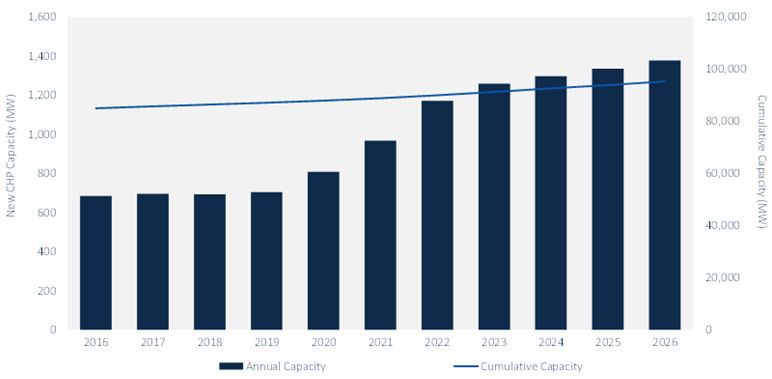

According to GTM Research’s latest report, CHP and Fuel Cells 2016-2026: Growth Opportunities, Markets and Forecast, 11 gigawatts of new customer-sited fuel-based generation will be deployed in the U.S. over the next decade. GTM Research forecasts that the cumulative U.S. CHP and fuel cell market will grow from 84 gigawatts today to 95 gigawatts by 2026.

While distributed renewables get the majority of the distributed generation (DG) headlines, solar and wind are not the only customer-sited generation sources. Today, 8 percent of all U.S. electric generation capacity comes from customer-sited CHP and fuel cells. This is almost double that of the total U.S. wind capacity, and 10 times that of distributed solar.

After a decade of limited growth due to regulatory uncertainties and a declining U.S. manufacturing sector, new incentives and corporate activity are priming the market for resumed growth. “What looks like a stagnant market on the surface is actually smoldering with a significant number of technology and fuel options, capable vendors and a new batch of customers who are ready to adopt fuel-based DG systems,” said Mei Shibata, lead author of the report. “The whole thing could light up again if implementation barriers are lowered and regulations are deemed sufficiently stable from a customer’s perspective.”

FIGURE: U.S. CHP and Fuel Cell Market Forecast, 2016-2026

Source: CHP and Fuel Cells 2016-2026: Growth Opportunities, Markets and Forecast

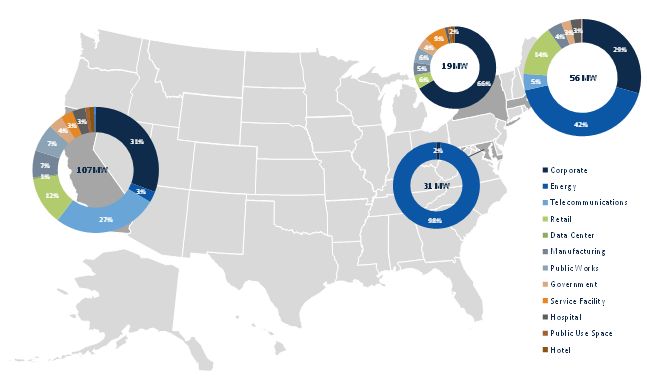

CHP adoption is increasingly driven by non-industrial customers, while corporations and data centers in a few select states continue to drive U.S. adoption of fuel cells. Today, four U.S. states make up 90 percent of all fuel cell installations: California, Connecticut, Delaware and New York.

FIGURE: Top Fuel Cell Applications in Major U.S. State Markets

Source: CHP and Fuel Cells 2016-2026: Growth Opportunities, Markets and Forecast

“Fuel-based DG has and will continue to play a significant role in the U.S. electricity system, as the U.S. grid infrastructure ages and the need for cleaner and affordable generation options increases,” says Shibata. “We may be close to a tipping point for the market to start growing again, but among new customer segments and applications.”

***

For more information, download the report brochure here.