As we approach the end of 2016, small- and medium-sized businesses (SMBs) are still a “no-man’s land” for solar installers. With respected companies like SolarCity, Sol Systems, and many others trying to solve this problem, why is commercial solar still the disrespected asset class?

The U.S. non-residential solar market as a whole has been relatively flat since 2012, and the only significant growth we have seen is in large commercial (systems over 500 kilowatts) that have investment-grade credit ratings. Currently, some of the fastest-growing sub-sectors are community solar and corporate procurement by large customers like Wal-Mart, Prologis and Apple.

Missing from this solar puzzle are the small businesses, warehouses and shopping centers across the U.S. Clearly visible on Google Maps, these flat roofs serve as an enormous opportunity for businesses to save money.

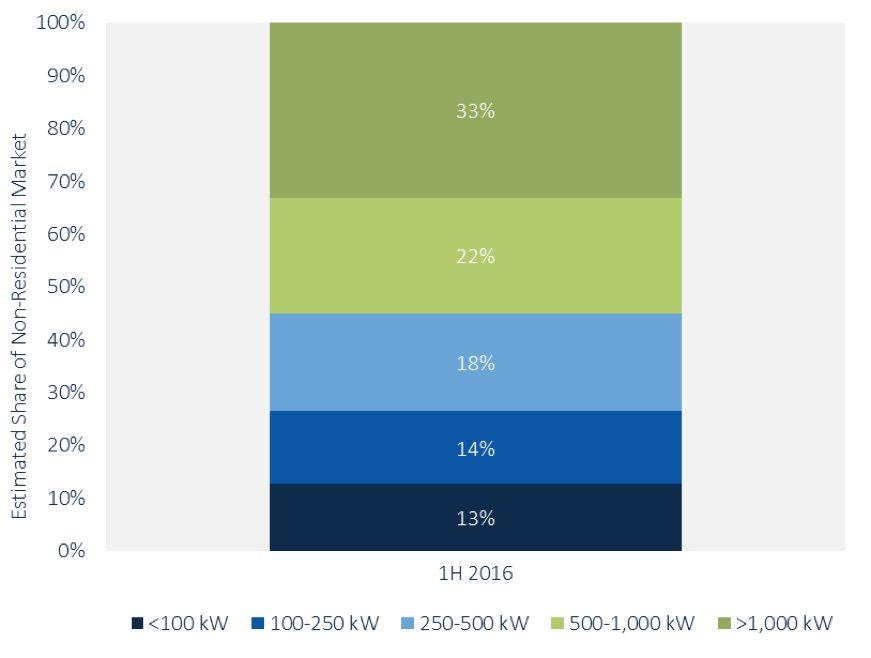

As the National Renewable Energy Laboratory noted earlier this year, rooftop solar has a technical potential of 1,118 gigawatts of capacity, with over half of this potential capacity coming from “small buildings.” Despite this, installations under 250 kilowatts account for only 26 percent of all non-residential solar capacity installed. Moreover, many of these smaller installations are either public-sector projects or are part of a portfolio installed for a large corporate customer.

FIGURE: U.S. Non-Residential Solar Market by System Size, H1 2016

Source: GTM Research

Fundamentally, this is a chicken-or-egg problem wherein the market lacks both supply (developers who put in the time and effort to sell to small- and medium-sized business customers) and demand (investors who want to hold those assets).

Due to the lengthy and costly process of customer origination, distributed solar developers have tended to focus on either residential or large commercial projects. Small commercial is left as an afterthought, mostly pursued by residential installers through incoming referrals. Leading commercial developers like SunPower and Borrego Solar either target public-sector customers or corporations. Only SolarCity has made a concerted effort to sell to the SMB market, but with little success thus far.

Local installers are best suited to originate SMB customers, as opposed to national companies, because they have a good understanding of local markets and customers. But currently, these installers have little motivation to serve that market until a PPA financing provider gives them a viable offer to buy the projects.

Likewise, tax equity investors have historically been more focused on the residential and utility markets, where they can cut a single large deal. Those that do invest in the non-residential market are fixated on national, creditworthy corporations that can sign large contracts for national portfolios (or large off-site projects) and are preapproved by banks pursuing securitization at scale. But well-run private companies shouldn’t be avoided just because it is hard for the finance industry to securitize their contracts.

One common mistake is that some solar installers take prices reserved for investment-grade credits like Wal-Mart and offer those same low PPA rates to commercial customers with private credits. That simply doesn’t work, because investors need an incentive to fund smaller projects that feature private credits, whose deals take just as much time and effort to process as the large ones. Rather, SMB customers must be charged higher rates and thus receive less upfront savings to provide extra rewards for the salespeople who chase them.

Investors must also be willing to finance and hold these money-making assets for the long term. The bet is that over time, credit rating agencies and the securitization markets will expand their definitions to give this marketplace full credit because they include solid customers who are willing to sign long-term contracts. But if that never happens, investors may be stuck holding these contracts for the entire 20-year term.

Small commercial solar is hard, and that challenge is further compounded by the fact that most companies pursue it as a side business rather than treating it as a core offering. But with over 5 gigawatts of commercial PV installed since 2012, the market is already large enough to justify the focus and dedicated resources that have led to the explosive growth in the residential and utility-scale spaces.

And with the other sectors becoming very competitive, the margins in the SMB space could be quite lucrative. Getting installers and investors to embrace this market won’t be easy, but it’s the first step toward achieving that growth.

And the next step? Bringing these two pieces of the puzzle together in an efficient and scalable way -- a topic we’ll explore in the second part of this series.

***

Nicole Litvak is a senior analyst at GTM Research covering U.S. distributed solar. Jigar Shah is the president of GenerateSolar.com, an investor in small-medium rooftop solar projects.