The U.S. and the world have been on an impressive path to a mostly renewable electricity system over the last few decades.

I’ve labeled the point at which solar becomes the cheapest default power source — backed up with energy storage to firm the solar — as the “Solar Singularity." It's an homage to Ray Kurzweil’s ideas on the exponential growth of information technologies.

I wrote a book, Solar: Why Our Energy Future Is So Bright, in 2014, focused on the Solar Singularity concept and how we seem headed inexorably for that happy future. I’ve published a couple of annual updates so far here at GTM, and this is my third.

With the ongoing political turmoil in the U.S., is all our progress going to hell in the proverbial handbasket? Has our renewable future been Trumped? Or are we still on a glide path to the Solar Singularity?

I think we’re still firmly on our path to that sunny future. The worst damage Trump and Co. can do is to delay these largely inevitable long-term trends by a couple of years.

So let’s go through the numbers. As of mid-2018, where do we stand on solar, battery storage, electric vehicles and self-driving cars, which together constitute the parallel and intertwined revolutions that are set to transform our energy system worldwide?

With these four technologies developing steadily, we can reasonably expect to see, by 2035 to 2040, a world powered predominantly with solar and other renewable electricity -— not only homes and businesses, but also transportation and industrial processes.

First, we look at solar, the foundation of this new system.

Solar

The Department of Energy SunShot goal of $1/watt was officially met since my last update — three years ahead of schedule. This iconic goal was achieved for utility-scale solar, but it won’t be long before we’ll be seeing similar prices for commercial and even residential solar systems.

