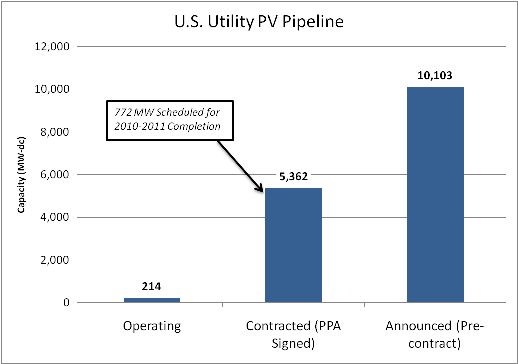

There are less than 215 MW of grid-connected utility PV capacity in the United States. The cumulative operating capacity of this market segment is roughly in line with Germany’s worst installation month in 2010 (February) and is less than one-tenth of Germany’s best month (June). Despite this, the global PV industry is increasingly turning its attention toward the U.S. utility PV market as a driver of global demand after the impacts of feed-in tariff cuts (Germany, Czech Republic, Spain) are felt.

There are 5,362 MW of projects in the “contracted” pipeline, meaning they have either signed PPAs, feed-in tariff agreements, or are being developed by utilities themselves. Add to this an additional 10,103 MW of projects that have been publicly announced and are yet to sign PPAs and we see that the total “pipeline” is more than 15.4 GW. The last of these projects are expected to reach completion in 2015. If all these projects were successfully completed, utility PV capacity will have grown more than 80 times over the course of five years.

As the just-released GTM Research report on the U.S. Utility PV market suggests, 2010 will be looked back on as the year in which the utility PV market first emerged. In previous years, projects were few and far between, with no more than two projects greater than five MW each connected in a single year. Larger PPAs had been signed, but projects had regularly been forced to renegotiate their contracts and delay project completion. As of November 2010, however, seven such projects had already been completed and at least three more are expected by the end of the year. In total, nearly 275 MW of utility PV assets could be connected in 2010, nearly two-thirds the size of the entire U.S. market in 2009. (You can here more on utility solar and the issues of tying it to the grid at Networked Solar taking place January 25 and 26.)

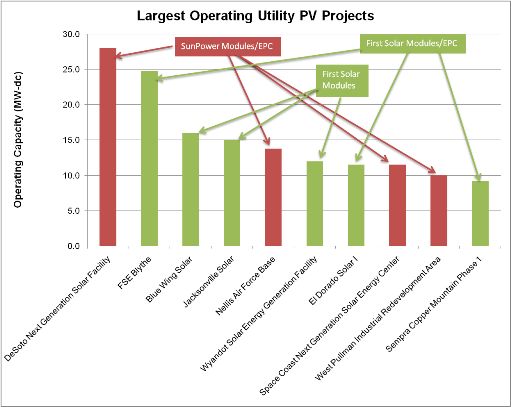

If there is one aspect of the existing U.S. utility PV market that cannot be ignored, it is the dominance of First Solar and SunPower. The figure below displays the ten largest operating PV projects in the U.S., of which either First Solar or SunPower was involved in every one. Given their downstream operations, both companies have three mechanisms through which they serve this market: as a developer, as an EPC provider, and as a supplier. SunPower has thus far acted primarily as a module supplier and EPC provider, allowing developers such as Fotowatio Renewable Ventures and Florida Power & Light to take on the project financing, site selection, and other project development tasks. First Solar has taken this route for some projects, such as Sempra Generation’s Copper Mountain and El Dorado projects, but has also acted as developer in the case of the Blythe project, which First Solar later sold to NRG Energy.

