2013 was a particularly busy year for miniature grids, accounting for over half of the total project initiations in the period 2011-2013. The increase in project initiations points toward accelerated growth over the next five years.

In addition, recently initiated projects have integrated a more diverse set of distributed energy resources, with roughly one-third of projects deploying battery storage. This mirrors the growth of distributed energy in the power grid at large, but it also depicts the ongoing microgrid evolution from diesel-based backup systems to advanced, highly controllable miniature distributed energy resources (DER) combinations. GTM Research explores this evolution in detail, including a capacity forecast and vendor opportunities, in its upcoming report, North American Microgrids 2014: The Evolution of Localized Energy Optimization.

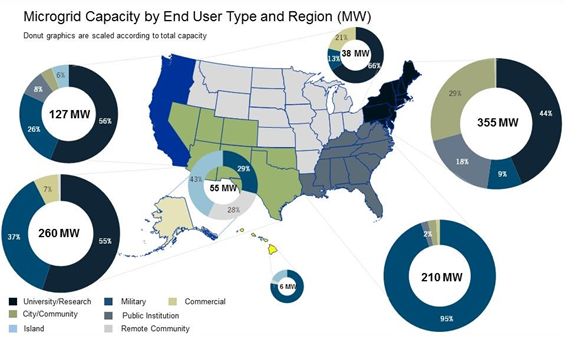

Despite plenty of optimism in the market, caution is still warranted. With a project pipeline containing fewer than 60 projects and an overall capacity of roughly 1 gigawatt, the market is still in its infancy. Significant legal barriers remain, especially for multi-building, multi-owner microgrids. In addition, microgrid user priorities vary by region (see map below). At the same time, low electricity price environments such as the Midwest are still largely devoid of microgrids.

Source: North American Microgrids 2014: The Evolution of Localized Energy Optimization

Nevertheless, it is reasonable to anticipate that the recent wave of project announcements will drive the market past its demonstration phase. Increased market segmentation and specialization are also occurring, from military applications to public institutions to industrial microgrids. In addition to the existing microgrid planning methodology, Energy Surety Microgrid, the U.S. military is working on cybersecure microgrid reference architectures through its Smart Power Infrastructure Demonstration for Energy Reliability and Security (SPIDERS) program. Once fully developed and tested in 2015 (at Hawaii's Camp Smith), these templates have the potential to speed up microgrid implementation across a larger project base and ease the technology's transition into the federal and commercial sector.

In parallel, state-led initiatives such as Connecticut’s microgrid pilot program, implemented in close cooperation with local utilities United Illuminating and Connecticut Light and Power, may significantly alter utilities' current skepticism about safe microgrid interconnection and reliable microgrid services. In addition, vendors and utilities can benefit from repeated cooperation across several deployments, as illustrated by the collaboration of Power Analytics, OSIsoft and Viridity Energy, which worked on a project at the University of California, San Diego and now cooperate to link three San Diego naval bases to one microgrid.

Source: North American Microgrids 2014: The Evolution of Localized Energy Optimization

The more often a particular type of microgrid makes it from the planning to the deployment stage, the higher the transparency around the off-grid and grid-connected services it can deliver. This slowly but steadily emerging microgrid typology is the basis for a more segmented vendor and buyer landscape, faster project development, and more targeted identification of cost-reduction opportunities. Vendors that have experience across several microgrid types, such as S&C or ZBB Energy Corporation, will have an inherent advantage in increasing their understanding of different implementation environments.

For example, remote and island microgrids tend to be renewables-based and frequently integrate storage, often in locations where expensive and emissions-heavy diesel-based generation makes them a more attractive option than they would be on the mainland. These systems are often newly constructed PV storage combinations in the 500-kilowatt to 2-megawatt range, lacking the sophistication of larger institutional microgrids that integrate a range of legacy and new generation assets and participate in electricity markets. In contrast, the recent wave of urban critical-facility microgrids is largely powered by fossil fuels and is used as a means of meeting exceedingly high reliability requirements for facilities in this category. Due to the small scale of critical loads, costs per installed capacity are still relatively high (in the range of $3,500 to $4,500 per kilowatt), while renewables-based island microgrids are closer to $1,000 per kilowatt.

Overall, strategic partnerships among vendors, developers and, ideally, utilities can serve several market needs in parallel. Sharing experiences across a larger group of stakeholders is the first step toward a more streamlined process of permitting, planning and implementing microgrids, and performance information collected over a wide range of projects will make it easier to advocate for regulatory changes.

Two organizations launched in 2014, the Microgrid Resources Coalition (including NRG and the International District Energy Association) and the Microgrid Alliance (Alstom, Enbala, HOMER Energy, General Microgrids, and Landis+Gyr) share the common goal of industry advocacy, member education and policy formation, adding to existing initiatives such as the Galvin Electricity Initiative. This is a promising development, but certainly not enough unless legal action and meaningful policy reform follows.

***

GTM Research's report North American Microgrids 2014 comes out later this month. Pre-order it here. Don't miss the panel on the future of microgrids at Grid Edge Live.