The battle over net metering between Colorado's Xcel Energy and rooftop solar advocates could make the recent impassioned debate in Arizona seem tame.

Xcel Energy, Colorado’s dominant electricity provider, will have its 2014 Renewable Energy Standard Compliance Plan reviewed by the state Public Utilities Commission in February.

In its filings, the utility proposed to change net energy metering (NEM) to a “net metering incentive.” To validate the request, Xcel filed a value of solar study that puzzled Colorado solar advocates.

“They presented a draft study to the stakeholder review committee, asked for feedback, and then just filed it with the PUC with no discussion,” said Rick Gilliam, Vote Solar Initiative Research Director. “Xcel said they want a conversation about solar, but they won’t return phone calls.”

“There are two main arguments,” according to Meghan Nutting, SolarCity Policy Director. “One is that Xcel wants to recover infrastructure costs from the Renewable Energy Standard Adjustment fund.” Xcel’s net metering incentive is the difference between what the study concluded are distributed solar’s cost and benefits, Gilliam explained. “They want to deduct that from the RESA fund.”

In Xcel’s formulation, taking the net metering incentive from the RESA fund would make it as “transparent” as other performance-based incentives, Xcel VP Karen Hyde testified to the PUC in July.

“But it is questionable whether that is legal,” Gilliam said. “State law says RESA is to incur costs for implementing the RES.“

Xcel’s concern is a cross-subsidy, according to Robin Kittel, Xcel's Director of Regulatory Administration. With NEM, solar owners can sharply reduce their electricity bills and avoid much of the prorated Electric Commodity Adjustment (ECA) bill charge. This shifts system costs to non-solar-owners.

This makes it transparent that “every solar customer continues to receive benefits from the utility system that are the same or greater than the benefits received by his or her non-solar neighbor,” Hyde testified.

“It is not clear significant revenues are lost,” Nutting said, because few solar owners actually zero out their bills and completely avoid ECA charges. “There is no cost shift. APS, Arizona’s dominant utility, reported that the average monthly bill for solar owners in its territory from July 2012 to June 2013 was $71.27. Part of that pays for infrastructure.”

“It would be different in Colorado because, overall, the average customer use there is higher,” Gilliam acknowledged. Sunrun reports its average Colorado customer pays more than $20 per month to Xcel.

Of Xcel’s 16,000 Colorado solar owners, 1,700 received checks for producing more electricity than they consumed, Kittel said, and the “average residential solar customer serves 90 percent of load” with onsite production.

“The other argument,” Nutting said, “is that the 2014 Compliance Plan should only apply to 2014 and renewables, but this decision will impact future compliance plans, integrated renewables planning and what other utilities in the state do.”

“Cost-benefit studies are complicated,” Gilliam added. “To try to go over those details in a litigated process is a poor way to get a reasonable outcome.”

“The present NEM incentive was implemented as part of the RES legislation. It is appropriate to bring it to this proceeding,” Kittel said. “It only applies to 2014, but we are asking the Commission to be aware of the cross-subsidy, because Colorado solar advocates have a 1-million-solar-roofs target.”

Motions by solar groups to remove the current debate from Compliance Plan proceedings were rejected.

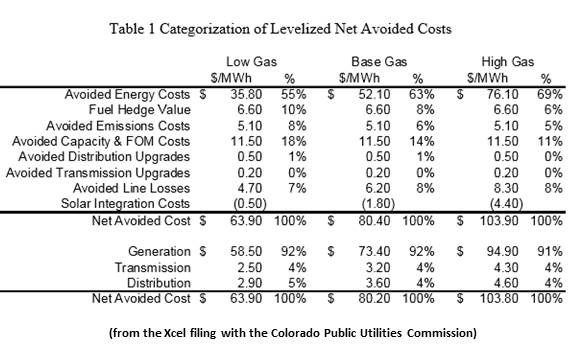

Xcel’s study, which Nutting called “unvetted,” applied an “avoided costs” method. It concluded that the revenue lost to net metering is the retail rate of $0.104 per kilowatt-hour, according to Kittel. The system’s avoided cost, or benefit, is $0.046 per kilowatt-hour. Xcel wants the $0.058 per kilowatt-hour difference shifted from the RESA fund to Xcel’s ECA account to compensate for revenues lost to solar owners.

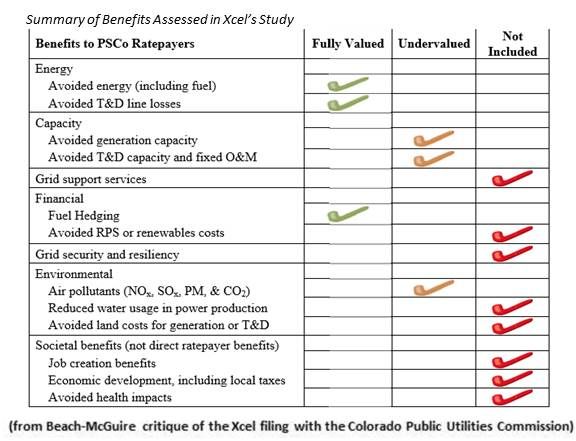

The solar industry critique of the study identified specific aspects of distributed solar’s benefit that were either undervalued or not considered by Xcel’s study. As a result, the critique concluded, “the annual net benefits of solar DG on the [Xcel] system are $13.6 million per year.”

“Xcel would say that overvalues solar,” Gilliam said. The way to get beyond the debate over which study is right, he explained, is to have a state-agency-facilitated stakeholder discussion about costs and benefits, item by item.

Future “facilitated discussions among stakeholders could define how to quantify and incorporate system costs and benefits into new rate designs,” according to Xcel VP Hyde’s testimony.

“The other alternative is we end up in a fight,” Gilliam said. And this could be the first in a series of moves by Xcel, he added. The next would be a rate change request based on the lower cost valuation. And if Xcel is compensated from the RESA fund, it would effectively cap NEM at the RESA fund’s 2 percent of utility bills cap. Finally, Xcel would, as Hyde’s testimony acknowledged, pursue a legislative change to NEM.

After proposed NEM rollbacks failed in Arizona and other states, Gilliam said, Xcel seems to have “decided to try something more subtle and creative.” A confrontation at the PUC is nearing, he warned. “The only way to stop it now would be a settlement. But I have made offers to Xcel and there has been no substantive response.”