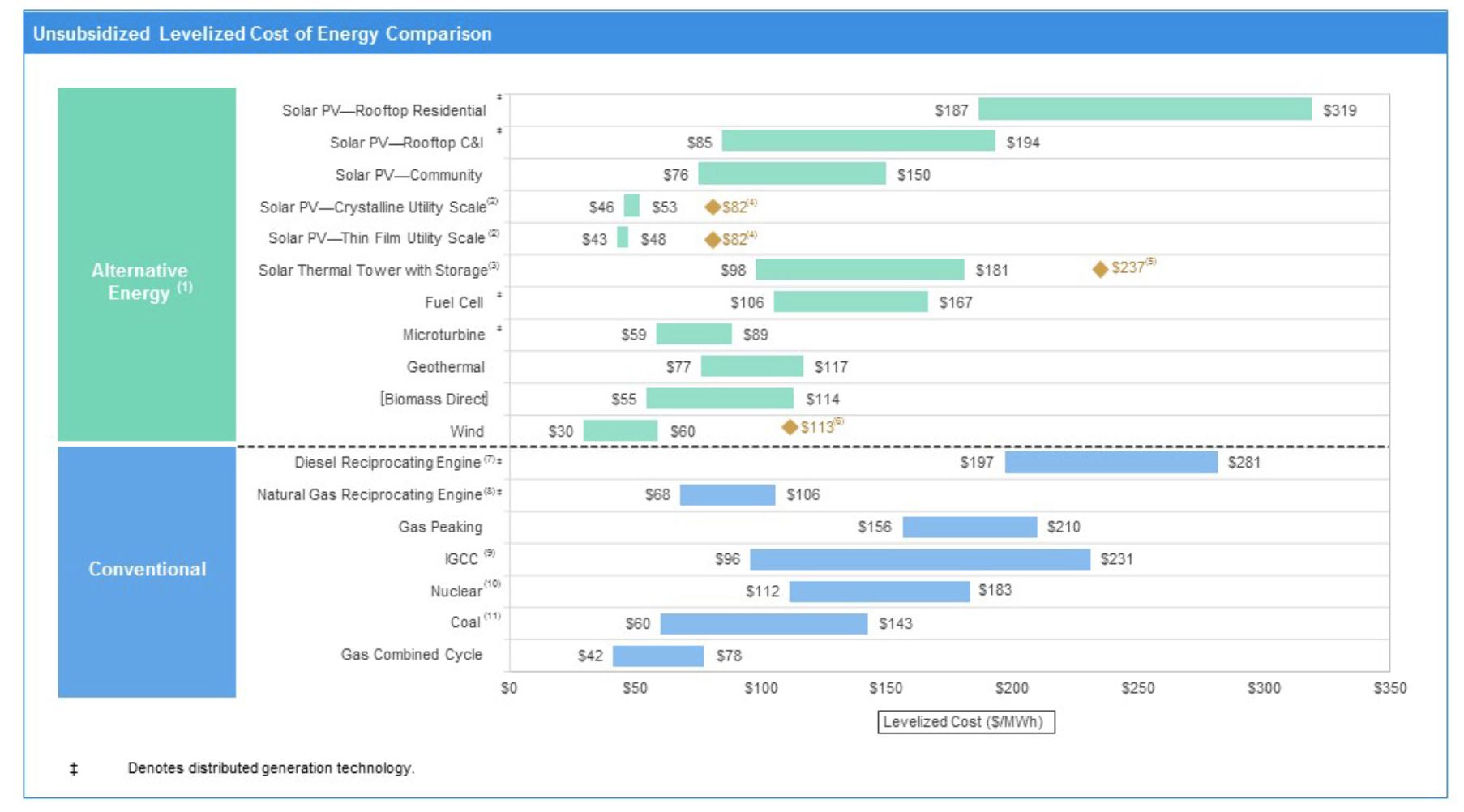

The 2017 Lazard report shows that solar and other renewable energy's levelized costs continue to decline, with solar now far cheaper than conventional power technologies on a levelized cost basis (that is, in an apples-to-apples comparison).

Lazard Analysis on Levelized Costs of Various Energy Technologies

California hit a major milestone in early 2018, with fully 50 percent of its electricity coming from solar power during peak solar production on March 4. And for the whole year, solar power provided 15.2 percent of electricity.

In a very encouraging counter-trend to the national trend away from support for renewables, California passed SB 100, a law requiring utilities to achieve 100 percent carbon-free electricity by 2045, following Hawaii’s own law a couple of years ago. (More on this below.)

U.S. solar deployment in 2017 was great but not record-breaking, at 6,234 megawatts — considerably down from the remarkable 10,807 megawatts in 2016 (prompted by the expiring tax breaks). The Lawrence Berkeley National Lab’s annual report on the utility-scale solar market projects U.S. solar installations (of all types) not to exceed 8,281 megawatts by 2023, but this is another classic under-prediction.

For example, Wood Mackenzie Power & Renewables (formerly GTM Research) just released numbers showing that 8.5 gigawatts of utility PV projects have been announced in the first half of 2018 alone. That amounts to more utility-scale PV than in 2014 and 2015 combined. The current U.S. utility-scale pipeline is 23.9 gigawatts — "its highest point in the history of solar."

