Projections for utility-scale solar growth from 2020 to 2022 now exceed forecasts drafted before the Trump administration’s announcement of Section 201 tariffs, according to a new Solar Market Insight report from energy research and consulting company Wood Mackenzie Power & Renewables.

Many external factors, including global oversupply, a spike in corporate procurements and the passage of California’s SB 100 law mandating 100 percent clean energy, have helped shift the market since the January 2018 tariff announcement. Analysts say the overall health of the industry has blunted the industry’s worst-fear impacts, even if the dynamics of the market look different than they did then.

“It’s absolutely not apples-to-apples, but to me that’s a really important message,” said Colin Smith, a senior solar analyst at Wood Mackenzie Power & Renewables who covers the utility-scale market. “Not only has the market recovered and done really well despite the tariffs, it’s actually to the point where we expect more solar — at least on the utility-scale solar side — than we did in the pre-tariff conditions.”

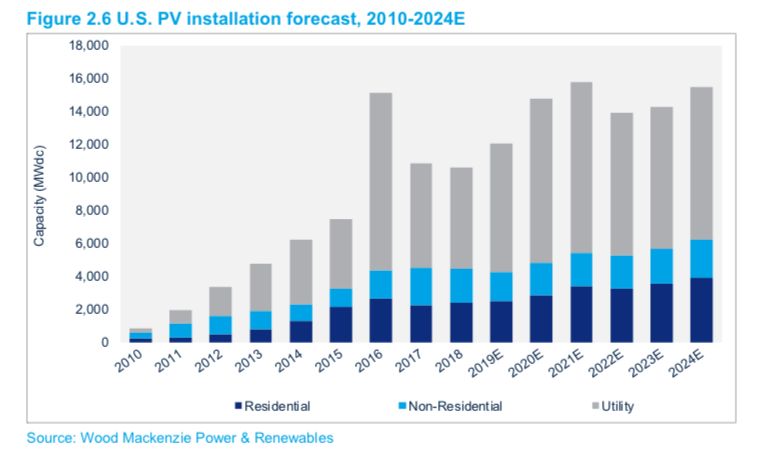

Smith said WoodMac’s Q1 2019 utility-scale forecast for 2020 is 8 percent higher than its Q4 2017 forecast, released before the administration finalized tariffs. Its 2021 forecast is 19 percent higher than the pre-tariff projection.

Though the Q4 2017 forecast came after much tariff-related market uncertainty, which Smith acknowledges “was a fairly disruptive presence,” causing developers to extend timelines or temporarily shelve projects, he also said, “we’ve seen the market recover incredibly well” since the January tariff announcement.

Notwithstanding the jumble of tariffs impacting solar systems — on modules, inverters, aluminum and steel — prices have also hit historic lows: $0.93 per watt DC for utility fixed-tilt systems and $1.04 per watt DC for utility single-axis tracking systems.

Despite the positive outlook, analysts say the imposition of tariffs and the months of preceding uncertainty still had measurable impact in 2018.

Total solar installations faltered slightly last year, according to numbers WoodMac released this week along with the Solar Energy Industries Association, with annual capacity additions dipping 2 percent below 2017 totals. Utility-scale solar saw a contraction similar to that of the overall market, down 3 percent over 2017. Smith mostly attributes the latter to tariffs, with interconnection delays for Public Utility Regulatory Policies Act projects also playing a role.

Overall, the downturn is “fairly insignificant in the context of market outlook,” according to Austin Perea, a senior solar analyst at WoodMac and the lead author on the new report. He said the slight drop in the market mostly stems from utility-scale project developers pushing operation dates from 2018 to this year, which benefits the 2019 forecast. That sits at about 12 gigawatts total.

With a a robust utility-scale pipeline of over 23 gigawatts and expected growth in coming years, analysts say the industry has proved resilient to the tariff-tied uncertainty that once gripped it. Analysts also pointed to an “unprecedented” 13.2 gigawatts of utility-scale power-purchase agreements signed last year as another indication of a bounce-back.

“We’ve just seen a tremendous amount of growth and a tremendous amount of planning in the long term,” said Smith. “Now, we’re in this position of seeing the market gain a lot of strength.”

Despite the 2018 lull, solar also continued its six-year streak of ranking among the top two sources of new generation capacity added to the grid*. In coming years, WoodMac projects an upward trajectory that will inch toward the record-breaking installations of 2016. The company’s utility-scale projections put both 2020 and 2021 above 10 gigawatts.

“We’ve seen the market rebound tremendously,” said Smith. “The 13.2 gigawatts announced this year speaks for itself.”

Correction: This sentence originally stated that solar ranked behind only natural gas. In 2015, it ranked behind wind. That year, natural gas ranked third in new generation capacity added.