What does the future hold for the smart grid’s advanced metering infrastructure (AMI) market? Given flattening smart meter shipments across mature markets globally, AMI vendors are now seeking new revenue streams, and the data analytics space is emerging as an attractive opportunity with its scalable, recurring-revenue-based model.

According to the latest report by GTM Research, Utility AMI Analytics for the Smart Grid 2013-2020: Applications, Markets and Strategies, aggregate expenditure on AMI analytics is expected to total $9.7 billion by 2020. As the market develops, opportunities will increase for vendors that are able to offer turnkey analytics solutions without the need for customized integration.

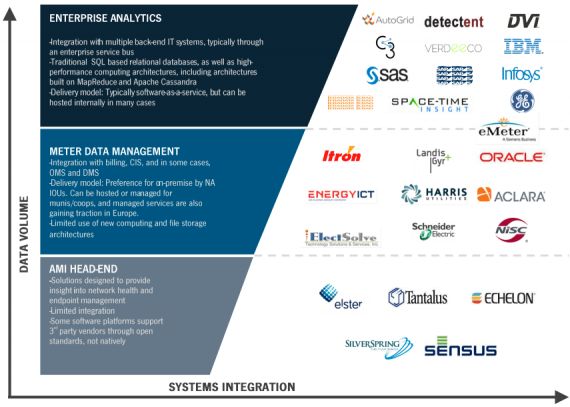

FIGURE: AMI Analytics Vendor Taxonomy

Source: Utility AMI Analytics for the Smart Grid 2013-2020

Furthermore, a clearer picture is developing of how exactly this new data can best be applied. The report examines the six highest-value applications that leverage AMI and software analytics to provide value beyond the meter-to-cash-process as determined through numerous in-depth utility and vendor interviews.

The report also discusses market drivers leading to the adoption of software analytics in several geographies, as well as providing in-depth market forecasting, competitive vendor and utility landscapes, vendor and AMI maturity rankings, and 26 comprehensive vendor profiles. AMI applications covered in the report include:

- Outage management

- Voltage optimization

- Asset benchmarking and optimization

- Load planning and demand response

- Revenue protection

-

Customer segmentation

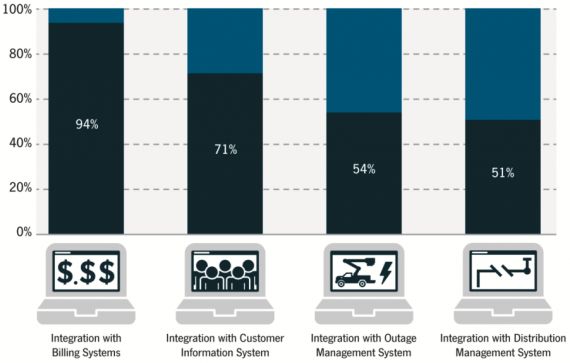

FIGURE: Percentage of AMI Projects Integrated With Selected Utility Systems

Source: Utility AMI Analytics for the Smart Grid 2013-2020

“Critical utility business decisions, both from an operational and customer perspective, are being driven by increased access and utilization of data," said Zach Pollock, report author and Smart Grid Analyst at GTM Research. "For many utilities, AMI is the first of many new sources of information that will be leveraged to decrease operational and capital spending, as well as to recover lost revenue. However, AMI data alone rarely provides actionable intelligence. It is only through additional context and analysis that maximum value can be obtained, and software-based analytics is clearly the key to unlocking this value.”

In the interim, the majority of benefits from AMI will be realized through the expanding capabilities of meter data management systems, as well as through functionality tied to specific AMI vendors at or above the head-end. However, it is important to note that several progressive utilities have begun to adopt true enterprise solutions which incorporate AMI data in conjunction with myriad other data sources. Ultimately, it is these comprehensive solutions that will extract the most value from the plethora of new sensors and monitoring devices, including smart meters that utilities will adopt through subsequent grid modernization initiatives.

For more information on the Utility AMI Analytics for the Smart Grid 2013-2020: Applications, Markets and Strategies report, please visit www.greentechmedia.com/research/report/utility-ami-analytics-for-the-smart-grid-2013-2020.