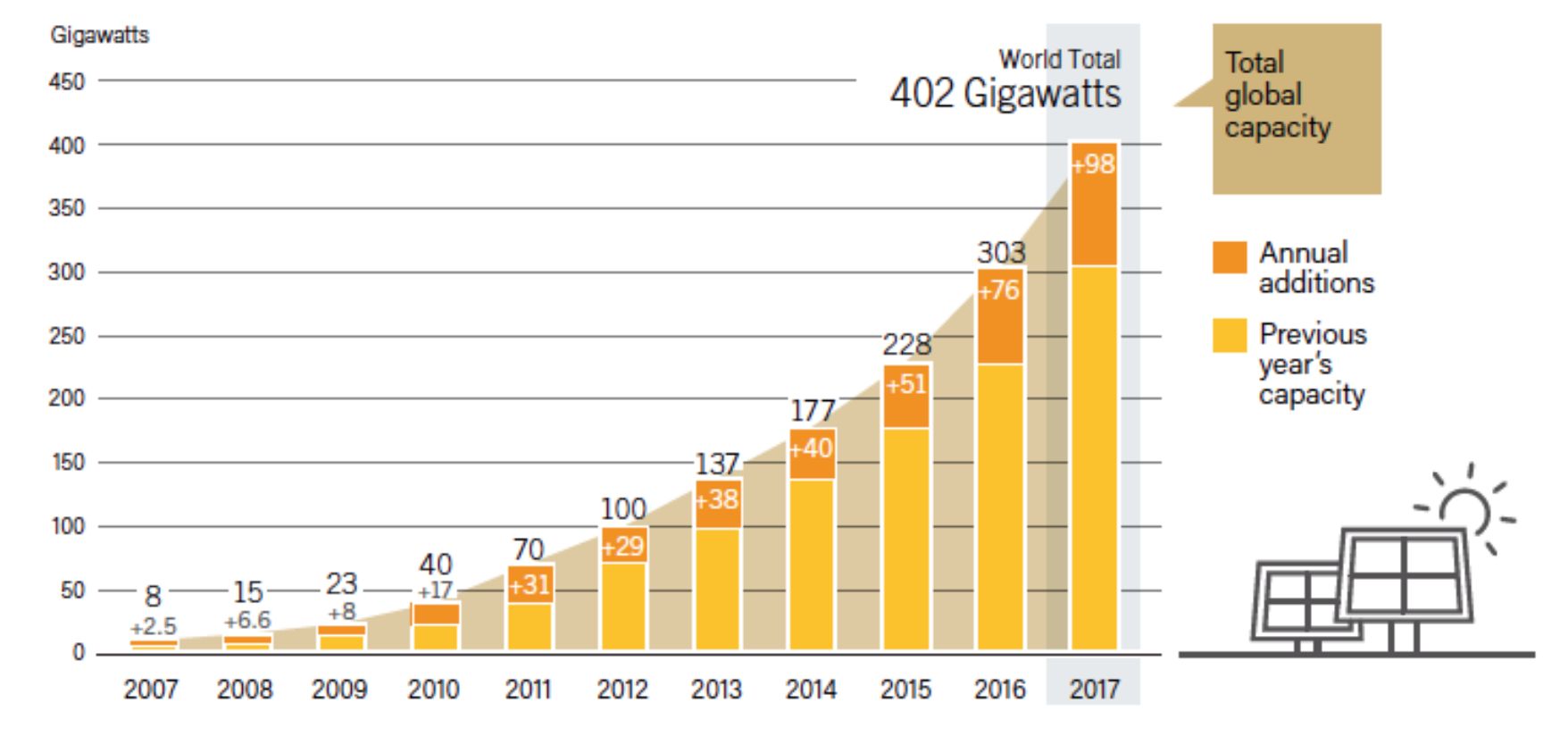

Globally, we see the remarkable growth trend continue, with 33 percent growth from 303 gigawatts installed at end of 2016 to 402 gigawatts a year later, according to the annual REN21 report.

According to Wood Mackenzie's global figures, the world will install over 120 gigawatts per year after 2019 — hitting 1 terawatt of capacity by 2023.

China, Japan and India will account for 20 percent of the total global market through 2023. But the market will be spread out all over the globe. North America and Europe make up 28 percent of the market. The Middle East and Latin America will make up more than 15 percent of installations by then.

The REN21 report shows the inexorable rise of solar around the world.

Global Solar Growth Trends

Source: REN21 and IEA

Source: REN21 and IEA

The same REN21 report finds that global wind power growth is still steady, rising from 487 gigawatts to 539 gigawatts in 2017. That gigawatt addition has been consistent over the last four years, but it seems very likely that solar is set to surpass global installed capacity for wind in the next few years. Solar is inherently far more scalable and geographically versatile, due to its lower profile (literally) and lower environmental impacts. Wind power technology continues to improve, and I see wind power going increasingly offshore with ever-larger turbines.

Wind looks strong. Global wind capacity is expected to double by 2027, according to Wood Mackenzie, with 65 gigawatts added per year on average. But 20 years from now, my money is on solar being a far larger source of global power than wind.

