President Trump touted a claim that his new solar import tariffs have been successful at bringing back U.S. solar manufacturing in a meeting with a group of governors at the White House on Monday.

"We had 32 solar panel plants," said Trump. "Of the 32, 30 were closed and two were on life-to-life resuscitation. They were dead."

“Now, they’re talking about opening up many of them, reopening plants that have been closed for a long time,” he said.

Trump added that less than two months since the tariffs were announced the U.S. is opening "at least five" new factories. He also said that the U.S. makes "better solar panels than China."

The problem with the president's statements is that they're only partially true. While there is talk of new solar PV manufacturing in the U.S., there is no indication that a handful of plants are reopening in response to the tariffs, according to experts.

MJ Shiao, head of Americas for Wood Mackenzie, acknowledged that it can be tricky to know what counts as a solar manufacturing company, "even the industry isn't totally consistent" on that.

"With that in mind, it's tough to really follow what Trump is pointing at with closures and openings," he said. For one thing, by any reasonable definition, there were more than two -- and actually more than five -- U.S. panel manufacturers in operation as of the end of 2017.

As for new factories: "Many manufacturers will certainly explore building manufacturing capacity in the United States, but a combination of timing, market factors and the tariffs themselves will put an end to most of these schemes," Shiao and Shayle Kann, senior adviser to GTM Research, wrote in an analysis piece for Columbia University's Center on Global Energy Policy.

The "mirage" of a U.S. manufacturing renaissance

Industry watchers, including GTM, have been closely monitoring the status of new solar PV cell and module production facilities. And it's true that some companies are taking action.

In late January, Shanghai-based JinkoSolar announced that it is finalizing plans to build an advanced solar manufacturing facility in the U.S., which is believed to be the rumored "Project Volt" facility in Jacksonville, Florida. The Chinese manufacturer also announced it had signed a solar module supply agreement with a U.S. counterparty to provide around 1.75 gigawatts of high-efficiency solar modules over three years -- an endorsement that challenges the notion that Chinese companies make lower-quality panels.

"The idea that Chinese companies make technologically inferior solar products on the back of cheap labor is an outdated myth," Shiao wrote in an email. "The Chinese government has invested heavily in solar manufacturers."

United Renewable Energy, a vertically integrated PV maker formed by the combination of the three Taiwan-based solar cell manufacturers, is also planning to open a U.S.-based manufacturing facility. But the details are still unknown.

"These plants may indeed move forward," Shiao and Kann wrote. "Jinko Solar in particular has clearly done its homework and received board approval to proceed. However, the development of two facilities does not a renaissance make. Without additional, sustained policy support, the promise of a major wave of new U.S. solar manufacturing will likely prove to be a mirage."

On January 22, Trump approved a 30 percent tariff on crystalline-silicon solar cells and modules, that declines 5 percent per year over the four-year duration of the tariff. He also approved a 2.5-gigawatt exemption for imported solar cells for each year. Based on the way the tariffs are structured -- and disregarding any attempts to undo them -- Shiao and Kann find the economic advantage of opening a U.S. manufacturing plant may never materialize.

"Given the difference in manufacturing cost, a U.S. cell/module facility may already be uncompetitive with solar panels coming from Southeast Asia by the time it begins operation in year two," they wrote.

Perhaps that's why there's no indication that five factories are scheduled to launch in the U.S., as Trump claimed.

Average Selling Price During and After Tariffs

_During_and_After_Tariffs_956_346_80.jpg)

Source: GTM Research

"While we have not heard of five new factories in the works, we can be clear about what we do know: that these tariffs will raise prices for U.S. solar customers and cause thousands of Americans to lose their jobs," said Abigail Ross Hopper, president of the Solar Energy Industries Association, in a statement.

SEIA estimates around 23,000 solar jobs will be lost this year due to the import tariff.

U.S.-based SunPower disclosed just last week it will have to lay off 3 percent of its global workforce and restructure certain parts of its business in order to cope with the tariffs. SunPower is hoping the Trump administration will approve its request for a tariff exemption, but that process will take several weeks at least.

In fairness to the president, some companies are hiring. Texas-based Mission Solar Energy, for instance, recently announced it will hire 50 new staff members, but the change falls short of a U.S. manufacturing renaissance.

One of the trade case petitioners, SolarWorld Americas, confirmed earlier this year that it is continuing to ramp up hiring in the wake of the tariff decision, although progress will depend on "market developments," a spokesperson said. And on Wednesday, the crystalline-silicon solar manufacturer announced that its creditors have agreed to lend the comn additional $5 million for operations as the company builds back toward full capacity utilization and profitability.

Last week, the Oregon-based manufacturer also announced it had renewed its partnership with the nonprofit training organizing Solar Energy International, which will allow SolarWorld’s current and prospective "Authorized and Platinum Installers" to receive exclusive discounts for SEIA’s online courses. But it's unclear how big of an effect the partnership will have on SolarWorld's business.

Meanwhile, the initial trade case petitioner, Suniva, has gone quiet.

The company filed for bankruptcy last year, just before launching the Section 201 trade case, and reports have circulated since that foreign manufacturers are looking to buy Suniva, or at least its equipment. Suniva's current status, however, is unknown. GTM contacted the manufacturer for comment Tuesday but did not receive a response before publication.

Did competition put 30 U.S. manufacturers out of business?

