We all know the conventional narrative of the energy storage industry's recent rise to prominence: Electric-vehicle manufacturing spurs a rush of increasingly cheap lithium-ion batteries that developers can use for the grid.

That's true, but it's only part of the story. For a while, there simply wasn't much data to use to dig in deeper. Without a more granular understanding of the forces shaping battery system prices, it's impossible to accurately predict where prices will go in the coming years -- other than down, which is a pretty safe bet these days.

Now the storm clouds of data have burst over the informational drought. Mitalee Gupta, one of the newest members of GTM Research's energy storage team, has spent the last four months assembling an intricate bottom-up model that tracks each of the component costs of a complete storage system.

Working from the ground up, she's been able to isolate the various cost trends in batteries, inverters, enclosures, engineering, procurement and construction contracts, and everything else that goes into a project. The model can then identify how each of those costs scales with the power and energy capacity of a given system.

The output tells a more detailed story about where the industry is heading.

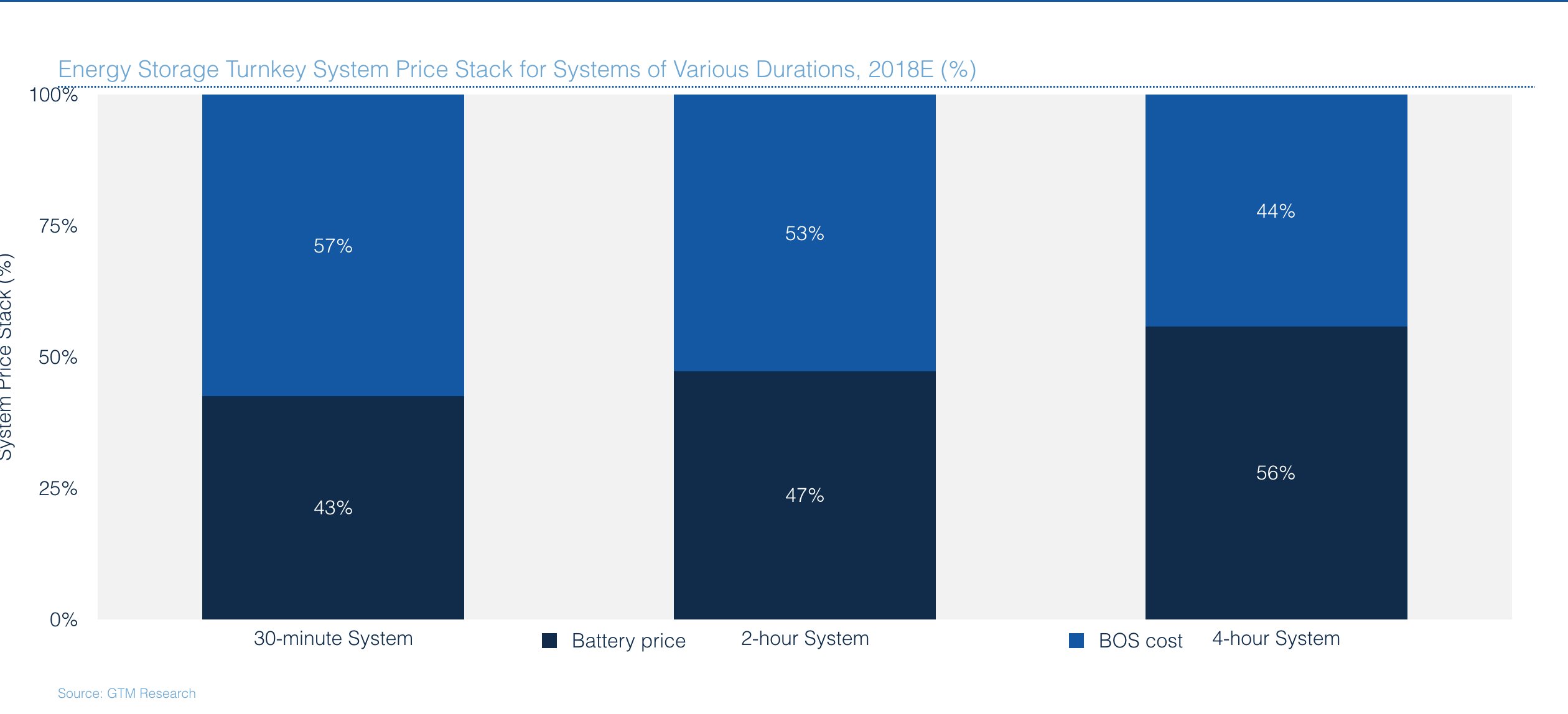

Battery price declines did indeed drive some stunning system-cost reductions -- 60 percent over the last five years, by Gupta's count. But that period is coming to an end. Balance-of-system costs now make up more than half of total costs for shorter-duration batteries, so developers will increasingly look beyond the battery pack for additional efficiencies and savings.

