There will be at least 2.4 gigawatts of floating solar installed globally by the end of 2019, according to Wood Mackenzie Power & Renewables.

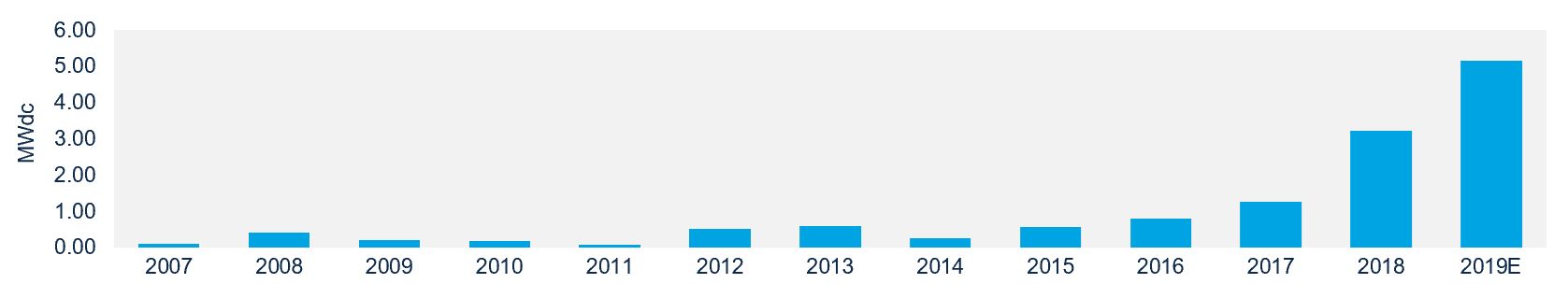

Although floating solar systems typically involve higher costs than traditional ground-mount arrays, project sizes are increasing, which will bring costs down. According to new research, the global average project size of floating solar projects has been climbing steadily since 2015 and is expected to continue rising.

