understand how to most effectively use it for peak shaving and, in a separate project, for frequency regulation. “We’re trying to pair multiple components to get the biggest value,” she said.

More bang for your buck will be the secret for storage success in coming years. While some technologies regulate voltage and others can store more energy to dispatch at peak, experts agree that solutions that meet the specific needs of a utility are going to get deployed even if they’re not completely optimized. For project managers, it’s really important to understand those hyper-local issues to get the most out of storage, according to Rahul Walawalkar, vice president of emerging technologies and markets for customized energy solutions. He also said that round trip efficiency will be a key issue for any technology.

Others agreed that carefully weighing the different options for specific applications will be key. “When we talk about benefits, they’re entirely dependent on the time you operate and where you are,” Haresh Kamath, strategic program manager for EPRI, said during the webinar, which was hosted by Smart Grid Today. “If you’re justifying cost on those very variable targets, you have to be careful.”

Many demonstrations are already underway to better understand how storage can work best in different applications. The DOE helped fund 16 projects, including a 25 MW/3-hour battery plant for the Modesto, Calif. Irrigation District to firm 50 MW of wind. At PJM, stimulus funds helped install a 20MW flywheel storage facility. Pacific Gas & Electric is planning a 300 MW/10-hour compressed air storage facility in Tehachapi, Calif. Unlike utility projects, which can be viewed as proprietary, storage is likely to result in a lot of information sharing, as the need for it is already overdue. AEP Ohio, which is just starting a community energy storage pilot, said that all of its data from the project will be open source.

Aside from gaining a more complete understanding of how storage will impact the grid, FERC’s ruling earlier this year about pay for performance for grid storage, which requires grid operators to pay more for faster-ramping resources, is also pushing the market towards commercial viability. Walawalkar is optimistic, betting that there’d be at least a half-dozen technologies on the market by 2015. Even with changes in the market, Kamath didn’t expect to see a standardized grid-ready product until after 2015, and maybe closer to 2020. “We need to have something that’s a lot more than a science project,” he said.