Back in the day, “supply expansion” used to be synonymous with “capacity expansion” in PV manufacturing. More demand than you can handle? Want to expand the business and set yourself up to take advantage of growth in the end market? Then increase your factory footprint and buy more manufacturing equipment.

Certainly, there have been exceptions: some top-tier firms have been using contract manufacturers for module assembly since the last decade. But as a general rule (and to the delight of capital equipment suppliers the world over), the last growth phase of the solar manufacturing sector was characterized by growth in internally owned manufacturing capacity as the primary mechanism by which to expand revenues and shipments. It is this collective mentality with regard to expansion that plunged the supply industry into overcapacity in the period 2011 to 2013.

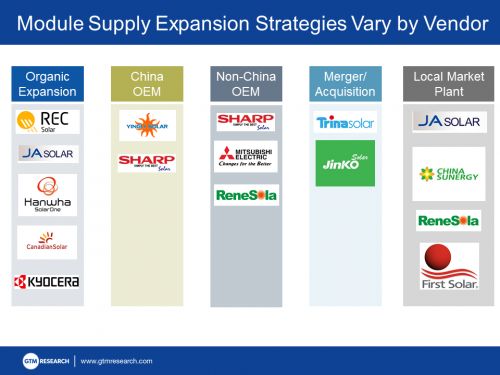

As the chart below shows, today’s supply strategies are a lot more sophisticated. This is most apparent in the case of China-based module vendors, which epitomized the old "add-capacity-first-think-later" mindset to the extreme. With the Ministry of Industry and Information in Beijing placing heavy regulations on “pure” capacity expansion projects, the imposition of trade restrictions in the EU and U.S. and supplier balance sheets still bearing bruises from several quarters of heavy losses, adding more capacity in China is no longer the sole (or even the preferred) approach of increasing supply capability; strategies now differ significantly by individual supplier.

Source: GTM Research PV Pulse

Yingli Solar, the largest supplier of modules in the world in 2012 and 2013, uses contract suppliers in China for everything from ingots to modules, and has recently dabbled in OEM arrangements with producers in Mexico and Canada. ReneSola also uses OEM partners in locations as diverse as Turkey, Poland, India and South Korea to supply modules that are free from trade restrictions and tariffs to its customers in the EU and U.S. In contrast, Trina and Jinko have moved to acquire struggling lower-tier Chinese suppliers that own relatively modern equipment at pennies on the dollar -- and while JA Solar is planning another internal expansion in China for cells and modules this year, it has also invested in a module assembly joint venture in South Africa with a local downstream firm, which it plans to use for shipments to the U.S. Meanwhile, crystalline silicon module firms based outside China have outsourced component production to an ever-greater degree since 2012.

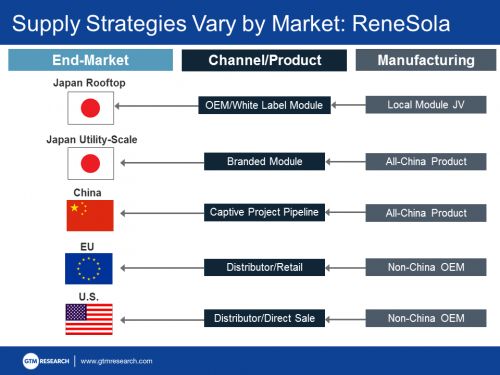

In fact, supply strategies and business models don’t just vary by firm -- as the chart below shows, even the same vendor can have markedly different strategies for different geographical markets. Take ReneSola, for example: it serves the EU and the U.S. by using OEM partners and sells its modules through distributors and direct sales to installers and developers. In China, it has followed peers such as Jinko in extending its reach further downstream into project development and sales, using all-Chinese products. In Japan, the firm has invested in an 80-megawatt joint venture for module assembly, hoping to use the appeal of domestic production to gain a leg up on its competitors in the rooftop market. Over and above all this, ReneSola is planning a broad shift from wholesale to retail sales in high-GDP markets, aiming to generate half of its sales via this approach by the end of 2014 (take a look at the company website if you don’t believe me).

Source: GTM Research PV Pulse

Ultimately, the sophistication and variety exhibited by today’s PV vendors is a sign of an increasingly complex and diverse end market, and it's one positive outcome of the overcapacity-induced perdition of the last two years. While a few firms are still prone to partaking in periodic pissing contests about how many gigawatts of factory capacity they command, the best and brightest have absorbed the lessons of the past and have overlapped long-term strategic initiatives with more opportunistic, market-focused approaches -- undoubtedly a reflection of a more mature and efficient supplier landscape. To paraphrase the German philosopher Friedrich Nietzsche (or equally, American Idol Kelly Clarkson), what has not killed today’s solar firms has made them, if not necessarily stronger, at least a lot smarter.

***

Commentary and analysis in this article were drawn from GTM Research's monthly global PV supply chain tracker, PV Pulse. For more on the Pulse, click here.