As the U.S. International Trade Commission holds its first public hearing on the Suniva and SolarWorld trade case today, many solar stakeholders are already thinking ahead to the fall -- and about President Trump.

To be sure, the ITC holds a lot of sway in this case. The commission is expected to complete its investigation of the Section 201 trade petition by September 22, and if the trade body determines foreign imports have caused no injury to the domestic solar industry, the case will be thrown out. However, there's a good chance the final determination rests out of the ITC’s hands.

The ITC’s prehearing report states that numerous U.S. producers of crystalline silicon photovoltaic (CSPV) products reported adverse impacts on their operations due to import competition. In one query, nine U.S. producers ranked imports as an extremely important cause of injury, and one firm ranked it as an important factor.

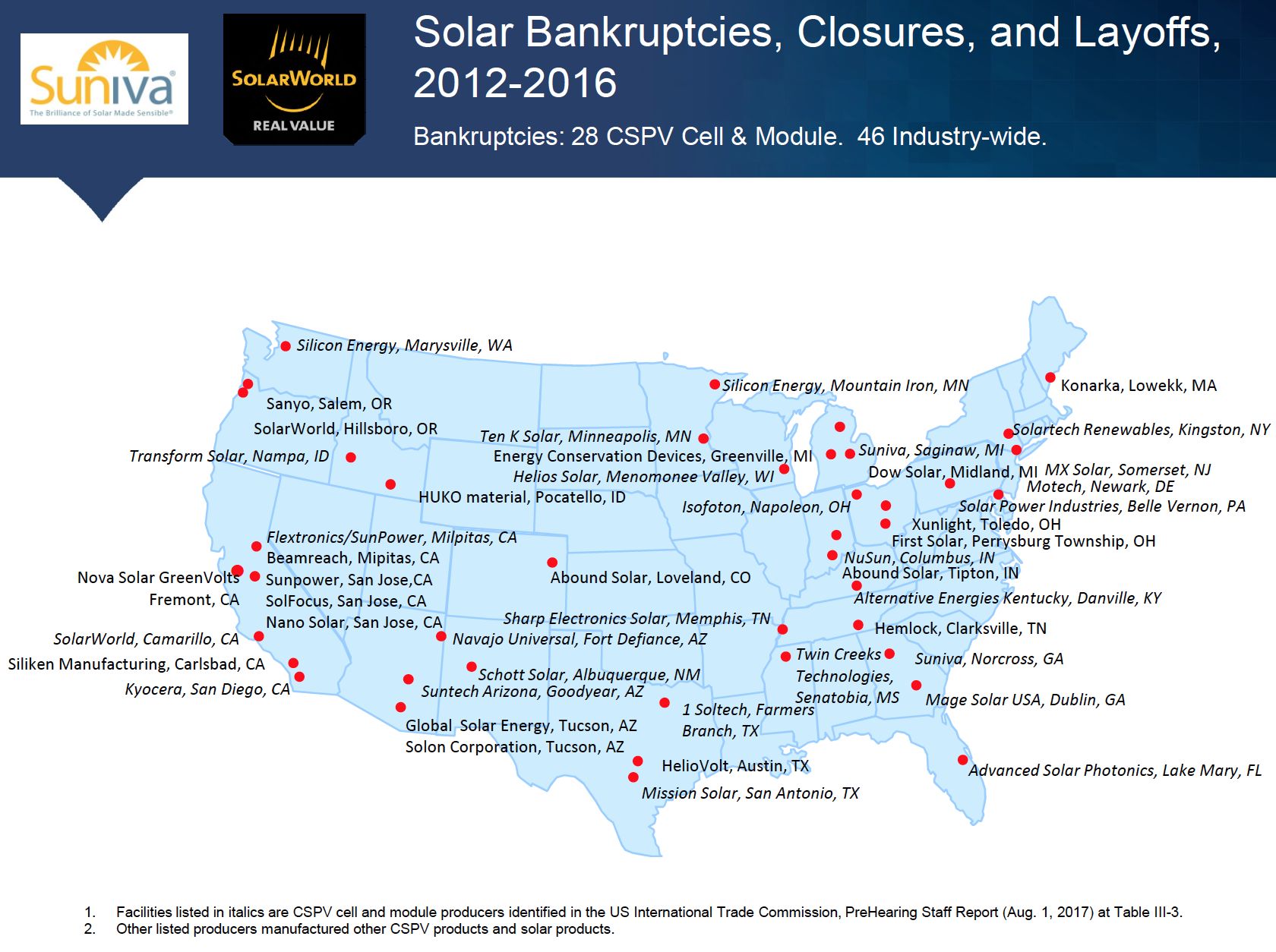

During testimony today, Matthew McConkey, partner at law firm Mayer Brown representing Suniva, insisted this case isn’t only about the two petitioners. “The United States is literally strewn with the carcasses of shuttered solar manufacturing facilities,” he said.

