A shift away from single-entity owned and operated projects is greatly improving microgrid project economics in the U.S. microgrid market. In its newly released report, U.S. Microgrids 2016: Market Drivers, Analysis and Forecast, GTM Research provides an analysis of customer drivers and emerging ownership models, and detailed segmentations of the current market to arrive at future market expectations to 2020.

A key driver of recent growth for the U.S. microgrid market, multi-stakeholder ownership models, arose from a surge in regulated utility interest to co-develop microgrids as a “non-wires” alternative to capital infrastructure investments. “These new models can significantly reduce the capex and O&M burden on end customers. At the same time, strategically located, dispatchable generation becomes very attractive to regulated utilities targeting congestion relief and substation peak demand reduction,” said Omar Saadeh, Senior Analyst, Grid Edge, and author of this report.

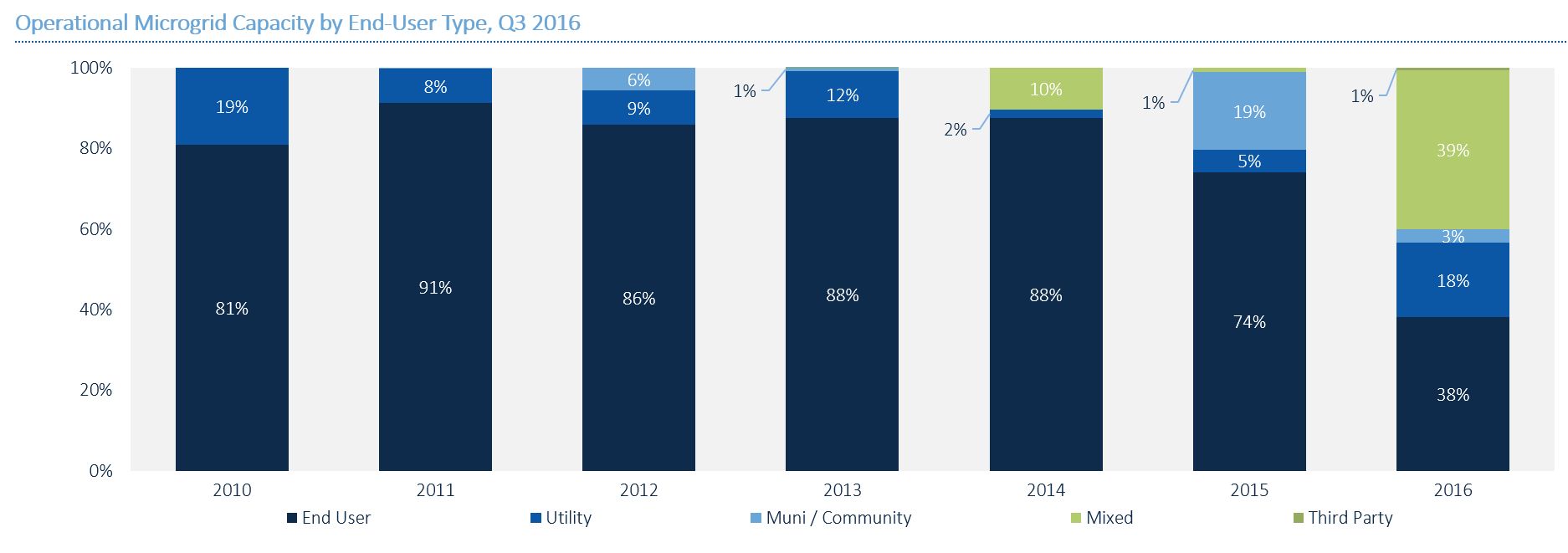

More than two-thirds of currently installed microgrids are owned by end customers, and among end customers, the military is both the current and expected leader, accounting for 32 percent of expected annual capacity in 2020. A key feature of the multi-stakeholder ownership model is its ability to provide stacked value propositions to accommodate the objectives of end-customers. Planned military development of microgrids is partly responsible for another trend in the microgrid market -- boosting use of renewable fuel types, which is expected to double from 2016 to 2020.

FIGURE: Operational Microgrid Capacity by End-User Type, Q3 2016

Source: GTM Research

“A broader affinity for socialization of energy delivery is creating an upward swing in microgrid adoption,” said Saadeh. GTM Research’s new report breaks down the various components of this key trend. As Saadeh further elaborated, “While microgrids have historically focused on behind-the-meter benefits for end customers, recent ownership trends suggest a very different future.”

Find out more about our comprehensive report on the U.S. microgrid market.

To get all of our reports on the grid edge, learn how to become a member of our Grid Edge Executive Council.