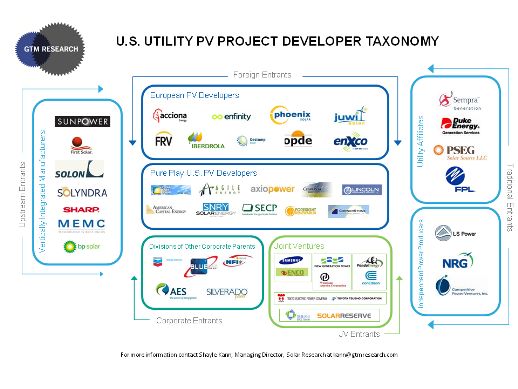

Four factors played a role in enabling First Solar and SunPower to attain such early dominance in the market. First, and most importantly, both companies acquired established utility project developers before the market gained significant international attention. SunPower acquired Powerlight in late 2007, while First Solar purchased OptiSolar’s project development arm in early 2009. Second, both companies benefit from being considered “bankable” suppliers, a prerequisite for attaining project finance from most U.S. lenders. The list of bankable modules is ever-growing and variable among financiers but even today generally includes fewer than 15 suppliers. Third, First Solar and SunPower benefit from the “made-in-America” brand, which had been a major factor in utility and financier decision-making through 2008. While this distinction may carry less weight today as low-cost suppliers gain a foothold in the U.S. market, it was undoubtedly a factor in these early projects. Finally, until recently, the U.S. utility market was small enough that more established developers (e.g., European project developers, U.S. independent power producers) and suppliers (e.g., foreign module manufacturers) paid scant attention, leaving First Solar and SunPower among the few players left in the game.

Taken together, First Solar and SunPower maintain a 94% share as either module or EPC suppliers in operating U.S. utility PV projects. While this will certainly fall over the next five years, their early dominance should not be taken lightly. They are the only two suppliers that have the proven ability to get multiple projects financed with their products and follow the projects through to completion. This comes in stark contrast to the multitude of utility PV projects that have been delayed or cancelled during the same period. To some extent their early success has become a self-fulfilling prophecy; the more they succeed, the more likely they are to maintain their lead. Given that financing remains a major industry bottleneck and few projects are considered bankable, this presents a difficulty to new entrants. For these new entrants, both developers and suppliers, it is therefore imperative to counter this by focusing on early execution in order to build a similar track record.

The contracted project pipeline tells a different story. Although First Solar and SunPower maintain a combined 54% share of the project pipeline, there are a total of 53 developers with at least one contracted utility PV project. Only eleven of these developers, however, currently hold more than two contracts, an indication of the market’s increasing dilution.

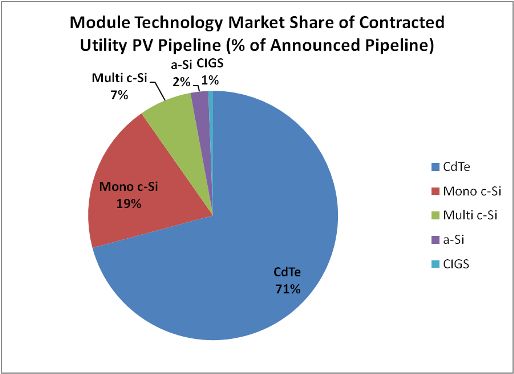

Of the 5.3 GW of projects currently contracted and in development, 3.4 GW have publicly announced their module technology selection. The figure below contains a breakdown of module market shares in the contracted pipeline. Given that First Solar and SunPower have by far the two largest pipelines, it is no surprise that CdTe and Mono c-Si maintain a combined 91% share of the pipeline. However, multi c-Si has begun to make inroads. For example, Yingli’s multi c-Si modules were selected for a series of Recurrent Energy projects in California and Suntech’s multi c-Si modules are currently in construction in American Capital Energy’s 20 MW Searchlight Solar project. With that said, most top-tier Asian multi c-Si manufacturers are yet to make an aggressive push into the U.S. utility PV market, and tepid growth in the European markets could force these suppliers to act sooner rather than later.

However, as anyone in the U.S. PV market knows, PPAs can only go so far, and many of these projects will never come to fruition. Permitting, financing, procurement, and interconnection will delay some projects and kill others. In particular, the U.S. PV market is in danger of facing a number of high-profile project failures as a result of over-competitive PPA bidding processes leading to untenably low PPA rates. This danger only becomes worse as a bevy of new project developers enter the market (see below), with new announcements arriving weekly. But more on the project development landscape soon.

Click the figure above for a larger view.

This is an excerpt from GTM Research's recently published comprehensive U.S. utility PV market report, The U.S. Utility PV Market: Demand, Players, Strategy and Project Economics Through 2015. For more on the report, go here.