Biodiesel is a renewable fuel that serves as an alternative to petroleum diesel. Although it can be used as a source of heating oil, its primary use is as a blend with diesel in trucks and automobiles. There are a variety of feedstocks that can produce biodiesel. First-generation feedstocks include animal fats, recycled cooking oils, and vegetable oils like rapeseed, soy, and palm oil. Biodiesel is produced through a simple refinery process called transesterification that uses catalysts to convert either vegetable oil or fats into methyl esters (86%) and a byproduct called glycerin (9%), which is used by the pharmaceutical, cosmetics, and soap industries.

On an environmental basis, biodiesel has a number of compelling attributes, as it produces approximately 78% less CO2 than traditional diesel, with reductions of 58% for particulate matter and 60-90% for other GHGs. NOx emissions actually increase 10% compared to diesel, yet there are simple methods that can be used to ameliorate the NOx. In general, biodiesel is better suited to overcome many of the upstream and downstream infrastructure issues that plague ethanol. For example, biodiesel can use all the same storage containers and pipelines that are currently used with traditional diesel. Low blends of biodiesel can be used in any diesel engine without modifications, though high blends require some engine adaption. However, most biodiesel fuels have a higher cloud point than diesel, meaning that special care must be taken in cold-weather climates when storing, transporting, or blending biodiesel. Biodiesel performs similarly relative to diesel on a BTU basis (8% lower than diesel), with higher cetane and fuel density levels.

Although biodiesel has many positive attributes, it is not immune from the criticisms leveled at first-generation ethanol, specifically the "food vs. fuel" debate. Biodiesel production uses at least 10% of the U.S. soybean crop and 60% of European rapeseed oil for what amounts to a relatively limited impact on the overall diesel market. That is, global biodiesel was 4.1 billion gallons in 2008 -- about 1.5% of the 265 billion gallons of diesel consumed in that year.

The last 18 months have been a very difficult stretch for U.S. biodiesel producers.

Subsidized U.S. biodiesel flooded the EU market in recent years, resulting in estimated U.S. exports of 550 million gallons in 2008 -- accounting for approximately 19% of total E.U. biodiesel consumption in 2008. In 2009, the EU responded with an anti-subsidy tariff (€237/MT, which translates to $0.78 per gallon) and an anti- dumping duty (€208.20 per MT -- $0.68 per gallon) that essentially locked out U.S. producers from Europe.

Call this strike one.

Then, on January 1st, 2010, the U.S. Congress let the $1 per gallon tax credit for biodiesel producers expire.

Why are subsidies so important to biodiesel producers?

Let's assume that 7.2 pounds of feedstock is required to produce a gallon of biodiesel. The current spot price of soybean oil is $0.38lb, which translates to $2.74/gal. If you add $0.81 per gallon in capital, energy, and operational costs (net of any sales of glycerin), we find that the levelized cost to produce a gallon of unsubsidized soy-based biodiesel is $3.55/gal. As of February 15, 2010, the U.S. national retail price for diesel is $2.76/gal -- illustrating why U.S. biodiesel is estimated to be running at 15% of capacity.

Strike two.

In recent weeks, Senators Max Baucas (D-Mo) and Charles Grassley (R-IA) have attempted retroactively to reinstate the $1/gal tax credit via the Jobs Bill that passed the Senate. The original $85B bill contained the tax credit. However, in recent weeks, Congress has miraculously discovered fiscal restraint and as such, has nixed the biodiesel credits.

Proponents of the industry, like the National Biodiesel Board, point out that 25,000 jobs were lost in 2009 in the biodiesel industry and at least that many could be lost in 2010 if the biodiesel credit is not restored.

Critics counter that implementing the biodiesel credit is a very expensive way to save/create jobs. For example, a 30MGY facility would receive approximately $30M in subsidies to save about 30 jobs (at $1M per job). This compares to a $100M construction project for roads and bridges that support 1750-2000 jobs ($57K per job).

Strike two and a half (foul tip).

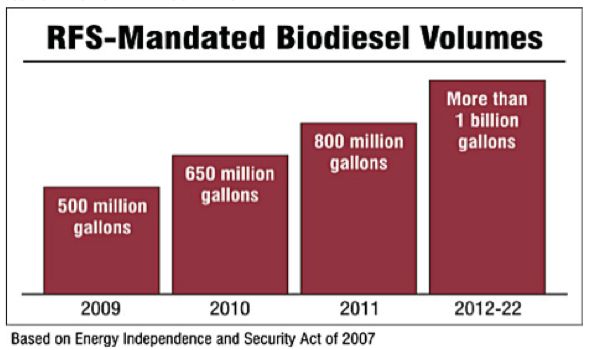

One saving grace for the industry could be the recently updated Renewable Fuel Standards (see EPA Issues Renewable Fuel Standards: What it Means for 1st and 2nd Generation Biofuels). U.S. refiners are required to purchase at least 650 million gallons of biomass-based diesel in 2010.

Yet, it is not entirely clear whether these RFS mandates will be sufficient to avert the collapse of the industry. In an industry with production capacity close to 3 billion gallons, limitations on its ability to export to the largest global market, and without the subsidies to compete against diesel in the domestic market, it is likely that we will see a wave of companies in permanent bankruptcy.