Storage inverter improvements have already begun to play a significant role. Innovation in other BOS elements, like the battery enclosure, is just getting started.

Here are the biggest trends coming out of this research.

The era of crazy price declines is over

It's been a rip-roaring few years for the industry.

The front-of-the-meter storage market grew almost 7x from 2012 to 2016; during the same period, turnkey storage system prices declined by over 60 percent. (The report defines cost and price from the perspective of the developers, meaning the amount they have to pay and the amount they charge their customer, respectively.)

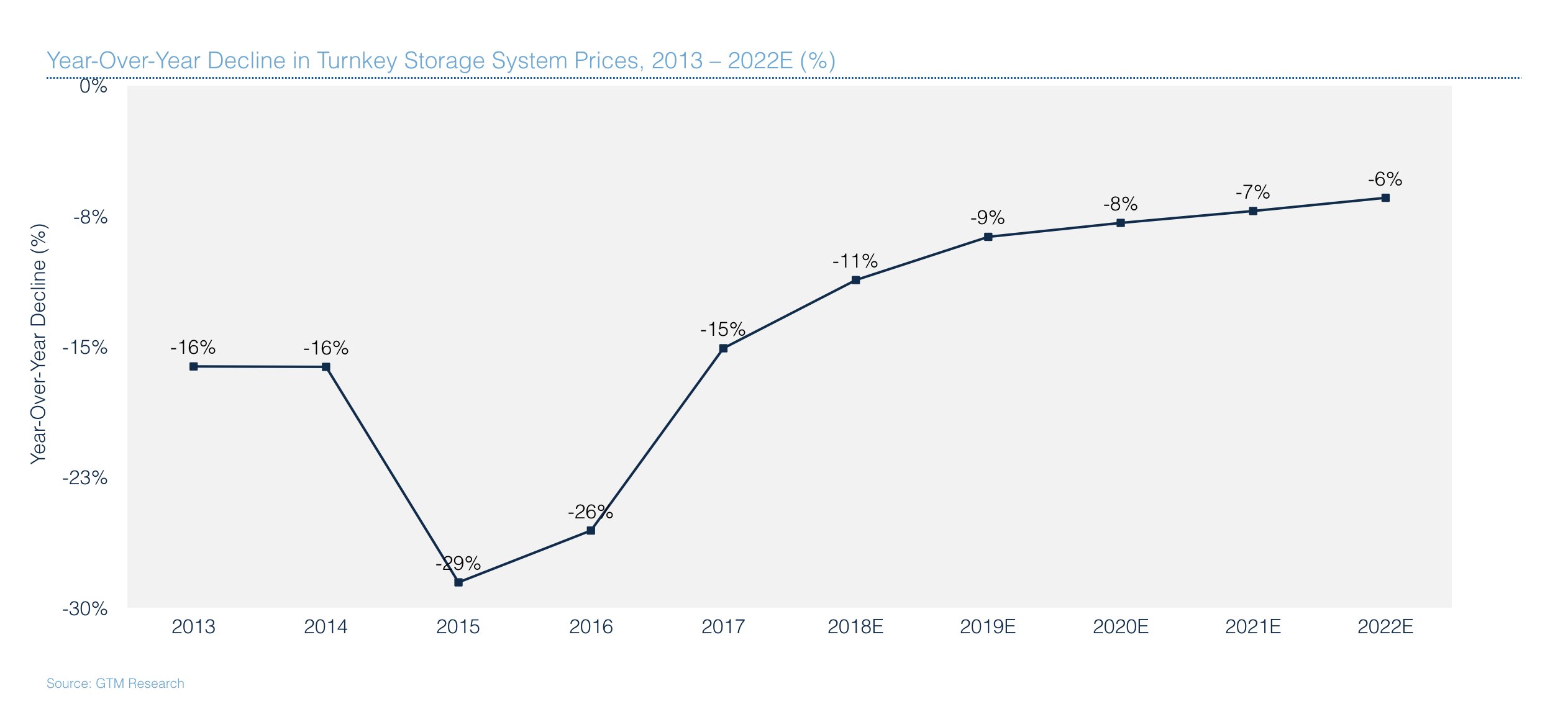

Year-over-year turnkey system price declines reached a stunning 29 percent in 2015 and 26 percent in 2016.

