The Northeast isn’t the sunniest region of the U.S., but, nonetheless, it represents an enormous investment opportunity for mid-scale commercial solar, according to a new report by Wiser Capital.

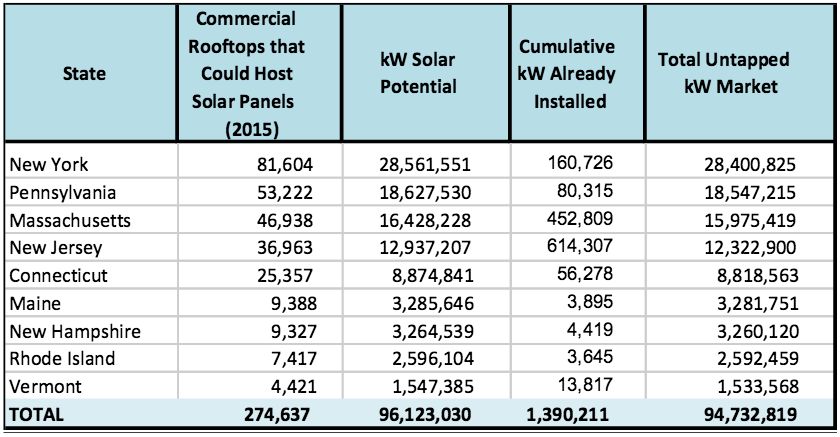

The report calculates that there are more than 274,000 buildings fit to host mid-scale commercial solar in the Northeast. Assuming a system size of 350 kilowatts, the assessment finds there are more than 94,700 megawatts of potential solar installations. This untapped market translates to an investment opportunity worth approximately $67.5 billion.

“Many people assume that sunny states like Texas or Florida are automatically good markets for solar, but that’s simply not the case,” said Nathan Homan, executive director of Wiser Capital. “Adequate sun for solar electricity exists across the U.S. The Northeast is a prime market for solar due to available commercial roof space, higher-than-average utility rates and regional incentives.”

Wiser, a renewable energy investment firm, set out to measure market capacity in the Northeast to try to find new investment opportunities in the emerging medium-scale solar space. The report evaluated nine states: New York, Pennsylvania, Massachusetts, New Jersey, Connecticut, Maine, New Hampshire, Rhode Island and Vermont.

Based on available roof space, New York, Pennsylvania and Massachusetts were found to represent the largest opportunity for medium-sized solar projects -- making up roughly 30 percent, 19 percent and 17 percent of the market opportunity, respectively.

But roof space alone doesn’t make for a robust solar market. The report found that New York and Massachusetts have the most viable markets because of their particular cost and incentive structures.

In Massachusetts, the attractiveness of solar is helped by the state’s strong Solar Renewable Energy Credit (SREC) market and its considerably lower escalator rates for a solar PPA over historical utility cost increases. Wiser estimates that a typical 350-kilowatt system that covers 80 percent of electricity use for a commercial entity, assuming it consumes approximately 38,500 kilowatt-hours of solar electricity per month, could see savings just shy of $1 million over a 25-year PPA.

New York doesn’t have an SREC market, but solar projects do qualify for a three-year performance-based incentive. In this case, a typical 350-kilowatt system in Con Edison territory that covers 80 percent of electricity use for a commercial facility could achieve a cumulative savings of more than $1 million over the course of a 25-year PPA term. This model assumes the client consumes approximately 43,000 kilowatt-hours of solar electricity per month -- this is a higher figure than in Mass., because New York has better solar access, or more hours of sun per day.

To assess the mid-scale commercial solar potential in the Northeast, Wiser researchers started with data on the number of commercial buildings in the Northeast from Environment America. Those figures were then limited to the number of buildings that could host a 50-kilowatt solar system. Researchers then used a Department of Energy methodology to calculate the number of commercial rooftops in cool locations that would be suitable to host solar.

To calculate the potential savings for the host facility, Wiser relied on the Open PV database, where installers can share data on system sizes and installation costs. Megan Birney, director of strategic affairs at Wiser Capital, acknowledged this is a possible weak spot in the analysis, because there is a lack of transparency on the actual costs to install solar systems due in part to market competition.

This lack of information is hurting the mid-scale solar market, she said. “If you can’t convince somebody you’re going to save them money, it’s hard to sell them solar.”

The market also suffers from a dearth of competitive financing, which similarly stems from a lack of information. The mid-scale commercial solar market in the U.S. currently lags well behind residential, large-scale and utility-scale solar projects.

But this trend is changing, said Birney.

“Wiser Capital and other companies out there are actually assessing risk on previously unrated facilities, so now they can look at projects, understand the risk and reward, and be more comfortable taking on those risks for a given ROI,” she said.

“In residential solar, when third-party finance entered the game, it transformed the market,” she added. “Now that’s what we’re seeing in the commercial market.”