Annual solar plant operations and maintenance (O&M) costs will double from nearly $4.5 billion in 2019 to over $9 billion in 2024.

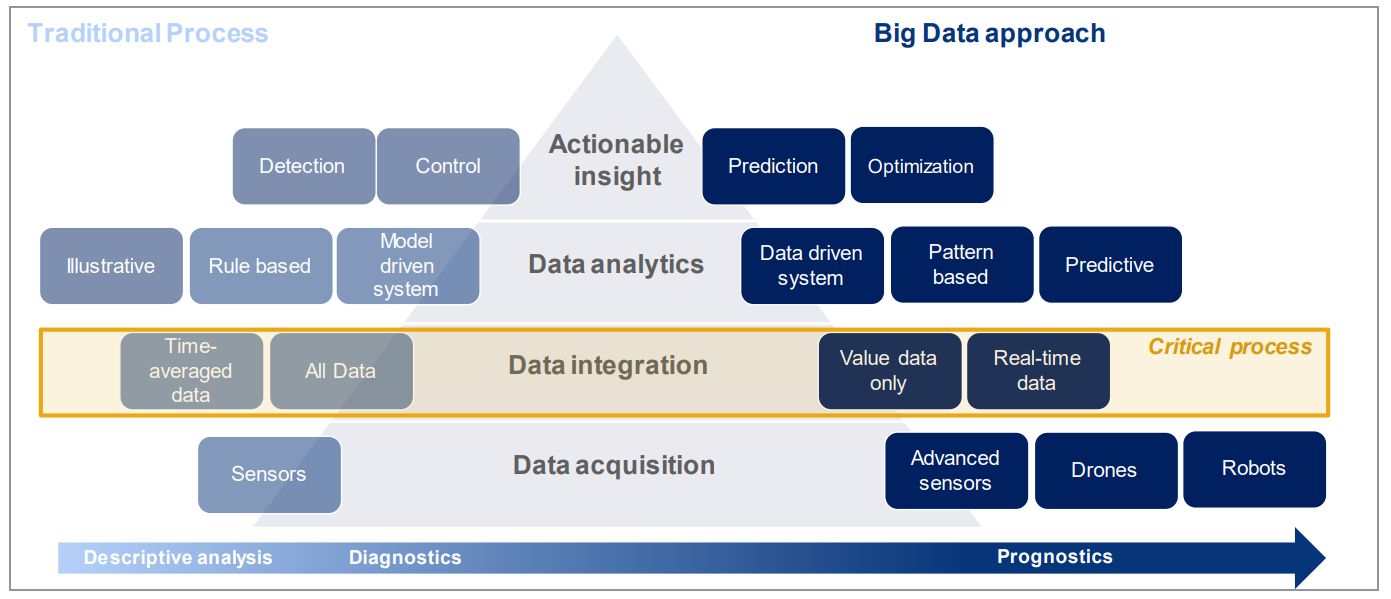

New research from Wood Mackenzie finds that as the solar O&M market grows, global downward price pressure is driving the implementation of automated solutions and digital platforms for O&M, particularly process automation and asset management optimization.

The future is undoubtedly digital — but not all facilities and asset owners are ready to implement digital solutions.

Optimizing the solar market

Process automation can help the industry optimize technician time in the field, as well as other areas. Technician efficiency is already rising, as measured by how many megawatts of solar capacity can be served by a single technician, and that trend is expected to continue.

Technicians used to be able to service only 20 megawatts of solar capacity. Now, it’s possible for a single technician to serve 40 to 60 megawatts — more than doubling their efficiency in some cases.

Evolution of Solar PV O&M Offerings

Source: Wood Mackenzie

Improving the efficiency of site tasks such as mowing, module washing and even security can help reduce overall O&M spend.

Asset owners and operators are also increasingly investing in advanced analytics and O&M-specific software. This allows them to move away from more time-consuming methods of spreadsheet-based analytics, reducing operational costs and increasing data quality.

Digital platforms for asset management can help minimize corrective repairs through proactive maintenance. Unplanned repairs alone can cost owners up to $3,000 per megawatt each year (based on an average-sized solar power system of 50 megawatts). The solar industry will see $16 billion of unplanned repairs over the next five years.

Roadblocks to digital O&M

Although a significant portion of solar PV projects currently have a monitoring system in place, few are synced in real time with diagnostics tools. Even fewer conduct basic periodical performance assessments.

Ideally, asset owners would have all operations running autonomously and linked to an enterprise resource planning system. However, an end-to-end digital platform is not yet the norm. Asset operators might deploy some of the digital solutions available, but have yet to implement a complete digital ecosystem.

Solar plant management digitization can hit barriers when asset managers realize they aren’t able to communicate with the existing data structure. This is especially true with older solar projects, where components are not sophisticated enough to handle multiple communication protocols. For these projects, there is little benefit to implementing costly, state-of-the-art advanced analytics platforms.

It also doesn’t make sense technically or commercially for owners of projects close to end-of-life to deploy an expensive and intelligent platform. An older plant’s data-acquisition system will not support all digital system requirements.

Global demand and price pressure

As the solar market hits 114.5 gigawatts globally this year — up 18 percent from 2018 — the O&M market will continue growing as well. Data from 2018 shows an ongoing trend of price pressure on O&M providers, which is inspiring competition at rock-bottom prices.

Digital O&M is becoming more relevant as solar players seek to reduce costs, increase efficiencies and grow margins.

***

Leila Garcia da Fonseca is responsible for Wood Mackenzie's wind and solar O&M market research for the Americas region. She is the author of the recent report The Increasing Role of Digital in the Solar O&M Space.