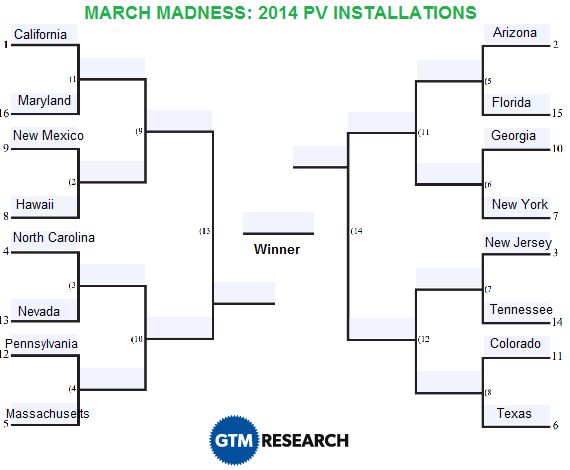

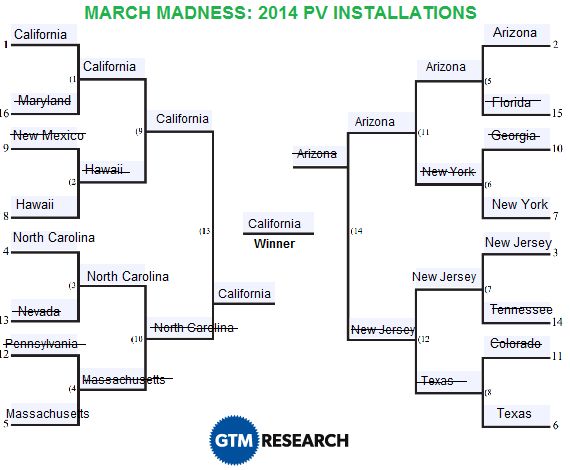

This past weekend brought Selection Sunday to the GTM Research offices. And no, we're not talking basketball. We tapped into the U.S. Solar Market Insight report to seed the top solar states based on 2014 forecasted PV installations.

Solar analyst Cory Honeyman joins me as we look at some key matchups in the bracket.

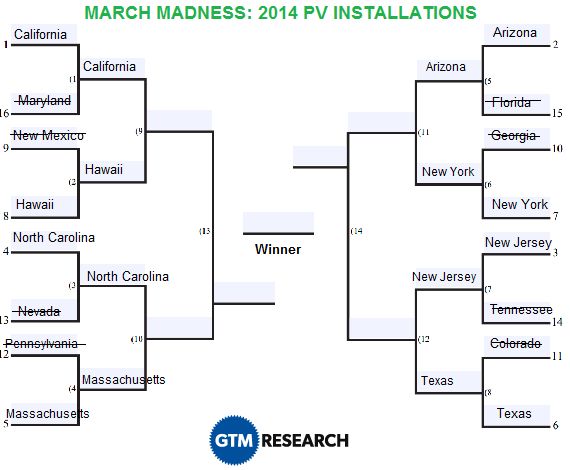

Round One Key Matchups

Hawaii vs. New Mexico

After a record-breaking year for Hawaii in 2013, growing PV grid saturation challenges make the state a popular pick for a first round exit, while on the other side, there’s the perennial mid-major market New Mexico, which stands to benefit from a pipeline of utility PV projects that have longstanding PPAs in place and are slated for completion this year.

So is Hawaii bound for an abrupt downturn? Not so fast. Expect Hawaii to reach the next round despite a slight downturn, benefiting from a one-two punch of pent-up residential PV demand in HECO’s interconnection queue and new interconnection policies to further unlock the backlog.

Georgia vs. New York

GTM Research chose this game as a top matchup in round one as soon as the selection committee announced it. In the final quarter of 2013, both Georgia and New York finally translated robust procurement into actual installations.

Down south, Georgia’s market is just beginning to ramp up utility PV growth as a result of Georgia Power’s Advanced Solar Initiative. Meanwhile, in New York, the NY-Sun program has launched the state onto the national radar as an emerging growth market across both the residential and non-residential sectors.

This matchup is essentially a toss-up, as both states are poised to post more than 100 megawatts in 2014. But we forecast a clutch performance from NYSERDA’s Competitive PV Program, which is expected to lead the way for NY and position it as a non-residential market to watch in 2014 and beyond.