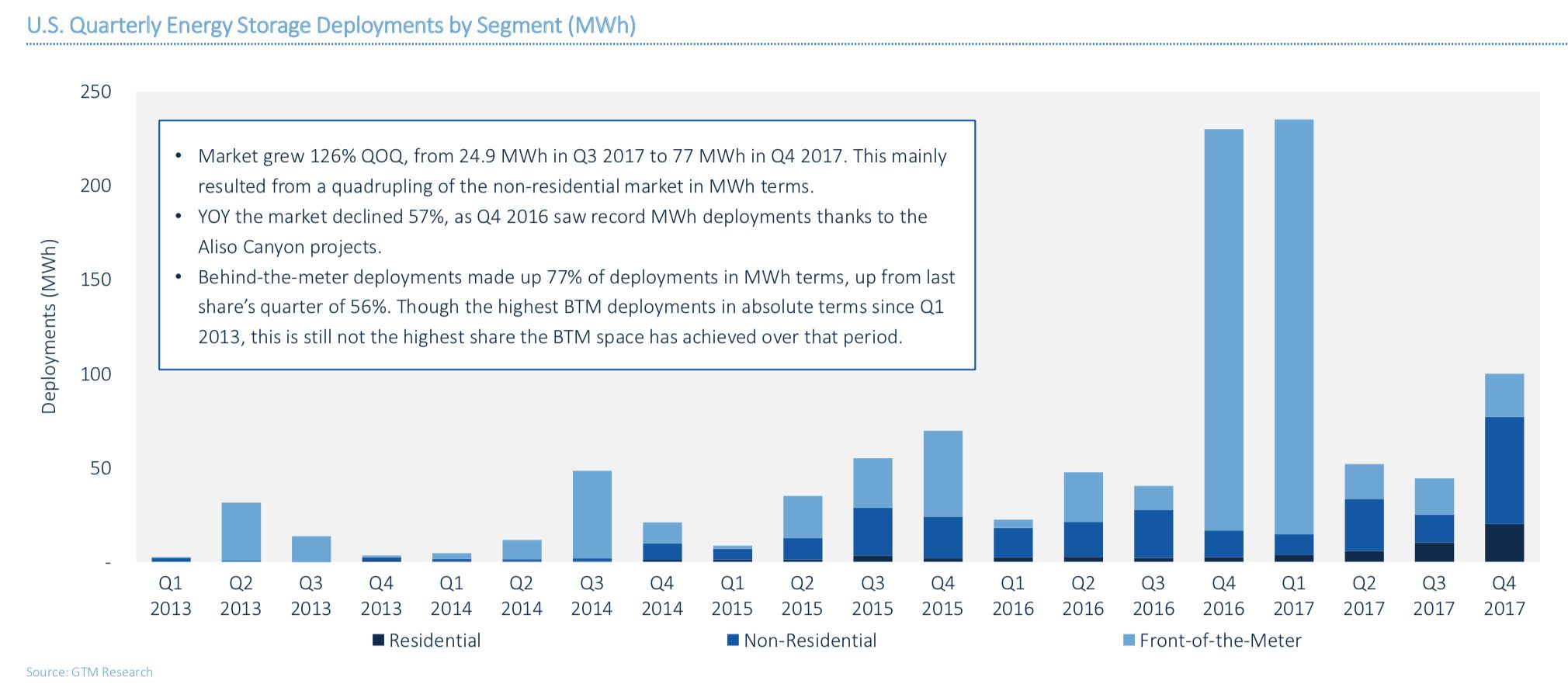

Energy storage

The U.S. battery storage market grew slightly in 2017 (in megawatt-hour terms, although there was a slight dip in the less-important megawatt count). The Wood Mackenzie Power & Renewables Year in Review found that the energy storage market was led by California and Hawaii, mostly at the residential and commercial level.

Wood Mackenzie Summary of 2017 Storage Market Growth (MWh)

A welcome surprise is Texas leading the wholesale (front-of-meter) storage market in 2017, with 52 megawatts deployed compared to California’s 44 megawatts, and New York rounding out the top three with 25 megawatts.

