A VC colleague and industry luminary remarked about the proposed IPOs of the likes of Amyris, Codexis, Tesla, Solyndra, Molycorp, Fallbrook Technologies, and other greentech firms: "When some of these inevitably belly-flop, I sure hope it doesn't set the whole sector back."

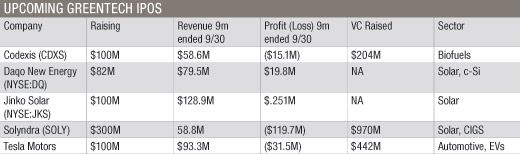

His concern is reasonable. What most of these firms have in common is a very unclear path to profitability. (Although that hasn't stopped A123 from keeping its head above water in public markets.) The two recent greentech companies with even a hint of a profitable business model, solar firms Jinko and Daqo, withdrew their IPOs because of "market conditions."

Warren Hogarth, an investor at venture capital firm Sequoia Capital, spoke at a recent industry event and said, "It won't do the industry any service if we put companies out that run up in the first three months and then collapse soon afterwards." Hogarth added that "companies are filing [for IPOs] and there is optimism for those companies, but there is also a pervasive sense of caution," concluding: "It's earnings that matter."

We repeat: "It's earnings that matter."

If a number of these companies actually do make it through the IPO window, will their propensity for eroding shareholder value be the proverbial turd in the greentech punchbowl? Or is there a wave of greentech IPOs with healthier optics on the horizon?

Amyris and Codexis: Biofuel Belly-Flops?

Amyris filed their long-rumored S-1 last week. Amyris feeds sugars to custom microbes which in turn exude hydrocarbons that are then converted to fuels or industrial chemicals. The first product out of the company was an artificial version of artemisinin, an antimalaria drug that drew millions in support from the Bill and Melinda Gates Foundation.

We summarized Amyris' background and risks here. But here are the real kickers in the list of investment risks:

- They have no experience producing products at the commercial scale.

- They have no production agreements: “While we are in active discussions with several contract manufacturers, we do not currently have definitive agreements with contract manufacturers that would provide the production capacity required to achieve commercialization of our products in 2011 at the volumes we intend, or at all.”

- They have a limited operating history and have not generated revenues from the sale of any of their renewable products. To date, their revenues have consisted of sales of ethanol produced by third parties, funding from third-party collaborative research services and government grants.

That last bit bears repeating: All of their revenues to date have been from the resale of other vendor's products, not from the sale of their own renewable products. More on this from the S-1: "To build the capabilities we will need to import and distribute our renewable fuels products in the U.S., we have established our subsidiary Amyris Fuels, LLC. Amyris Fuels currently generates revenues through the sale of third-party ethanol to wholesale customers through a network of terminals in the southeastern U.S.”

That seems to make them a distributor. A money-losing distributor, that is.

The company had 2007 sales of $6.1 million, 2008 sales of $13.9 million and 2009 sales of $64.6 million. The company lost $11.7 million in 2007, $41.8 million in 2008, and a whopping $64.4 million in 2009. To date, Amyris’ cumulative deficit stands at $120.4 million.

***

Markets will be monitoring Thursday's anticipated IPO of biofuel maker Codexis to divine Wall Street's appetite for greentech.

Codexis has tried to go the IPO route before. The biofuel-catalyst developer filed and cancelled its IPO plans back in 2008. It's trying again, albeit with a bigger pool of customers and some more revenue. The firm posted a $20 million loss in 2009 despite a 64 percent rise in revenue to $83 million.

Codexis is funded by CMEA, Shell and CTTV, the investment arm of Chevron. The firm's biocatalysts are used in the pharmaceutical industry, but the greentech angle is the deal that Codexis has with Shell to produce commercially viable biofuels from cellulosic biomass. Other green applications for their product include carbon management, water treatment and "green" chemicals. Codexis has the advantage of looking at several target markets and the luxury of some very large and important customers.

In the past, we've seen first-generation biofuel firms like Renewable Energy Group, a biodiesel producer in Ralston, Iowa, cancel its plans to raise up to $150 million, and Seattle-based Imperium Renewables, also a biodiesel producer, set aside its ambitions for a $345 million IPO.

