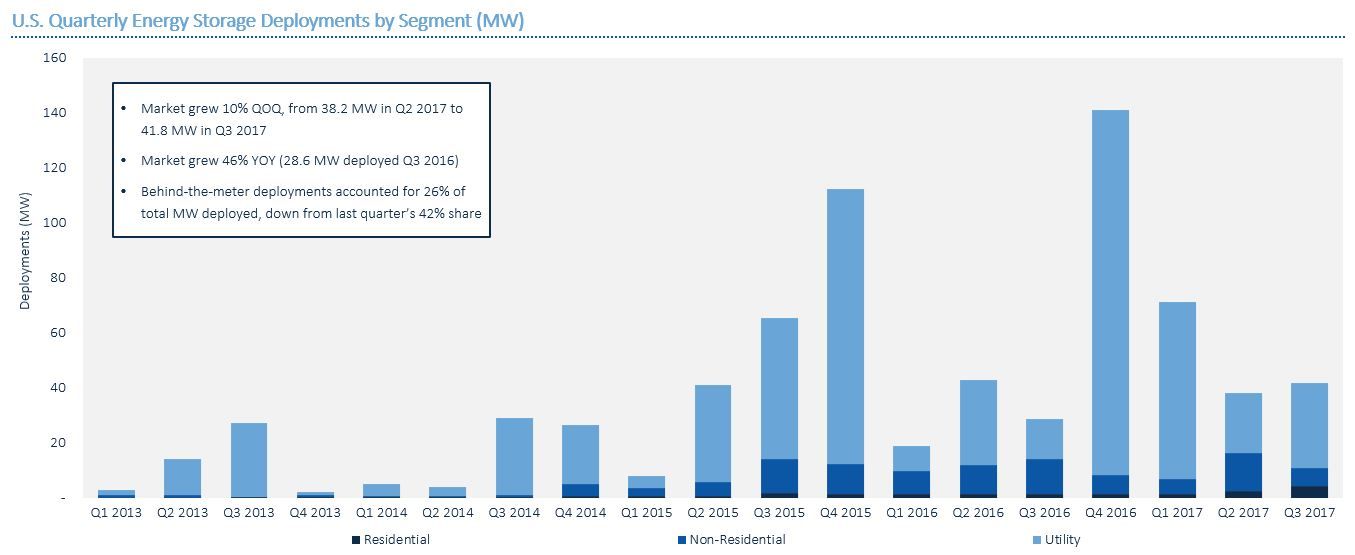

According to the latest U.S. Energy Storage Monitor from GTM Research and the Energy Storage Association (ESA), 41.8 megawatts of energy storage were deployed across the U.S. in the third quarter of 2017.

This represents 46 percent year-over-year growth and 10 percent growth over the second quarter of the year.

Source: GTM Research / ESA U.S. Energy Storage Monitor, Q4 2017

The front-of-meter segment continued to drive the greatest share of the market. More than two-thirds of total deployed capacity for the quarter came from a single 30-megawatt project in Texas. The report notes additional, but smaller, utility projects came on-line in Florida, Tennessee and Massachusetts.