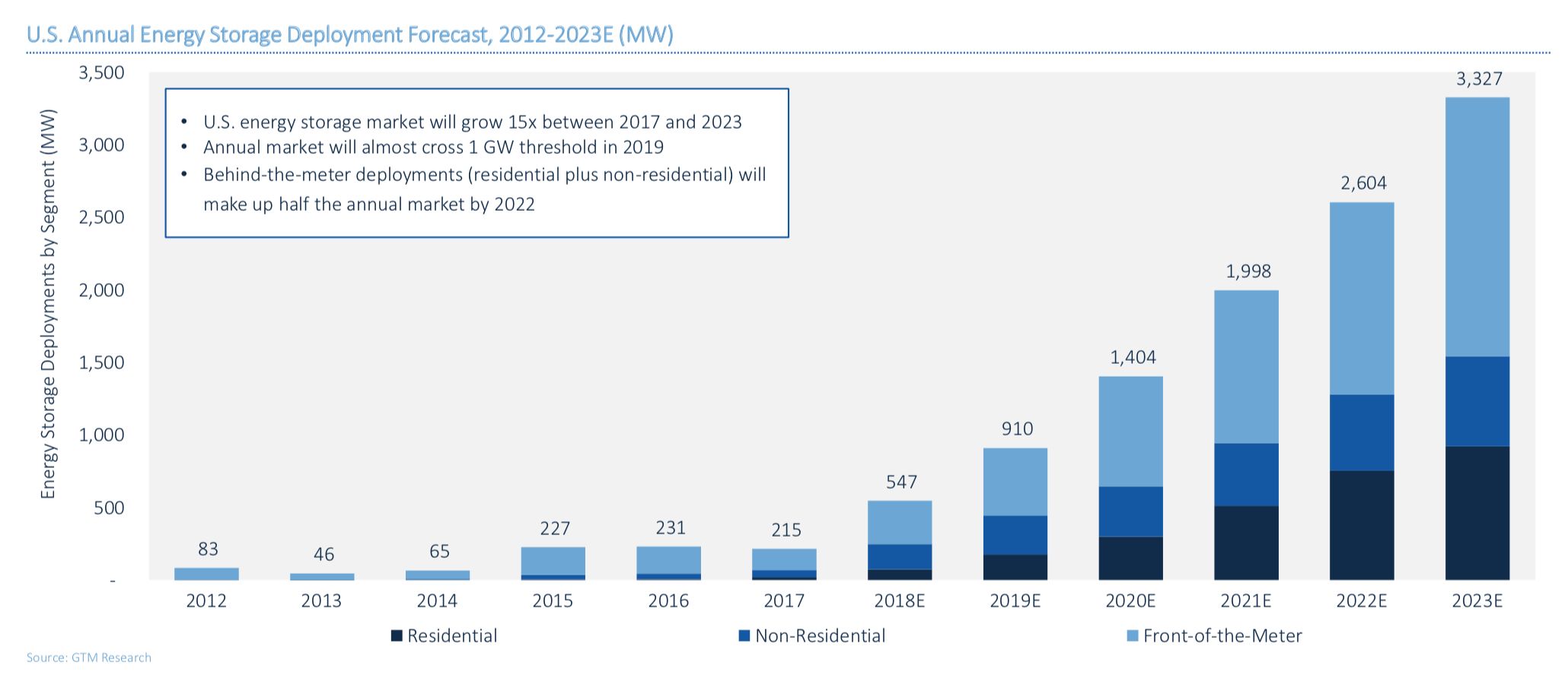

Despite the modest growth in 2017, Wood Mackenzie projects strong growth to almost 10,000 megawatt-hours cumulative through 2023, led by front-of-meter storage projects. This year will also see the U.S. market top 1,000 megawatt-hours in annual installations for the first time, deploying in just one year what took from 2013-2017 for the first 1,000 megawatt-hours to be deployed.

Wood Mackenzie Projections for Energy Storage Growth in the U.S.

Globally, the picture was even better for 2017, with new records being set for storage around the world. According to Wood Mackenzie's figures, there were 1.4 gigawatts and 2.3 gigawatt-hours of storage installed globally last year. A wide range of creative use cases in residential and utility-scale solar — plus strong policy pushes in Australia, America and South Korea — created "one of the most exciting years for energy storage."

The best news this year is that costs for storage are still trending downward, as we’d expect. UC Berkeley’s Dan Kammen and his colleagues, in a recent study, found a “learning curve” for declining energy storage costs similar to Swanson's law for solar and Moore’s law for computer chips. Kammen and his team found an average of 17.3 percent declines in the cost of energy storage with every doubling of global production. This is very similar to the cost trend we’ve seen for solar over the last few decades.

If this trend continues, as history suggests strongly that it will, then we are likely to see very affordable energy storage in the next few years, assuaging longstanding concerns about the high price of deploying energy storage as a backup for variable renewables like solar and wind power.

In sum, the energy storage revolution is well on pace, though the pace of growth perhaps should be higher given the market hype around energy storage in the last decade.

Electric vehicles

2018 was an important year for EVs, and we knew it would be. This is largely because Tesla finally began to achieve the long-advertised large-scale production of the Model 3, its “affordable” sedan with the low-end price set at $35,000. Based on the best industry estimates, Tesla exceeded 5,000 cars per week by the end of August. As is generally the case, Musk was late in delivering this level of production — but it’s remarkable that Tesla was able to achieve this at all, given the headwinds facing the company.

