In this week's installment of Storage+, we've got some piping-hot market intel to sink our teeth into. Don't burn yourself.

The good folks at GTM Research recently finalized their latest edition of the Energy Storage Monitor, but in the hubbub of conference travel and bankruptcy reporting, I hadn't addressed it for you. So here goes.

U.S. energy storage installations are now growing markedly faster in terms of energy capacity than power capacity. We're seeing batteries operate for longer durations, which opens up a greater range of applications than the half-hour storage that pretty much only offers frequency regulation.

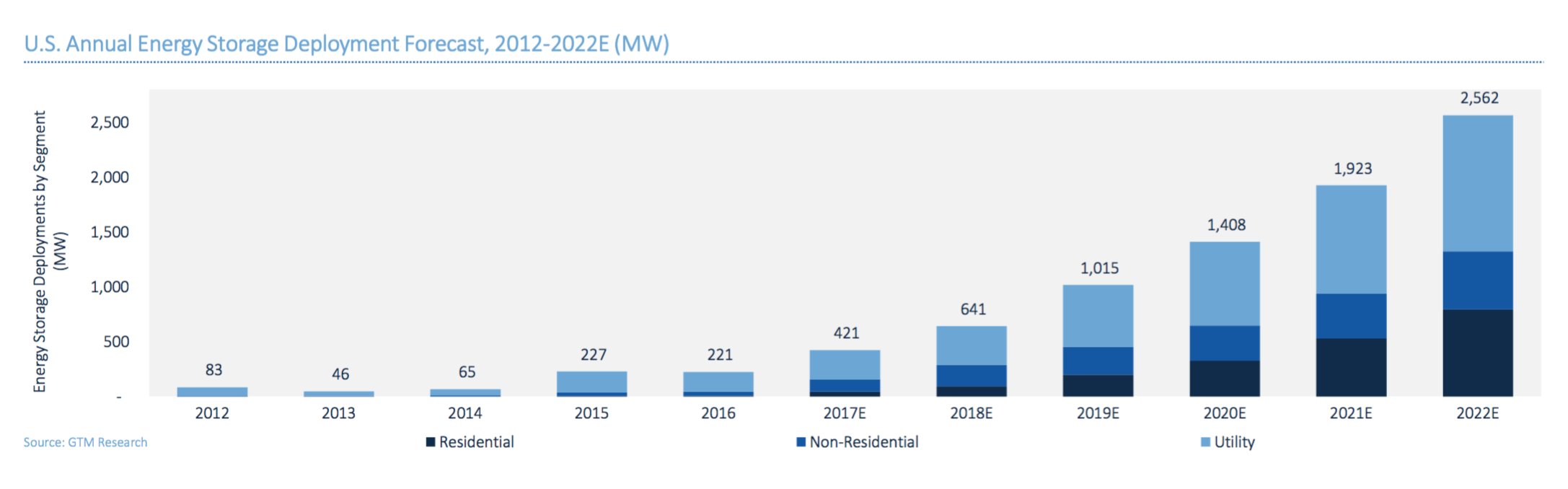

Measured in megawatts, storage deployments declined slightly from 2015 to 2016, but will grow 12-fold by 2022. Source: GTM Research / ESA U.S. Energy Storage Monitor

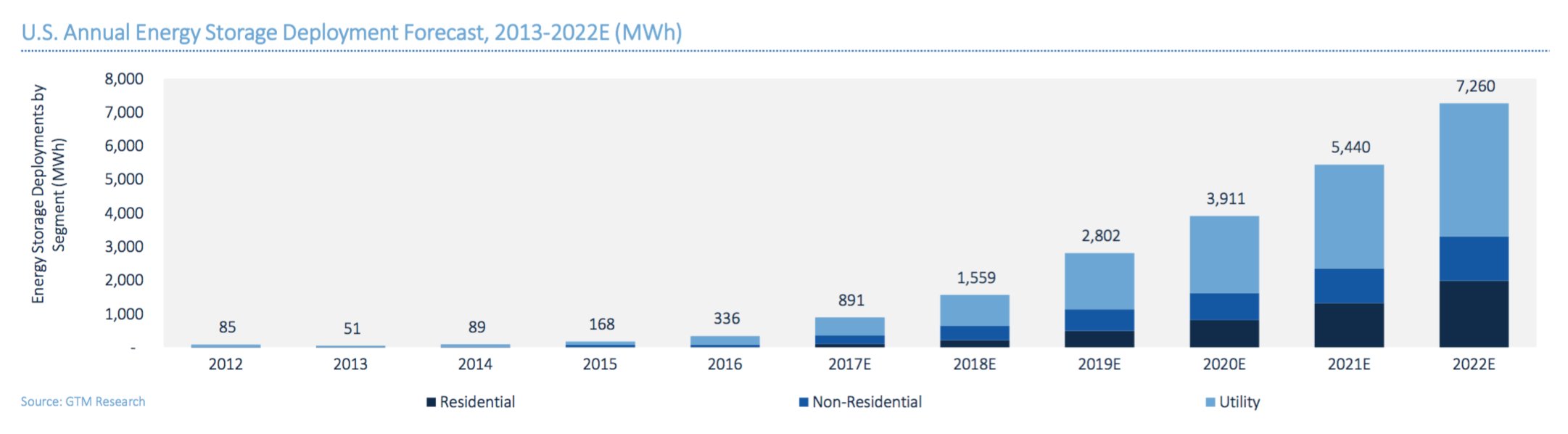

Measured by power, storage deployments will grow by a factor of 12 from 2016 to 2022, ending up at 2.6 gigawatts. If you look at energy, though, the market will grow by a factor of 22, culminating in 7.3 gigawatt-hours in 2022.