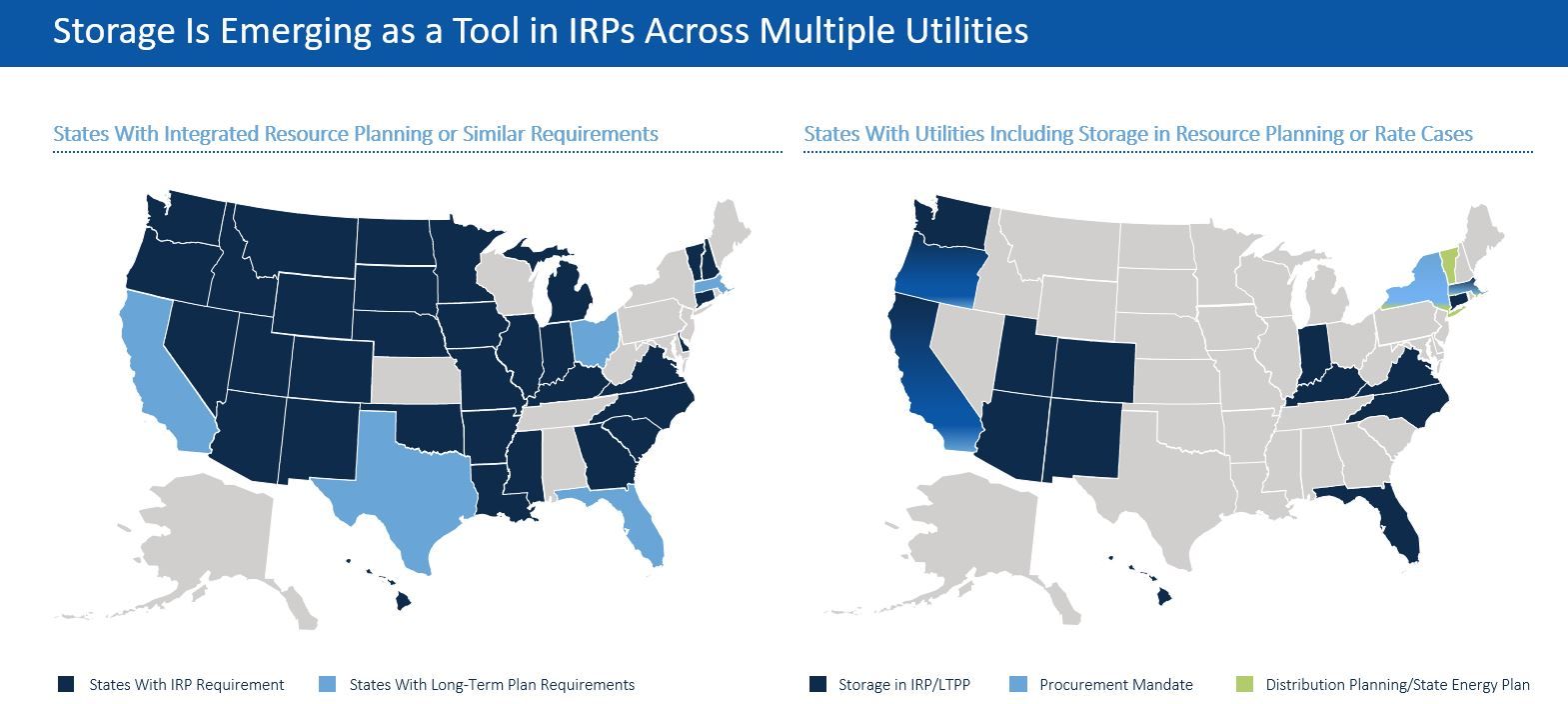

The size, use cases and geographic diversity of front-of-meter projects will continue to increase. According to the report, utilities across 14 U.S. states have included nearly 2 gigawatts' worth of storage into integrated resource planning.

Source: GTM Research / ESA U.S. Energy Storage Monitor, Q4 2017

“Energy storage is increasingly acknowledged in utilities' long-term resource planning across the country," said Ravi Manghani, GTM Research’s director of energy storage. “Many utilities that hadn’t considered energy storage in IRPs a year or two ago are now explicitly modeling hundreds of megawatts of storage into their resource stacks. It’s also encouraging to see consistent mention of multiple values that storage can provide to the grid.”

“Energy storage deployments are increasing rapidly, as more policymakers and grid planners are recognizing the many benefits of storage,” said Kelly Speakes-Backman, CEO of the Energy Storage Association. “Coupled with policies that provide a clear signal to markets, and regulatory reforms that compensate storage for the full value it offers, we see this trend continuing toward 35 gigawatts by 2025.”

The residential energy storage segment hit a new high-water mark after a surge in new deployments, largely driven by California’s Self-Generation Incentive Program and Hawaii’s Customer Self-Supply Program. The U.S. saw, on average, nine new grid-connected home energy storage systems deployed per day in the third quarter of the year, totaling 4.2 megawatts. This represents growth of 202 percent year-over-year.