Tesla's leadership future is uncertain, now that the SEC is suing Elon Musk for his infamous "take Tesla private" tweet. Musk is clearly under a ton of pressure and is behaving in ways not appropriate for a CEO of a groundbreaking company. The only information, however, that really matters to the Solar Singularity debate is the fact that Tesla is delivering (albeit a bit late) on promises to dramatically ramp up EV production.

Tesla’s Model 3 was the fifth best-selling car in the U.S. in August in terms of units sold, but the best-selling car sold in terms of revenue. Yes: Tesla’s Model 3 is now the highest-earning car sold in the U.S. That’s remarkable — and it should give pause to the growing legions of Tesla doubters.

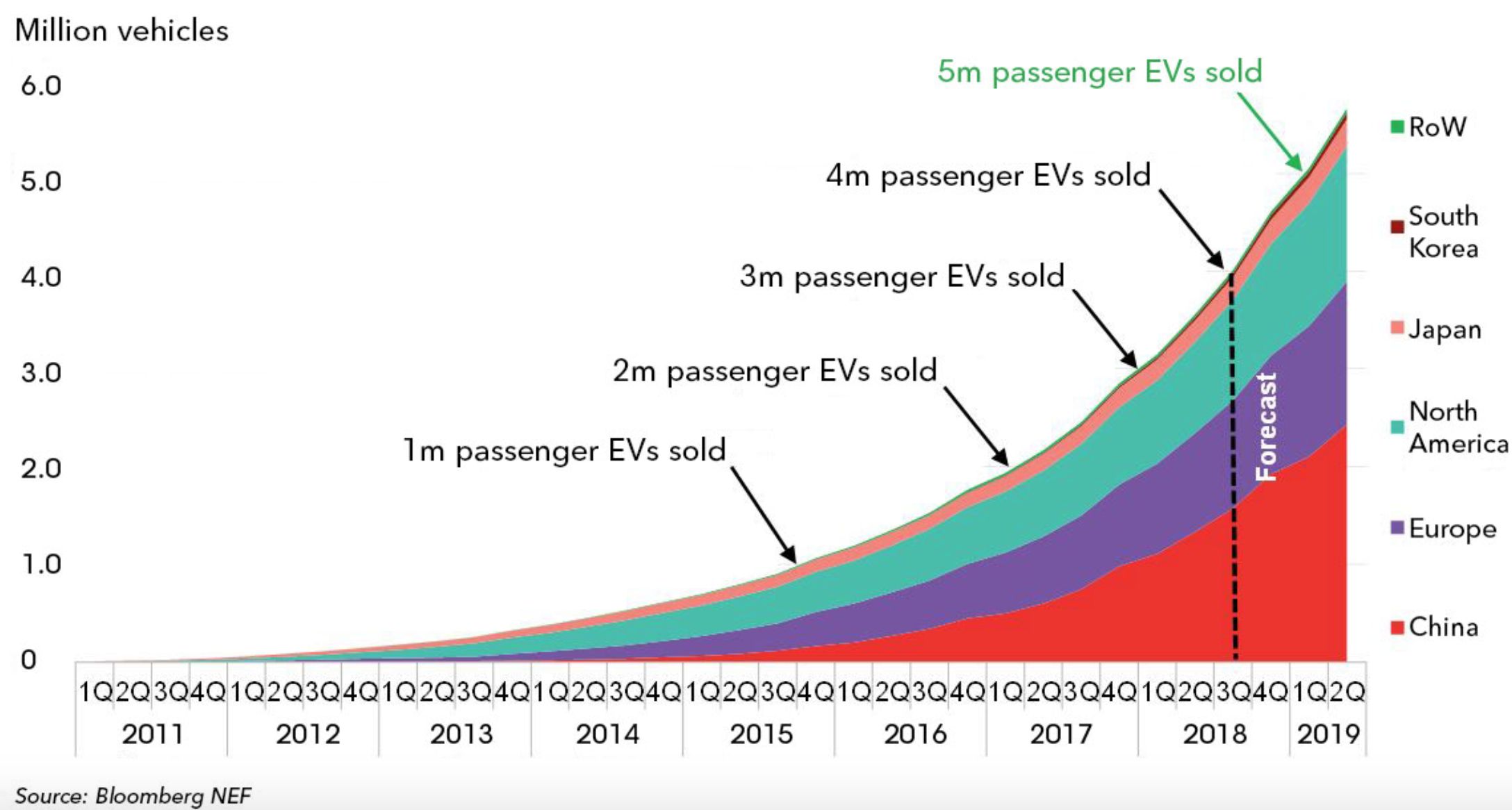

Beyond the Tesla controversies, global sales of EVs continue to grow steadily, surpassing 4 million total cumulative sales in August, doubling in just two years from the 2 million mark in 2016. Bloomberg New Energy Finance projects accelerating sales moving forward, with China’s growth in EV sales the main reason for that acceleration.