That's a pretty stunning rate of increase, beating even solar's impressive outlook. Then again, storage is still in a larval phase of existence, so its relative growth numbers benefit from a low starting point in absolute terms.

Measured in megawatt-hours, storage doubled from 2015 to 2016 and will grow 22-fold by 2022. Source: GTM Research / ESA U.S. Energy Storage Monitor

Case in point: GTM Research energy storage analyst Ravi Manghani and the team predict a tenfold increase in the value of the U.S. storage market from 2016 to 2022. If that comes to pass, storage deployments will generate $3.3 billion in revenue, which means the industry as a whole will earn just slightly more than what Google paid for Nest in 2014. Storage still has some growing to do.

To be fair, though, the tally of dollars earned by this industry fails to capture the growth of the business. That's because the success of battery makers hinges on reducing the price of batteries; and so the industry is selling more at cheaper and cheaper prices.

That dynamic created a remarkable situation last year when energy storage deployments doubled on a megawatt-hour basis from the year before, and market value in dollars grew by only 9 percent.

"Prices are dropping so fast, systems are getting more standardized -- they're getting a little more turnkey," said Matt Roberts, executive director of the Energy Storage Alliance, which partners with GTM Research to produce the Energy Storage Monitor report. "The industry keeps saying, 'We're going to do this, we're going to drive down costs,' and we’re doing it. [...] It’s promise and deliver."

Now let's talk about residential storage.

This branch of the industry plays a rather outsized role in the public imagination. That's probably because laypeople can grasp what home batteries do, while grid-scale storage really only makes sense if you're familiar with the on-demand nature of the grid's electrons, the challenges of balancing intermittent generation and what exactly a frequency regulation market does.

The U.S. residential storage industry, it turns out, deployed 907 grid-interactive units in 2016 (GTM Research doesn't track off-grid deployments, which are even more niche). That made up just 4 percent of energy storage market revenue last year.

You may recall that the initial Powerwall announcement prompted some 38,000 preorders. If that many people actually bought batteries in 2016, this would be an entirely different market. Does anyone know where those tens of thousands of missing early adopters went?

Kangaroo storage

Australia's been driving a lot of storage news lately. As I've previously reported for Squared, the sunny nation's mix of significant rooftop solar penetration and declining solar compensation has proven ripe for residential storage. The grid storage sector has been heating up too, in response to recent blackouts and rising electricity costs.

That grid instability recently prompted Elon Musk to tweet about installing a vast amount of grid storage in South Australia at a very rapid clip. A few days later, the South Australian government unveiled an energy plan to deal with grid instability by building the country's largest grid-scale battery and constructing a new $360 million, 250-megawatt gas plant for backup power.

Elsewhere down under, utility AGL has been talking up a new virtual power plant partnership with San Francisco-based Sunverge. They've installed 60 home batteries, on the way to 1,000 by next year. Sunverge has provided the batteries so far, as well as the software platform to aggregate batteries across the network, as Jeff St. John reported.

This is a coup for the company, which has deployed about 1,000 batteries to date. It also marks a step forward in Sunverge's recent reorientation from selling its own hardware to making its software available for other batteries.

"It was always our intent that we would learn from a fleet of assets, and that would inform how we build a more robust platform,” CEO Ken Munson told Jeff St. John. This pivot could allow Sunverge to scale well beyond the number of batteries it could produce in-house, by deploying its software with assets built by companies with bigger balance sheets and factory capacity.

Twin peaks

The California legislature has been considering a proposal to dial up the renewable portfolio standard to 100 percent (and here's why that's a risky way to eliminate fossil fuels). Now I'm hearing of a new proposal from Sen. Nancy Skinner and Rep. Kevin Mullin to make the existing RPS smarter.

They each introduced a "clean peak reliability requirement" to put new renewables to work in a more targeted manner. Here's how Mullin described the challenge in a press release: "As more renewables are built toward the 50 percent RPS goal, more fossil fuel power plants will be built to provide flexibility and reliability, which is incompatible with [greenhouse gas] reduction and cost-effective goals."

His clean peak bill would set a 4-hour period around the peak demand hour each day, and require the state to eventually power 40 percent of those hours with renewable power. This shifts the incentive structure from "build cheap renewables to meet the RPS" to "build storage-paired renewables that can dispatch for the 4-hour peak window." That shift should lessen the flood of surplus solar onto the grid at midday and mitigate the evening ramp from the belly of the duck.

For a more thorough look at how this works, I'll refer you to a story I wrote back in December when Arizona's ratepayer advocate proposed a similar concept under the moniker "RPS 2.0." Since then, I've been seeing variations on this concept pop up in several more states. It's likely that we'll see variations of this proposal emerge in other states as they move from the early stages of renewables adoption to long-term grid optimization.