The non-residential segment experienced a relatively quiet quarter in which 6.8 megawatts of energy storage were deployed. However, GTM Research is expecting a rebound for the segment in Q4 2017 and Q1 2018 as projects that recently reserved funding are expected to come on-line.

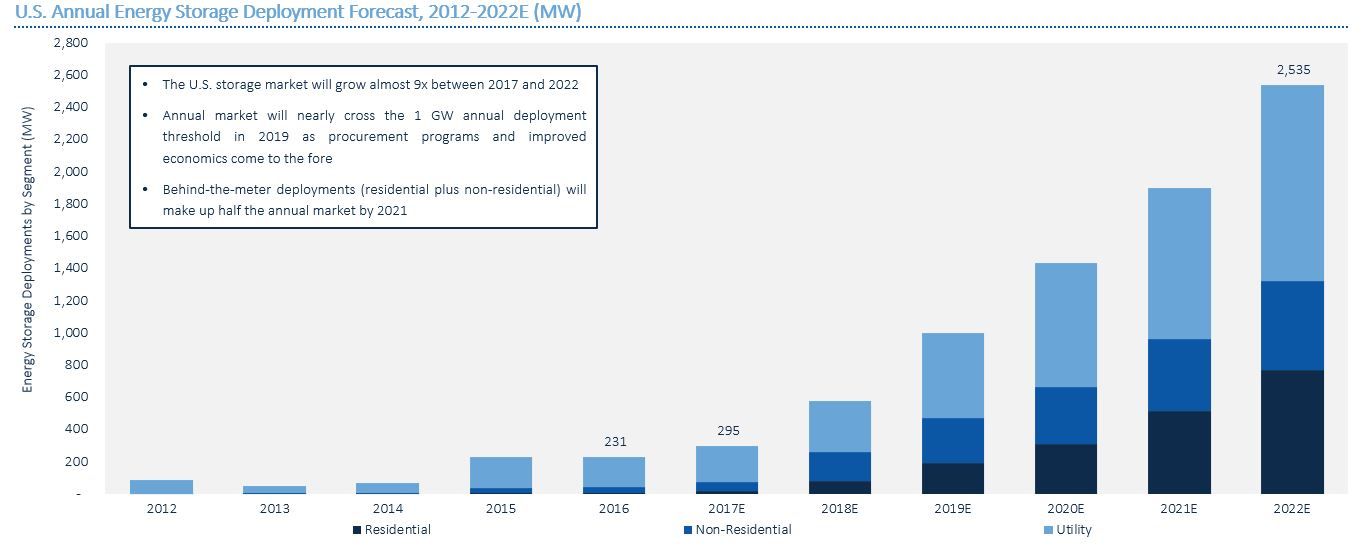

GTM Research expects 295 megawatts of energy storage to be deployed in total in 2017, up 28 percent from the 231 megawatts deployed in 2016.

Source: GTM Research / ESA U.S. Energy Storage Monitor, Q4 2017

The 95-page report offers many insights, including:

- The U.S. energy storage market grew 10 percent quarter-over-quarter, from 38.2 megawatts in Q2 2017 to 41.8 megawatts in Q3 2017

- Behind-the-meter deployments accounted for 26 percent of total megawatts deployed, down from last quarter’s 42 percent share

- California led in both residential and non-residential energy storage deployments in Q3 2017

- Annual market will nearly cross the 1-gigawatt annual deployment threshold in 2019 as procurement programs and improved economics come to the forefront

- Behind-the-meter deployments (residential plus non-residential) will make up half the annual market by 2021

- The U.S. energy storage market will be worth $3.1 billion by 2022, a ninefold increase from 2016 and a sevenfold increase from 2017

- The residential segment only contributed 4 percent of revenues in 2016 and is expected to be about 10 percent this year, though this value will grow to 38 percent by 2022 when the annual market will be worth $1.2 billion

Download the free executive summary here.

***

Need ongoing energy storage research and data? Learn more about GTM Research's Energy Storage Service.

Don't miss next week's Energy Storage Summit, which features two full days of data-intensive presentations, analyst-led panel sessions with industry leaders, and extensive networking.