While Suniva and SolarWorld Americas brought the Section 201 trade case, it's not true that they were the only remaining U.S.-based solar cell and module manufacturers prior to the tariffs, as Trump indicated. Mission Solar, Tesla and a few others were and are in operation.

According to Ross Hopper, Trump's statement that some 30 U.S. solar manufacturers had gone under is also "a myth" and that it was spread by Suniva.

"We took a look at those 30 companies, and they are not all cell and panel manufacturers. Even more importantly, they did not go out of business primarily because of imports," she said.

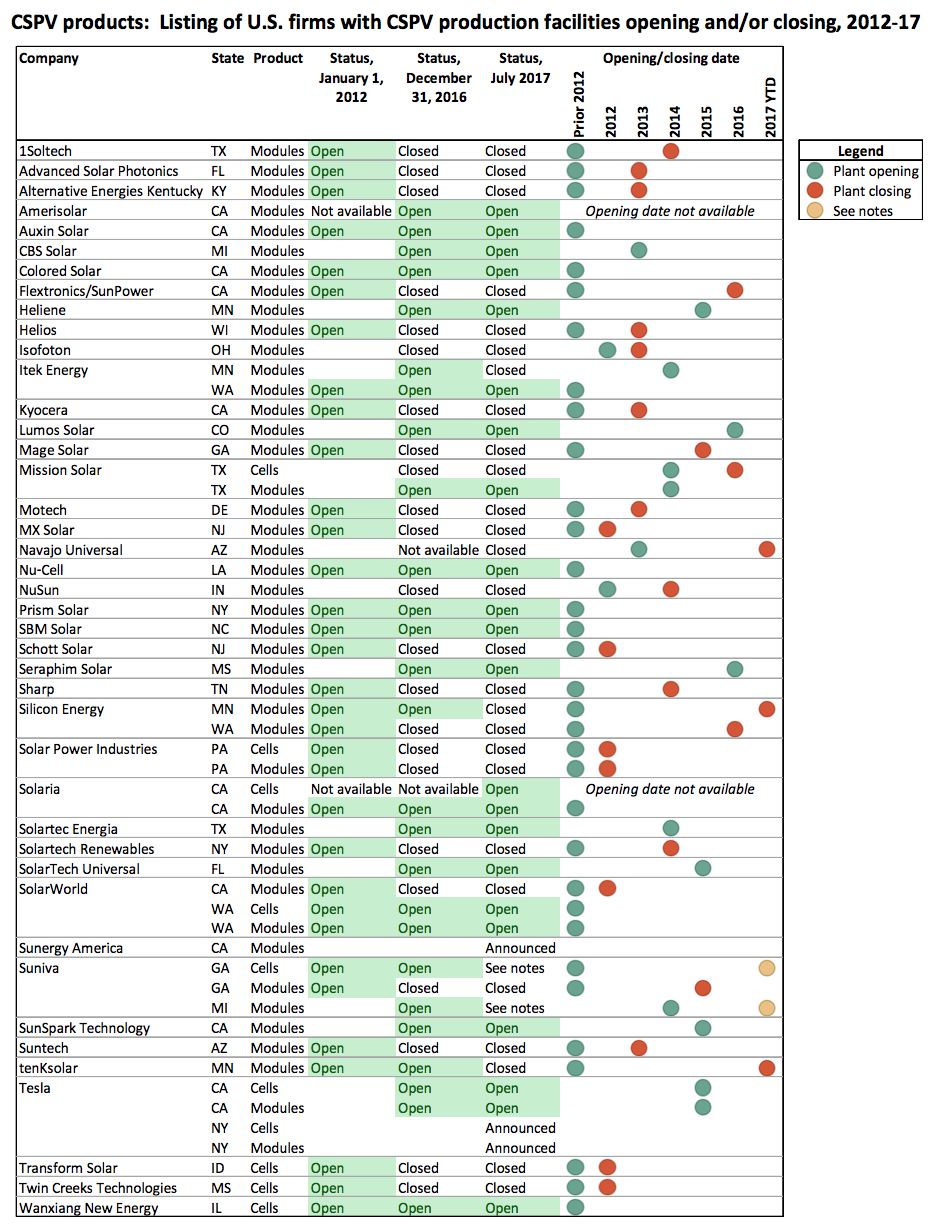

During the trade case proceeding, the U.S. International Trade Commission compiled a list of American solar PV manufacturers and found that 24 companies ceased operations since 2012, and two more closed some part of their business.

Indeed, some the companies on the list did not close as a result of import competition.

For instance, the U.S. unit of China's Suntech Power failed in 2015 after its parent company fell into bankruptcy in 2013 due to "rampant oversupply in the solar industry and punishing sanctions levied on Chinese panel producers," CNN reported at the time.

Another example, Twin Creek Technologies, wasn't a solar PV cell and module manufacturer, to Ross Hopper's point, but rather a technology company that developed cheaper manufacturing equipment for the production of solar modules, sensors, LEDs and other solid-state devices.

At least a couple of companies on the ITC's list, though, like NuSun and Silicon Energy, did put the blame on Chinese imports for their downfall.

So far there is no word of any companies on the ITC's list "reopening plants," as Trump suggested.

Source: U.S. International Trade Commission prehearing staff report

This story was updated to include additional comments from MJ Shiao and news of SolarWorld Americas' $5 million loan.