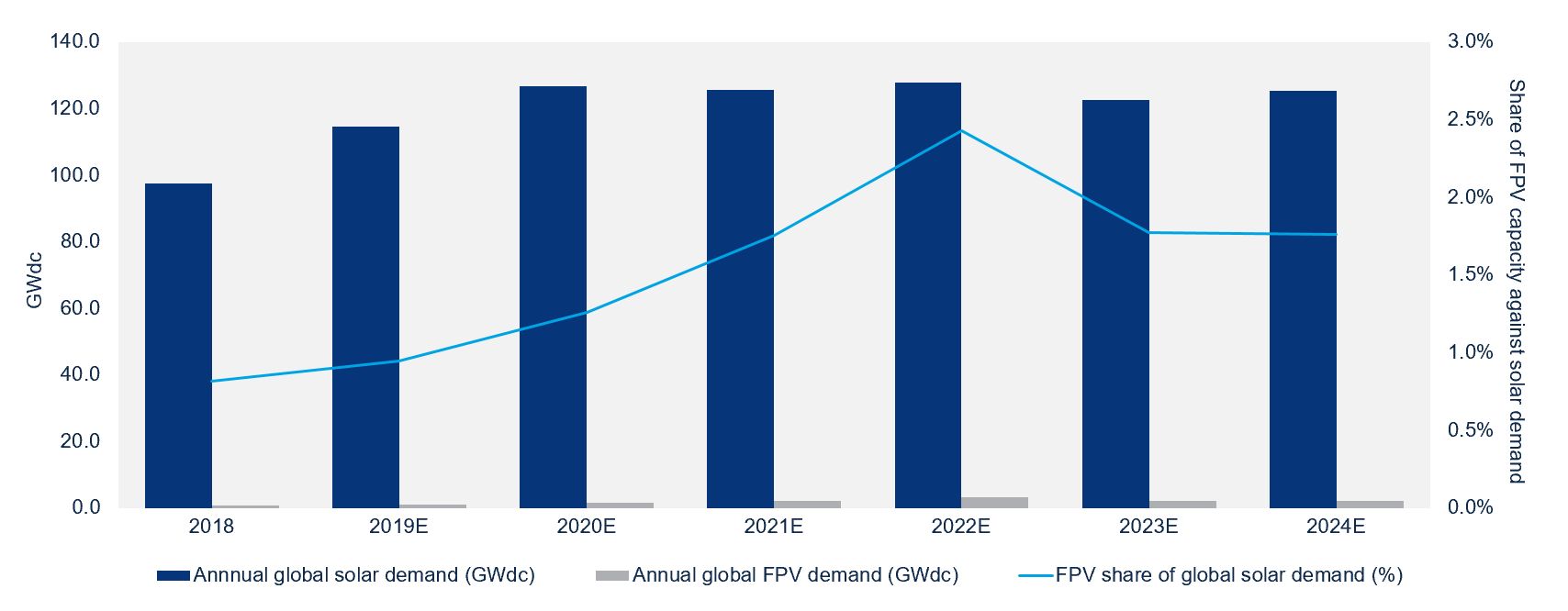

Looking ahead, global floating solar demand is expected to grow by an average of 22 percent year-over-year from 2019 through 2024. Floating solar will account for just under 1 percent of annual global solar installations in 2019, climbing to 2 percent in 2022.

Annual Global Floating Solar Installations as a Percentage of Annual Global Solar Installations, 2018-2024E, GW (DC)

Source: Wood Mackenzie Power & Renewables

Markets and use cases

The floating solar market has seen remarkable growth over the last few years.

The number of individual installations per year has been on the rise since 2013. By the end of 2019, more than 338 floating solar installations are expected to be completed globally in 35 countries, up from 27 countries in 2018.

Today’s floating solar market is concentrated in Asia, where 87 percent of global capacity is located. South Korea and Taiwan are the region’s largest markets.

Global Average Floating Solar Project Size From 2007-2019E, MW (DC)

Source: Wood Mackenzie Power & Renewables

The floating solar market is primarily driven by countries with exorbitant land costs or limited land availability for large ground-mount arrays, as well as countries that have ambitious renewable energy targets.

Floating solar often takes advantage of water space that would otherwise go unused. For example, floating solar arrays can be installed on hydroelectric dam reservoirs.

Not only is this an efficient use of space, but it also allows the floating solar array to take advantage of the existing transmission infrastructure that exists on site, which can further streamline the interconnection of the floating solar plant. If the floating solar array capacity is large enough, it can operate in hybrid fashion with the hydroelectric plant, providing energy when hydropower production is low.

The challenge: Balance-of-system and soft costs

Solar modules, inverters and floating structures are all mature technologies. The floating solar context, however, involves a new set of risks.

All-in costs for these floating solar applications are typically higher than for ground-mount applications of similar size and location, a result of high soft costs and structural balance-of-system (SBOS) costs.

SBOS includes the floating structure, mooring and anchoring systems. For the floating structure alone, solutions can vary quite a bit vendor to vendor. Furthermore, a unique mooring and anchoring solution must be designed and engineered for each site based on water-level variation and exposure to extreme weather, among other factors.

For the average floating solar array in China between 5 and 10 megawatts (DC) in size, SBOS will make up about 34 percent of all-in costs, compared to 8 percent for a ground-mount array of similar size and location.

Major Players in the Floating Solar Space, 2019

Source: Wood Mackenzie Power & Renewables (Note: Some floating structure vendors also produce their own mooring or anchoring solution, but the list of mooring and anchoring vendors represented are companies that solely produce these products.)

Lack of empirical data on system performance over time compounds the challenge. As a result, the technical due diligence for floating solar projects typically takes longer compared to a ground-mount array of the same size and in a similar location, contributing to higher all-in costs.

Soft costs (labor, design and engineering, supply chain and logistics) are another significant contributing factor to high capex for floating solar applications. These costs can vary significantly across projects and can be difficult to account for going into a project. Ambiguity around O&M and post-installation costs can also deter developers and investors.

These cost challenges, however, will respond to the growth of the market and increasing project scale, which is what Wood Mackenzie expects to see in the floating solar market over the next few years.

Scale matters when it comes to all-in costs for floating solar applications, so larger project sizes will yield lower all-in costs on a dollar-per-watt basis.

As more floating solar projects come online, it will become easier to assess system performance, and improvements in operations and maintenance costs and overall economics should bring costs down, presenting new opportunities in new markets for floating solar players.

***

Molly Cox is a research associate at Wood Mackenzie specializing in PV technology and operations. Her report Floating Solar Landscape 2019 focuses on trends, capex and market drivers across the leading global floating solar markets.