Though the availability of capital for large commercial solar has increased over the past five years, it still remains exceedingly difficult to finance and develop small commercial solar projects. These projects often have varying contract terms, power purchasers that lack credit ratings or easily assessed creditworthiness, and site-specific project requirements. What’s more, the transaction costs associated with smaller commercial projects are nearly the same as those for much larger deals.

These difficulties have often led developers to focus their attention on larger commercial projects, particularly those larger than 1 megawatt.

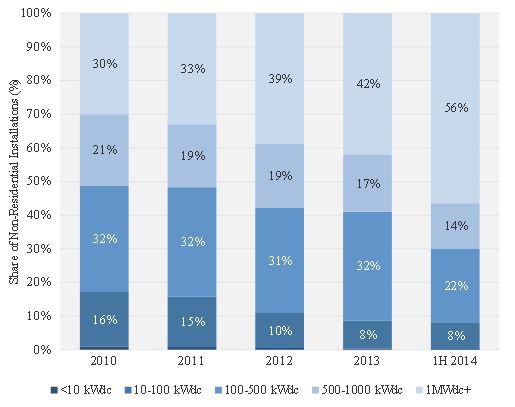

This dynamic has only become exacerbated over time. In 2010, 70 percent of all non-residential systems installed were less than 1 megawatt, whereas this category accounted for only 44 percent of the systems installed in the first half of 2014. The decline has been particularly stark for projects less than 100 kilowatts in size, whose market share has been cut in half over the same period.

FIGURE: Non-Residential PV Installations by System Size

It is important for the market to improve in the small commercial arena, in no small part because the theoretical market potential for that segment is virtually boundless by today’s standards. Fortunately, we foresee a number of developments that should aid in this transition.

First, states such as Massachusetts and New York are rolling out incentive programs with specific carve-outs for small commercial, recognizing the need for that segment to be treated independently.

Second, we have seen a variety of companies seek out innovations to lower the administrative burden associated with financing small commercial through solutions such as project scores, online diligence tools, and investment platforms.

Finally, some larger commercial developers have begun building small commercial assets on their own balance sheet as a proof of concept to attract third-party capital. We remain optimistic that the small commercial slump will ultimately reverse itself over the coming years.

We expect the U.S. non-residential PV market to exceed 1.3 gigawatts this year, growing 21 percent over 2013's totals.

***

This is an excerpt of the Q2 2014 U.S. Solar Market Insight report. Download the free executive summary or purchase the report here.