That freewheeling moment has come to an end.

"The biggest takeaway from this report is that prices for storage systems will apparently not continue to decline as much as they have historically," Gupta said.

Gupta's modeling predicts the industry is in for a period of steady but smaller price declines, heading into single digits after this year. This reflects a maturation of the industry: the low-hanging fruit will have been plucked, making way for more slow and steady supply chain improvements. A similar trend will unfold with solar PV system price reductions.

That shouldn't spark worries about a drop-off in demand for storage, she writes in the report.

"Although low, the rate of price declines in the future will still be steady enough to drive the storage market in the right direction in order to achieve forecasted deployment trends," she notes.

Those forecasted numbers are ample: 4.5 gigawatts cumulatively over the next five years.

BOS is the BOSS

Storage pricing and battery pricing are often described interchangeably, but that conflation no longer matches reality.

For 30-minute and 2-hour systems, everything besides the batteries -- lumped under the moniker "balance of systems" -- drives a majority of the price; 57 percent and 53 percent of the per-kilowatt price, respectively, Gupta found. Since battery costs scale up with energy duration, they compose 56 percent of a 4-hour system's price stack.

"Now people are more focused on other parts of storage systems, not just batteries and inverters," Gupta said.

Storage containers are a source of innovation, as discussed below. And the software and controls market is heating up.

"In all these mergers and acquisitions, companies are using software as a key differentiator for themselves," she noted. "We're seeing all these big companies go out and buy smaller companies based on the ability of their software to achieve different value streams."

Join the enclosure movement

The iconic large-scale battery projects resemble a field of barracks-like metal boxes stretched out across an expanse of concrete.

In examining BOS cost reductions, Gupta recorded a handful of instances of a new approach: concrete enclosures.

Once they reach a certain scale, it makes less sense to invest in separate systems for each ISO container -- HVAC, fire suppression, even the material of the container itself. At that point, it's in a developer's interest to build one large enclosure and stick all the batteries inside.

The economics improve further with the use of prefabricated concrete slabs, which hasten the speed of construction.

At the small scale, metal containers still make a lot of sense. For a 5-megawatt system with a 30-minute duration, a containerized approach incurs 23 percent cheaper BOS costs than a building. But, by Gupta's calculations, that economic advantage flips beyond 4 hours of duration.

If you scale the 5-megawatt system up to 30 megawatt-hours, the concrete enclosure will save 11 percent on BOS costs.

There haven't been many projects bigger than that so far, but the frequency is increasing. Projects that seemed huge a year ago will look humble in a year or two. As projects scale up, look for increasing use of concrete enclosures to hold them.

GTM Research analyst Brett Simon noted on Twitter that the recently announced tariffs on imported steel could further accelerate the move to concrete storage containment.

Inverters are the new battery

Keep an eye on inverters as a site of cost reductions.

They were a key driver of system price reductions in 2015 and 2016, as solar inverter companies found a foothold in the storage market.

That was just the beginning. The growing storage inverter industry is chasing some exciting new concepts that should result in cheaper projects.

One is higher-voltage power conversion. Much like the PV industry, maturation leads to a continuous pushing of the upper limits on power flow.

Another promising trend is DC-coupled architecture.

This is different from hybrid inverters, which deal with battery electrons and solar electrons. Those add a cost premium relative to solar inverters, and are especially expensive for retrofits of solar systems with existing inverters.

DC architecture connects the battery system to a DC optimizer and then routes it to the solar inverter. That lets the storage developer piggyback on the advances already made by solar inverter companies, and makes a storage retrofit much easier. This design avoids some of the round-trip efficiency losses found in an AC-AC architecture, which requires more rounds of power conversion to store solar power and discharge it.

There simply aren't many DC optimizers on the market yet, although more are coming. Dynapower, for instance, installed its first DC optimizers for utility-scale solar-plus-storage in December.