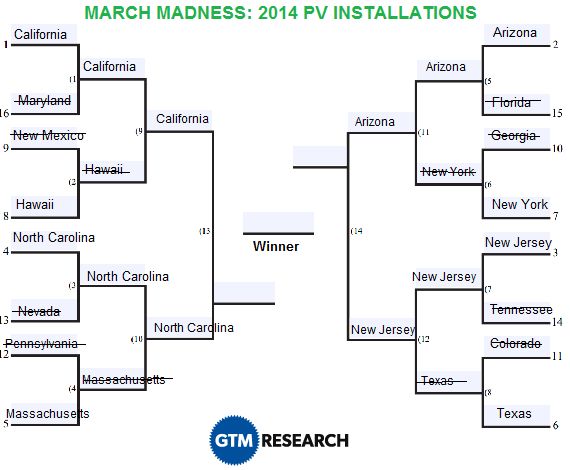

Round Two Key Matchups

North Carolina vs. Massachusetts

It’s a battle of booming top-five markets that makes this matchup an instant classic. In North Carolina, the utility PV pipeline keeps on replenishing thanks to developers cranking out solar farms under 5 megawatts-AC. These projects may be small in size compared to the mega-scale utility PV projects out in California, but the growth has been strong as projects pencil out with the in-state tax credit and avoided cost contracts.

Meanwhile, Massachusetts is what some analysts are calling the “new” New Jersey, with an attractive SREC market and a backlog of large ground-mount projects rushing to come on-line in 1H 2014 as part of the first SREC program. However, when it’s all said and done, North Carolina’s utility PV market will be too hot for Massachusetts to handle and propel North Carolina into the Final Four.

Texas vs. New Jersey

With high insolation levels and strong market fundamentals, Texas is always the “sexy” pick to make it far in the tournament -- and the state is ready to hit the ground running in 2014 thanks to progress in its utility PV pipeline.

But we're anticipating New Jersey to have a bounce back year in both the residential and commercial segments. That will wreak havoc on Texas’s pure play growth trajectory rooted in utility PV installations alone.

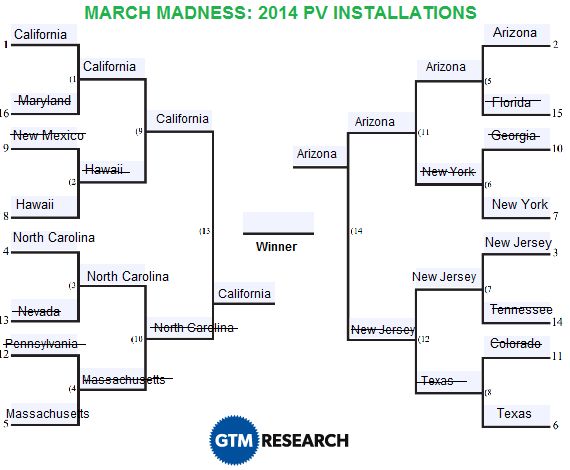

The Final Four

California vs. North Carolina

North Carolina made an impressive run reaching the Final Four, but the road ends with its face-off against California. California has realized stunning growth every year to date, and 2014 will be no different. Yes, looming uncertainties remain in the residential market with impending decisions surrounding net metering and rate design. But in 2014, a decreased dependence on state-level incentives offered by the California Solar Initiative (CSI) and gigawatt-level utility PV growth will place California in a league of its own.

Arizona vs. New Jersey

This matchup features two veteran state markets that experienced notable downturns in 2013. These market downturns can be attributed to the removal of incentives for commercial PV customers in APS territory and SREC oversupply hampering non-residential growth in New Jersey. Both of these states have a lot to prove in 2014. But Arizona will pull out the win as its residential market grows in spite of new reforms to net metering, while the non-residential sector benefits from school and government projects that landed incentives back in 2013.

Championship Round

Arizona vs. California

This is the battle of solar titans. Combined, Arizona and California have installed a cumulative 6,711 megawatts of PV through 2013, representing 56 percent of all U.S. PV.

Arizona is a market in transition as it seeks continued growth amidst reforms to net metering and the depletion of state-level incentives. While it remains to be seen how net metering reform will take shape in California’s residential market, it is the only state that will continue to see statewide gigawatt-level growth in 2014. The growth is attributed to veteran leadership from residential and commercial installers, which possess diverse channel strategies and financing solutions to land customers at scale without state incentives.

While the utility PV market is witnessing a downturn in procurement, its healthy pipeline of contracted projects is unmatched by any other state to date. When the final tally is posted, California will bring in yet another national championship for the Golden State.

As a whole, the United States is forecasted to install nearly 6 gigawatts of solar in 2014.

***

If you haven't already, download the free Solar Market Insight executive summary here. Cory will be at this year's Solar Summit in Phoenix and will be happy to review your own solar brackets.