The team at GTM Research often discuss the leaders in U.S. residential solar in terms of installers or financiers. But there are many steps in the downstream value chain, and the same companies aren’t necessarily controlling all of them. Even SolarCity, which we generally refer to as vertically integrated, sometimes uses third-party originators to acquire customers.

Thus, there are several ways to classify the "leaders" in residential solar. All are important, but the many different business models that now exist make it difficult to follow which companies participate in each stage of the process.

In order to keep track of it all, it's helpful to think about the three most important parts of the value chain.

Customer acquisition

In the past, all sales were done by the installers. However, residential solar customer acquisition is both difficult and expensive. There is now a growing group of originators (sometimes called resellers), who sell solar on behalf of an installer or financier.

These include companies like Evolve Solar, Blue Raven Solar and LGCY Power. Because of this, the seller can be the hardest player to identify, as the installer and/or financier ultimately receive the credit for the installation.

Installation

This is generally the easiest player to identify: it’s the company that actually installs the system. We also count companies like Sungevity as an installer, as they oversee the installation but use a subcontractor, similar to an EPC in the commercial sector that subcontracts installation.

All installers do at least some of their own customer acquisition, if not all of it. There are two primary cases when the installer does not make the sale: 1) when an installer like SolarCity buys customers from originators; and 2) when a financier like Clean Power Finance closes the sale (either themselves or through yet another party) and passes off the installation to a partner.

Financing

The financier is either the owner of the system (if it is financed with a lease or PPA) or the loan provider. In other words, it’s whichever firm sends customers the bills.

This is also the company that maintains a long-term relationship with the customer. There are far fewer financiers than sellers or installers, but the market is growing due a number of pure-play loan providers that have emerged.

There are three main types of financiers: 1) those that only finance (e.g., Sunnova); 2) those that install all the systems they finance (e.g., SolarCity); and 3) those that only install some of the systems they finance (e.g., Sunrun).

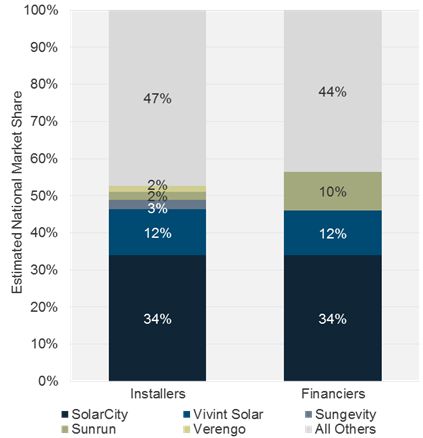

FIGURE: Leading U.S. Residential Solar Installers and Financiers, 2014

Source: GTM Research U.S. PV Leaderboard, U.S. Residential Solar Financing 2015-2020

For any given residential installation, the same company can do the sales, installation and financing -- or up to three different companies can be involved (see figure below for examples). Confusion can arise when talking about the leaders and their market shares in any one of these categories when market shares differ in another.

Take the example of Sunrun, whose financier market share is much larger than its installer market share because most of the systems that Sunrun finances are installed by partners. In contrast, SolarCity and Vivint Solar have identical market shares in the two categories because they both install and finance all systems.

Sunrun’s sales market share is potentially even smaller than its installer market share since it outsources some of its sales to originators like LGCY Power. On the flip side, Sunrun could also be doing some customer acquisition for its installer partners (I warned you -- it’s confusing).

FIGURE: Selected Residential Solar Companies and Value Chain Participation

Source: GTM Research

There are new players entering the market, and M&A is constantly occurring in each of these three areas, making it all the more vital to track their respective leaders. Part II of this series will examine some of this activity and how it is affecting the market landscape.

Edit: Here's part two.

***

Nicole Litvak is a senior solar analyst at GTM Research and the author of the recently released report, U.S. Residential Solar Financing 2015-2020. For more information,contact Zack Munsell at [email protected].