In the U.S. solar industry, change is the only constant.

State markets have always moved up and down with shifts to solar incentive programs. Throughout it all, a handful of states have consistently stayed in the lead. But 2013 is bringing a new set of adjustments that are slowing top markets, while also boosting "hidden" growth markets where there was previously little demand.

So where should solar installers be looking next? That's one of the topics we'll be discussing at GTM Research's U.S. Solar Market Insight conference in December. We'll also use other sessions to understand exactly how companies are expanding by looking in detail at customer acquisition strategies, the future of PV hardware, crowdfunded solar models, and key installer survival strategies.

In order to set the scene, it's important to understand the agents of change in top state markets -- as well as the opportunities emerging in previously dormant states, which we'll explore below.

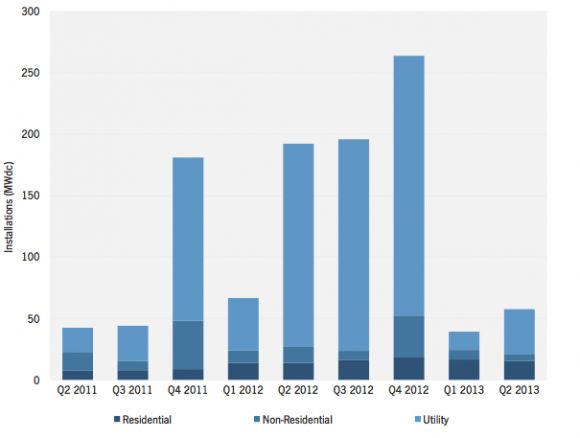

Arizona

Arizona is widely seen as the front line of the brewing war over net metering. As solar has exploded in the state, the largest utility, Arizona Public Service, has eliminated many incentives and called for replacing net metering altogether. As a result of recent changes, residential installations were down 8 percent in the second quarter of this year, while non-residential installations were the lowest in the last three years.

"The reduction in Arizona's incentives underlies the more significant challenge for utilities in established state markets -- that being how to value residential rooftop solar in the face of a declining customer base," said Cory Honeyman, a solar analyst with GTM Research who will be leading the panel on states.

Don't expect the death of Arizona's solar industry, however. Installations are becoming increasingly economic even without state incentives, so the market may rebound if net metering remains intact.

Source: GTM Research/SEIA U.S. Solar Market Insight report

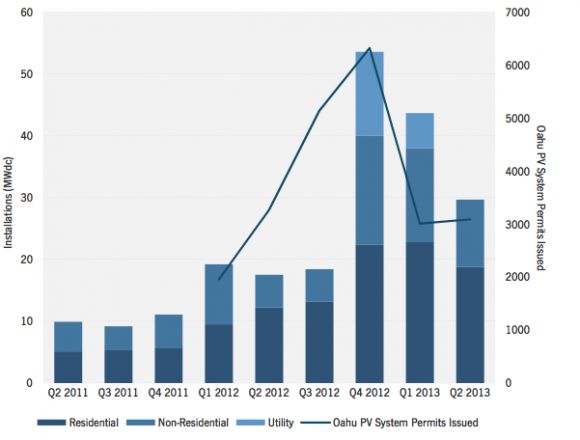

Hawaii

Driven by extremely high electricity prices and a 35 percent state tax credit, the Hawaiian solar market has exploded. But the saturation of solar is starting to cause issues for power providers. On Oahu, for example, HECO is seeing solar produce 100 percent of daytime load on circuits. The utility has since started charging $500 fees for permits, which has significantly slowed installations. On Maui, permits cannot be pulled unless the county approves each individual installation because penetration is so high. On top of these changes, Hawaii also lowered its state tax credit.

"Hawaii's market represents the looming (but far out) challenge to come for all established state markets: increasingly unmanageable PV grid saturation levels," said GTM Research's Honeyman.

However, Hawaii can still realize substantial growth if utilities figure out how to manage these high circuit-level penetrations.

Source: GTM Research/SEIA U.S. Solar Market Insight report

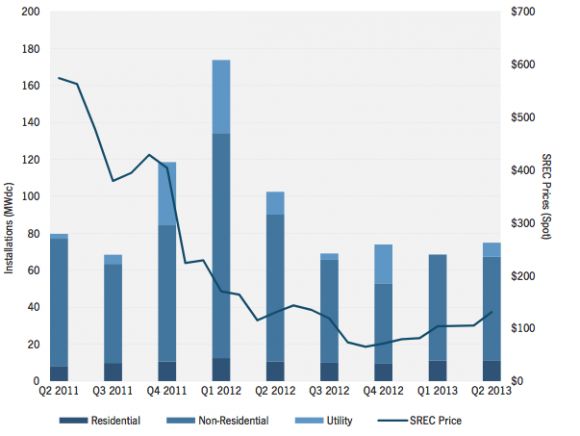

New Jersey

New Jersey has always been a volatile state as regulators shifted the industry from unsustainable rebates to a market-based solar renewable energy credit (SREC) program. After an initial boom caused by SRECs, an oversupply of credits forced demand rapidly downward in 2012. Although prices for SRECs have stabilized, installations in the state have remained flat, with the non-residential sector down 24 percent in the second quarter of this year.

"New Jersey represents a scenario of an SREC market gone wrong, with the state seeing dwindling build-out rates amidst an oversupplied SREC market that will remain so into the next year at the very least," said Honeyman.

However, given that the state has a strong renewable energy target with a revised solar carve-out, demand is expected eventually to pick back up.

Source: GTM Research/SEIA U.S. Solar Market Insight report

These issues facing top states will not kill solar demand, but they are slowing or flatlining growth in the short term.

"They are indicative of cross-cutting challenges that can face any state market as it matures," said Honeyman.

So where is activity shifting?

GTM Research has outlined five "hidden" markets, some better known than others, that are starting to emerge. These states will not necessarily take over the traditional market leaders, but they will cumulatively present a strong increase in demand.

These markets include Georgia, Louisiana, Minnesota, Virginia and Washington, D.C. Together, they may represent an additional 1 gigawatt of installations over the next few years.

Georgia will be driven by a new utility-scale program; Louisiana will be boosted by increasing state incentives; Minnesota and D.C. will be helped by new community solar targets; and Virginia will see new demand through Dominion Power's third-party solar pilot program.

These states add to the list of more mature emerging markets such as Massachusetts, New York and North Carolina.

"These relatively new growth markets can be classified under two approaches to demand: states where utilities directly procure solar for their side of the meter vs. states where utilities incentivize development of solar on the customer side of the meter," said Honeyman.

So how will these states factor into the future of the U.S. solar industry? And will they mature in the same way? Come find out at our Solar Market Insight conference on December 10-11 in San Diego.

The U.S. Solar Market Insight Conference presents data, analysis and expert forecasting on the state of the solar market in the U.S. This is the only event exclusively underpinned by the Solar Market Insight report series produced by GTM Research and the Solar Energy Industries Association. Check out the speaker lineup here, and register for the conference here. Register before November 11, 2013 to receive a $400 early bird discount.