Codexis set the terms of its maiden offering in late March at six million shares selling for between $13 and $15 a share, giving it a market cap of up to $509 million. Vinod Khosla, an investor in Amyris, has voiced concern that "too many companies have filed and we will get a nanotech moment." He's "much more concerned about premature IPOs" and cites Codexis as "pretending to be a biofuels company when it is an R&D firm."

Solyndra

Solyndra's innovative photovoltaic glass cylinders use thin-film CIGS in a relatively low-efficiency configuration. Several of Solyndra's VC investors have told me that the real value for Solyndra is in the cost savings in the Balance of System. Will the institutional investors who drive the success of an IPO buy the Solyndra BS, I mean BoS story? Especially when the cost per watt of c-Si and FSLR CdTe continues to fall, and the cost of Solyndra's product seems somewhat bloated?

A lot rests on the shoulders of Solyndra: the perception of the viability of CIGS technology, the perception of the viability of VC investment in solar manufacturing, and the skill of the DOE in picking technology winners.

GTM Research analyst Shyam Mehta did a masterful job at dissecting the Solyndra situation here. We looked at the Solyndra S-1 here. And we reported on the auditor's concern over Solyndra's business fundamentals here.

Tesla Motors

Like Solyndra and A123, Tesla is a "story stock." And like A123 and Solyndra, Tesla anticipates "continuing losses for at least the foreseeable future." A123 and Tesla stand as proxy for the EV vision.

Tesla reports having sold 937 cars through December 2009 to customers in 18 countries.

The company has booked 2,000 reservations for the $57,400 Model S, the all-electric sedan that enters volume production in 2012. According to the SEC document, the Model S will offer a variety of range options, from 160 miles to 300 miles on a single charge.

Major investors in Tesla are Elon Musk, Al Wahada Capital, a fund owned by the power and water authority of Abu Dhabi and Blackstar Investco, an investment arm of Daimler.

Michael Kanellos reported on the Tesla IPO numbers here.

Will institutional investors back a lossy luxury car vendor with an unhealthy dependence on government loan guarantees?

Fallbrook Technologies

Fallbrook Technologies of San Diego, a startup building an innovative transmission for vehicles and wind turbines, had $11.7 million in losses in the nine months through Sept. 30, 2009, and a net loss of $10.6 million in 2008, which was up from a $6.6 million net loss in 2007 and a net loss of $6.3 million in 2006.

The startup filed for a $50 million IPO.

***

Many, perhaps most, successful technology IPOs have come from companies that were not yet profitable at the time of their initial offering. Institutional investors and the public bet on the eventual long-term profitability of the company. All of the above-mentioned IPO aspirants are targeting enormous markets, whether they be solar, automotive or fuels. There is not a lot of market risk.

But the risk for companies targeting the energy sector is in scaling big and fast and in getting costs down to meet the commoditized nature of these markets for electrons, miles per gallon, and dollars per gallon. It remains a spectacular challenge.

I had a long discussion with a another pioneering greentech investor about these potential IPOs. In his view they parse along two lines: Solyndra going public with a story and revenue based on their core product, solar panels, while Amyris, Codexis, and Tesla are going public based on revenue from an interim and non-core competency product with only the promise of revenue from their core product.

Institutional investors can judge Solyndra by their current product, cost model and profitability trajectory.

But Tesla's hope is their Sedan, not the Roadster. Amyris' story is repeatable sales of chemicals or fuels, not trading ethanol. And Codexis story is a biofuel catalyst, not revenue from development contracts.

So, as we watch the thaw in the financial markets -- are the institutional investors, the "buy side," willing to overlook the lack of revenue from the core product and let the concept come through? Even if the real product and real profits might be years away?

And the other question of course is -- how much damage can the failure of one or more of these immature IPOs cause in the minds of institutional investors that will impact the next wave of greentech IPOs?

Other greentech firms that have a chance at the public market in 2010 and 2011 are LED maker Bridgelux, PV micro-inverter firm Enphase Energy, CIGS PV manufacturer MiaSolé, natural gas-powered fuel cell firm Bloom Energy, and smart grid player Silver Spring Networks.

It will be an interesting year. And possibly a good year for short sellers.