The following is a perspective from the author of GTM Research's latest report, Innovations in Crystalline Silicon PV 2013: Markets, Strategies and Leaders in Nine Technology Areas.

DuPont and Ferro recently announced sharp sales declines within their solar-cell-metallization paste divisions. Some have misinterpreted this news to mean that either the companies are losing significant market share to competitors or that solar panel installations are slowing. While 2012 has not been a strong growth year for PV, global installations do not appear to be decreasing.

Regarding the first point, these companies, together with Heraeus and Giga Solar, are still the clear leaders in the field, and are the unsung heroes of our industry – responsible for more steady improvements in cell performance and reduction in dollar-per-watt costs than any other industry sub-segment. The sales decline in silver pastes can largely be explained by the factors discussed below:

- The typical amount of silver paste used on the rear side of the cells has dropped dramatically (up to an 80 percent reduction) by printing segmented busbars with thin paste layers rather than continuous busbars with thick paste layers. In the future, with the new TinPad machine from equipment vendor Schmid, or the SmartWire approach from Meyer Burger, rear silver can be eliminated entirely from the cell design.

- The shift from two to three busbars has greatly reduced the amount of silver needed on the front side of the cells. Since the interconnect wires are closer together, the resistive power loss in the silver gridlines (fingers) is greatly reduced, and the fingers can be printed less tall.

-

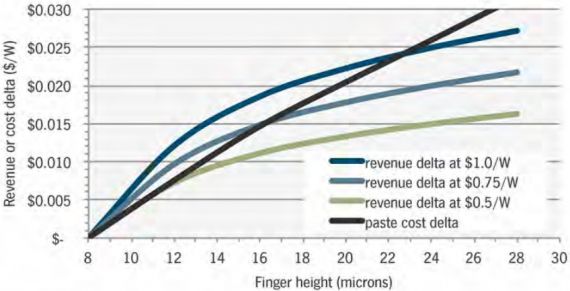

As the selling prices of cells/modules has plummeted, the “optimum” height of the fingers has also come down. Paste, screen, and screen printer vendors are still bragging about how tall they can print their fingers, and it is true that the cell efficiency still improves as the finger height is increased. However, beyond a certain point, one reaches diminishing returns, and the additional module revenue does not justify the extra paste cost.

These last two points are clarified in the figures below. The first figure shows how for a particular 2-busbar cell design, back when modules were selling at $1 per watt, it probably made little sense to print the fingers taller than 15 microns high. The additional module revenue obtained by making higher-efficiency cells with taller fingers was less than the additional paste cost.

Now at $0.75 per watt, that number is down to around 13 microns, and it will drop further in the future. The cells designed when module prices were at $3 per watt clearly need to be re-optimized.

FIGURE: Calculation of the Tradeoff Between Silver Paste Cost and Additional Revenue From Higher Cell Efficiency as Finger Heights Are Increased for 2-Busbar Cells

Source: Innovations in Crystalline Silicon PV 2013: Markets, Strategies and Leaders in Nine Technology Areas

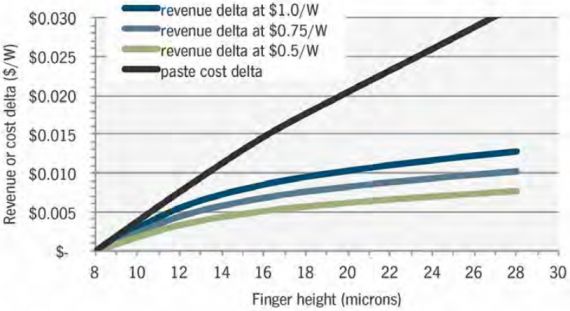

The next figure for 3-busbar cells (now the dominant cell design) shows the power of reducing the resistive power losses by decreasing the current path length in the fingers. It now makes little sense to print the fingers taller than 8 microns high.

FIGURE: Calculation of the Tradeoff Between Silver Paste Cost and Additional Revenue From Higher Cell Efficiency as Finger Heights Are Increased for 3-Busbar Cells

Source: Innovations in Crystalline Silicon PV 2013: Markets, Strategies and Leaders in Nine Technology Areas

New interconnect wiring equipment from multiple vendors will allow the finger heights to be reduced yet further and/or to enable higher cell efficiencies by adding additional wires, and in some cases by eliminating the front busbars.

- NPC: Stringer with 4 soldered wires

- Meyer-Burger/Somont: Stringer with 5 soldered wires

- Meyer-Burger: An array of round wires with no busbars in its SmartWire approach

-

Schmid: An array of round wires with no busbars in their Multi Busbar approach

Rather than printing taller fingers, the industry needs narrower fingers. This allows the fingers to be placed closer together to reduce resistive power losses in the silicon without increasing the shading losses. Plated contacts represent an attractive solution for the brave of heart, but the safer bet for most companies will be to ride the wave of improved pastes and printing equipment to bring finger widths down from around 85 microns now to less than 60 microns in the near future. Paste vendors, we need you as much as ever, but any of your customers that are “overmetallizing” their cells will likely not be around for long.

Want more competitive intelligence on the crystalline silicon PV materials market? Click here to learn about GTM Research's latest report, Innovations in Crystalline Silicon PV 2013: Markets, Strategies and Leaders in Nine Technology Areas.