Continued doublings, as I always remind readers of these annual updates, very quickly lead to ubiquity.

Tesla is important, but far from the only game in town in the EV market. Musk’s zeal for all-electric cars has prompted all of the big auto manufacturers to promise their own EV offerings. The debate over the likely and desirable future for autos has been won — it’s EVs, hands down.

Nio, a Chinese EV manufacturer deemed a potential challenger to Tesla’s overwhelming dominance in the EV space, recently became the second public EV company in the U.S. (Tesla went public in 2010) and achieved a $7 billion market valuation soon after going public.

I fretted in my book that we didn’t have enough information yet to make a determination about the likely trends of EV growth and other non-fossil ICE cars in the coming years. Were we already on a path to ubiquity? Or could early promises fall by the wayside, as lower gas prices prompted a second premature death of the EV industry, as happened after the 1990s surge in interest in EVs?

I think, however, that we can now feel confident that the next couple of decades will include a massive transformation of the vehicle market toward electric drive, in the same way that we can now rest assured that we’ll see a full-scale transformation toward renewable electricity in the global electric industry. Growth in EV sales is accelerating, the definition of a growing and young market, rather than a mature market. So we appear to be in the early elbow of growth in EV sales and, as more and more companies offer compelling EVs, we will likely see this acceleration accelerate.

Global EV Sales Are Accelerating

What this means, if I am right, is that we can, fairly and with good data, now declare the green energy war won on all fronts — because the global transformation that I’ve called the Solar Singularity is already apparent, even though it’s not yet fully distributed. It’s smooth sailing ahead for renewable electricity and transportation energy.

In practice, of course, we can’t just sit back and relax. We still need to do the hard work of transformation. But we can do that work with the knowledge that the road has already been paved for us and we just need to stay on track. The future is visible. We’ve won (and I can now focus on other fields without guilt).

The Trump effect

Or have we? I worried in last year’s update that President Trump might actually be pro-fossil fuel and anti-renewables — in line with his campaign statements. He has indeed been the modern era’s most anti-environmental president in his first year and a half in office.

It seems that there is no limit to the depths that Trump and Co. will sink, as they look to roll back environmental regulations and laws and save the fossil fuel industry.

That said, the key tax credits for solar and wind survived possible elimination in the major tax bill signed into law by the president in late 2017.

Trump is in the process of rolling back the Clean Power Plan, one of Obama’s signature accomplishments, and many other renewable energy laws and regulations, tracked here by Harvard’s Environmental Law department.

So at the federal level, the push for renewables, electric vehicles and other greentech has dimmed considerably. But the important tax credits are still alive and kicking. And more generally, there is enough market momentum, as evidenced above, that positive federal policy encouragement beyond the remaining tax credits probably isn’t necessary.

While the federal government backs away from support for renewables and cleantech, many states are stepping up even more firmly. California recently enacted a precedent-setting 100 percent “carbon-free” mandate for 2045 (not “renewables,” which has always been the goal of previous mandates; however, with California phasing out nuclear plants, there is little chance of new nukes being part of this 100 percent mandate for carbon-free sources).

California’s ambitious new mandate will surely spur a number of copycats. I anticipate that in the next few years, one-third to one-half of all states will have a similar mandate in place. Trump’s anti-environmentalism may well have backfired by inspiring more serious state action that otherwise wouldn’t have happened.

Despite the dire federal events we’re witnessing daily, this annual Solar Singularity update is actually more optimistic than previous updates. The war has very likely been won. Markets have achieved the key milestones necessary to ensure strong growth through the next couple of decades, including in the transportation market.

The future is here. We all just need to do our part to make sure this bright future gets fully implemented in the next couple of decades.

***

Tam Hunt is a lawyer and owner of Community Renewable Solutions LLC, a renewable energy project development and policy advocacy firm based in Santa Barbara, California and Hilo, Hawaii, and author of the book, Solar: Why Our Energy Future Is So Bright.