The evidence of real growth in microgrid deployments is becoming increasingly apparent.

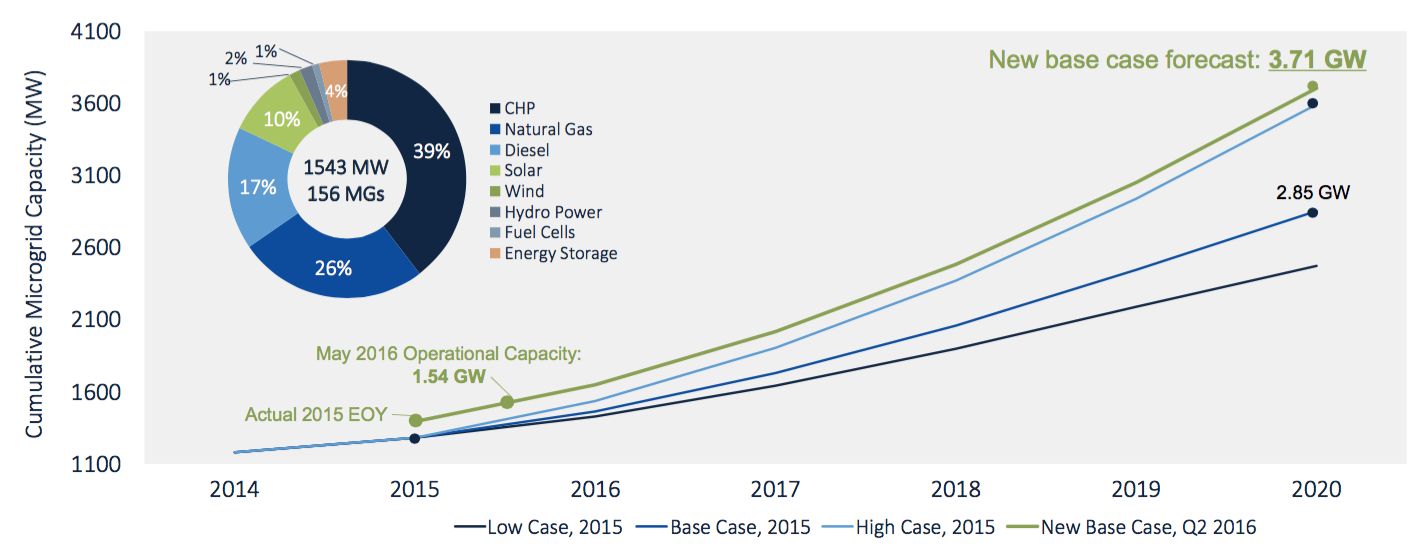

Since the beginning of the year, 13 newly commissioned U.S. microgrid projects have been deployed. A new forecast from GTM research anticipates a 30 percent increase in 2020 cumulative operational capacity -- now exceeding 3.7 gigawatts.

The underlying generation mix is also evolving. Granted, the vast majority of the market continues to depend on fossil-fuel-driven generators, but the share of renewables has approximately doubled since June 2015. Currently 10 percent of operational capacity, renewables account for 45 percent of the known capacity pipeline. Although seven of the largest microgrids account for 39 percent of today’s 1.5-gigawatt market, small to mid-sized projects are the most numerous.

GTM Research's senior grid analyst Omar Saadeh recently highlighted these trends along with others in its market update presentation at the Microgrid Knowledge Conference in New York City on May 19.

As reported in GTM Research's most recent U.S. microgrid market forecast, there are four key market trends contributing to expected capacity growth:

- Extreme weather and power outages have led states to support microgrid and reliability initiatives.

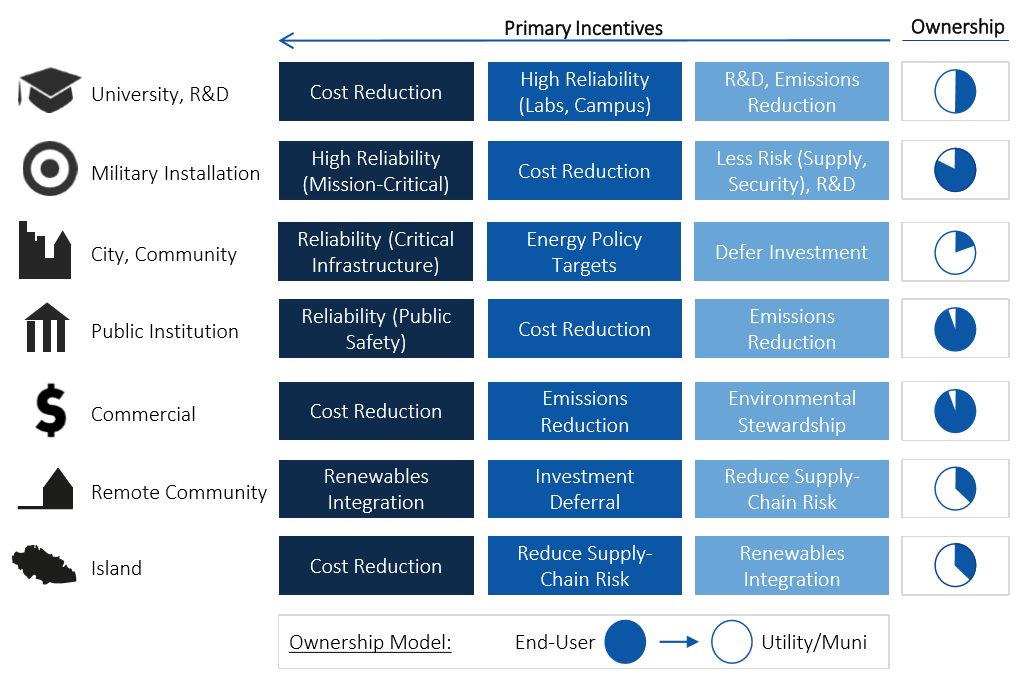

- Business models that incorporate shared ownership underscore the added value of microgrids to diverse stakeholders and interests.

- Technology vendors from diverse origins are refining their software to address the emerging need for energy management specialization. However, the market still lacks system integration experts, so strategic partnerships among providers will be crucial to providing reliable solutions.

- Energy service companies, including the branches of deregulated utilities, are more aggressively targeting commercial & industrial customers that value enhanced reliability. At the same time, regulated utilities are incorporating microgrids in grid modernization plans and testing control algorithms to better coordinate with multiple independently operated and grid-connected microgrids.

"As adoption barriers are overcome and as distribution utilities becomes more involved in feeder-specific grid enhancements, we do expect larger systems to come on-line," said Saadeh. "Co-ownership agreements between multiple stakeholders will continue to push this market forward. Beyond addressing the needs of individual behind-the-meter customers, such agreements help stack value propositions and share benefits between all stakeholders with vested interests."

Further details can be found in GTM Research’s Q2 Microgrid Market Update, which is available exclusively to Grid Edge Executive Council members. To find out more, click here.