If the ITC does find injury, the case will very quickly become political. The commission will hold a hearing to discuss a trade remedy on October 3. That recommendation will then go to President Trump, who has the authority to accept, reject, soften or toughen the ITC’s proposed sanctions.

It’s the Trump card that has some solar industry insiders concerned. The Solar Energy Industries Association (SEIA) is making the case that foreign-owned solar product manufacturers Suniva and SolarWorld brought their recent financial collapses upon themselves, even as the broader U.S. solar industry continues to thrive. SEIA calculated that 88,000 U.S. jobs would be lost if the requested tariffs are approved.

The trade group has garnered support from a bipartisan group of 16 senators and 53 members of the House of Representatives, who sent open letters to PTC Chairman Rhonda Schmidtlein urging the commission to reject the petition. “Increasing costs will stop solar growth dead in its tracks, threatening tens of thousands of American workers in the solar industry and jeopardizing billions of dollars in investment in communities across the country,” the Senate letter states. Several conservative free-market groups have also joined with SEIA to fight against protectionist trade measures.

Despite these efforts, some opponents of the case say they’re worried SEIA’s approach is flawed and that the trade group’s arguments will be ignored by a president who’s disconnected from Congress, from the traditional lobbying process, and from the rest of the Republican Party.

Stockpiling and price spikes

Opponents of the trade petition were unwilling to publicly acknowledge that tariffs could be approved, due to the sensitivity of the pending case. But it’s safe to say there’s a strong sense of unease -- and companies are planning for it. Solar developers have been stockpiling solar panels in anticipation of a price hike. And prices are said to have already increased 20 percent to 30 percent, just on the threat of new tariffs.

"The Trump administration has given a very clear indication that [trade remedies are] are their preferred mechanism for protecting existing manufacturers and attracting investment into new U.S. manufacturing -- and we’re not the only ones,” said one solar industry expert, referencing the administration’s recent investigations into aluminum and steel under Section 232 of the Trade Expansion Act of 1962. “It’s not like this trade case is magically popping up because solar is in trouble; it’s because the administration gave a signal that this is something they would support.”

In a speech delivered last summer, then-candidate Donald Trump specifically said he would use “every lawful presidential power to remedy trade disputes, including the application of tariffs consistent with Section 201 and 301 of the Trade Act of 1974, and Section 232 of the Trade Expansion Act of 1962.”

One source with ties to the investment community said that letters from lawmakers don’t mean much in this context, and added that SEIA should be doing more. People close to Trump or those hailing from Wall Street need to be opposed the tariffs in order for the president to oppose them.

Can traditional conservatives win over the White House?

SunPower CEO Tom Werner, a registered Republican, acknowledged the philosophical divide among conservative political leaders on trade, but felt confident the jobs numbers would compel the Trump administration to reject the trade remedies.

“Traditional conservatives, which are largely not in the White House, are free-market-driven,” Werner said. “I think the common thread between the White House protectionist comments and the traditional conservatives is the desire [to create] American jobs.”

“That’s the irony of this case -- it’s trying to protect [fewer] than 1,000 jobs of the solar industry’s 260,000 jobs,” he added, referring to Suniva's and SolarWorld’s current employee numbers. “We’re hopeful the intersection of these things will bring the White House together with traditional conservatives.”

Senator David Perdue of Georgia -- Suniva’s home state -- is considered a top Trump ally in Congress, and has come out against the Suniva and SolarWorld requested trade protection, which is giving opponents hope. In addition, Georgia Public Service Commissioner Lauren “Bubba” McDonald, Jr. was among the state officials who testified against the petition today. “The expansion of the solar market benefits the entire U.S. solar industry, including producers of cells, modules, panels and installers, as well as many downstream industries,” he said. “But more importantly, the growth in solar energy benefits electricity consumers.”

Debbie Dooley, president of Conservatives for Energy Freedom and founder of the Green Tea Coalition, said she couldn’t see a successful businessman like Trump supporting the “bad business practices” that SolarWorld and Suniva had engaged in. She pointed to Florida-based PV manufacturer SolarTech Universal as an example of a company that’s thriving despite market competition.

“I’m a big Trump supporter. I supported him from almost the beginning,” Dooley said. “[The trade case] is something I plan on fighting, and I think a lot of conservatives will fight, because it’s wrong and will be devastating. […] There will be many more jobs lost than jobs saved by giving these solar companies a bailout and adding the tariff these manufacturing companies are asking for.”

On the jobs front, opponents will have to counter employment numbers put forward by Suniva and SolarWorld. They’ll also have to get beyond Congress, to Trump’s inner circle of energy and trade advisers, whose professional backgrounds show they’re not big fans of imports and are in favor of heavy remedies.

The Trump team of trade advisers

A closer look at President Trump’s advisers indicates that trade case opponents have their work cut out for them.

Robert Lighthizer, confirmed in May as Trump’s trade czar, failed to win the votes of GOP Senators John McCain of Arizona and Ben Sasse of Nebraska, because they feared he does not understand the positive economic benefits of the North American Free Trade Agreement (NAFTA) and “would not negotiate trade deals that would protect the American consumer and expand economic growth,” according to a joint statement.

Lighthizer, who served as a deputy trade representative during the Reagan administration, wrote in a 2011 Washington Times piece that the "recent blind faith some Republicans have shown toward free trade actually represents more of an aberration than a hallmark of true American conservatism."

U.S. Commerce Secretary Wilbur Ross, who’s expected to play an outsized role in trade deliberations, has called China “protectionist” and characterized NAFTA as “obsolete.”

NAFTA is relevant to the Section 201 trade case because Suniva and SolarWorld are urging the ITC to apply the tariffs broadly, including to America’s free trade partners such as Canada, Mexico and South Korea.

“As long as the remedy is comprehensive, we think it will be a significant positive for U.S. manufacturing and U.S. jobs,” said SolarWorld lawyer Timothy Brightbill. “The worst thing that could happen would be to omit or leave out certain countries from relief. That’s why Section 201 is so powerful, because it covers all countries and import sources.”

SunPower’s Werner, whose company manufacturers solar products in Mexico, said that the law states free trade partners are exempted from trade tariffs. But while it’s true that free trade agreements are designed to give certain countries preferential treatment, the Trump administration could seek to undermine those protections as a first step in rolling back NAFTA.

White House trade adviser Peter Navarro, a staunch NAFTA opponent with hardline views on the threat that China poses to the U.S., is another potential presidential influencer on this issue. In a related personnel matter, Nova Daly, who led Trump's trade office transition team, currently works as senior public policy adviser on international trade at law firm Wiley Rein, which is representing SolarWorld in the Section 201 case.

Department of Energy Chief of Staff Brian McCormack, who previously served as vice president of political and external affairs at the Edison Electric Institute, could be tapped to advise the president as an energy and technology expert on the trade case. During McCormack’s tenure, the utility trade group sought to help its members roll back favorable residential solar policies, and he is now overseeing a DOE study on how subsidies and tax policies for intermittent renewable energy resources are forcing the premature retirement of baseload energy resources. However, McCormack will also be aware of how higher solar prices could negatively impact utility procurement decisions. So it is unclear what, if any, position he will take on the trade case.

"Reject the government favoritism that plagues Washington"

Tori Whiting, research associate at the Heritage Foundation, acknowledged that the Trump administration’s protectionist position on steel and other industries would suggest a pro-tariff stance in the Section 201 case. But she underscored that the administration has not yet come out for or against this particular solar-related measure, and so it would be premature to make that assumption.

The Heritage Foundation has not met with the administration on this issue, she added, but is waging a strong communications effort, along with allies in the newly formed Energy Trade Action Coalition. The National Electrical Contractors Association, the National Retail Federation and the Electric Reliability Coordinating Council, whose members include Ameren, DTE Energy, Duke and Southern Company, have also come out against the trade petition.

“The U.S. International Trade Commission will have the opportunity to reject the type of government favoritism that plagues Washington,” Whiting and her colleague Katie Tubb wrote in an article published today. “Acquiescing to Suniva and SolarWorld Americas’ petition for more tariffs would do deep damage to the rest of the U.S. solar industry and add yet another layer of federal subsidies to one of the most heavily subsidized energy technologies in America today.”

What happens next depends on what stakeholders hear about the trade investigation following today’s ITC hearing. The ITC has stated that the case is a very complicated, “so I think they’re seeing this is something that takes a lot of time to examine,” Whiting said.

Sources in the ITC hearing room in Washington, D.C. today said it was very difficult to tell which way the commissioners are leaning.