Africa is the land of opportunity for investors in decentralized off-grid solar, and two big deals in the past week suggest the market will continue to consolidate and scale up to address the continent’s 600 million people without reliable electricity.

Last week, Japan’s Mitsubishi put $50 million into U.K.-based BBOXX, a provider of pay-as-you-go solar home systems with a strong presence in sub-Saharan Africa. Days later French energy giant Engie acquired Mobisol, a leading home solar provider in East Africa, building on Engie’s long list of investments in the off-grid sector.

The Mobisol and Bboxx deals “demonstrate that utility-minded strategic investors continue to see a crystal-clear value proposition in becoming a utility of the future to last-mile customers,” said Benjamin Attia, an analyst in WoodMac’s Power & Renewables practice.

“Off-grid households lack access to far more than just electricity,” Attia said. “The potential to evolve the utility business model again to go beyond source-to-sink electricity service provision with the next billion customers is incredibly attractive.”

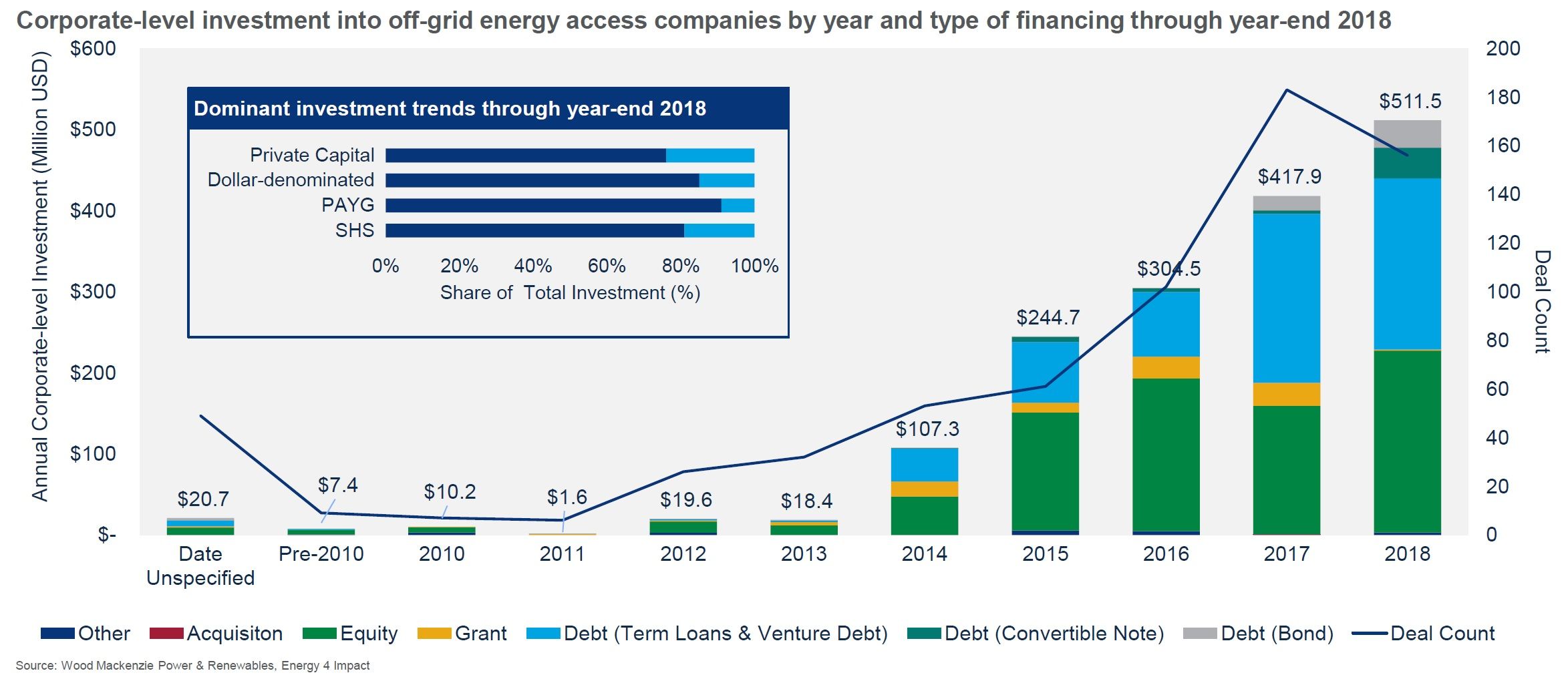

Corporate-level investments into off-grid renewables companies have grown exponentially in recent years, exceeding $2 billion globally on a cumulative basis through the first half of 2019, according to the latest WoodMac data.

Africa, and particularly East Africa, is by far the largest destination for off-grid investment to date. Total, EDF, E.ON and Shell are among the strategic investors putting money into the market.

Star of the show

While a variety of technologies and products are considered part of the off-grid ecosystem, solar home systems have been the star of the show from an investment perspective, and particularly those sold under a pay-as-you-go (paygo) model.

Under such a model, residential customers in remote areas are provided with a solar-generation unit, usually backed up with a battery, and the homeowners make lease payments over time as they benefit from the electricity. Paygo allows solar companies to tap into a vast base of potential customers that cannot pay for a system upfront, but it means the companies must carry that debt on their balance sheet.

Among Africa’s leading home solar players are Zola Electric and M-Kopa Solar, the latter backed by Sumitomo and Mitsui.

Scale is critical for such a business model to work over the long run, said Ashwin West, investment director at the African Infrastructure Investment Managers, a private-equity investor with about $2 billion under management. AIIM’s investment portfolio includes a number of off-grid companies, including BBOXX and Nigeria’s Starsight Power Utility.

“For an investment in the off-grid sector to really make sense, you need to develop a level of scale in the portfolio of customers,” West told GTM. “Until you reach a level of scale, the fixed costs to run and operate the portfolio of solar home system clients are high, which can put pressure on working capital requirements and hamper your ability to expand.”

Credit: Wood Mackenzie & Energy 4 Impact

There are still challenges for the paygo model, including the lack of credit history from populations that are not currently part of the formal banking sector. Companies must build high-quality portfolios of customers to ensure the solar systems are being used and payments are being made, West said.

The capital-intensive nature of an equipment-leasing business like paygo solar means there’s an ongoing need for providers to raise working capital through debt and equity.

The good news is it appears to be getting easier for companies to raise debt finance, making it easier for them to scale up. In 2018, the debt-equity balance in the total capital composition of off-grid investments shifted closer to 50-50, according to a recent report by WoodMac and Energy4Impact.

“Paygo solar homes have reached a level of maturity," Attia said. "We’re expecting that the uptake of solar home systems is going to increase rapidly now that [the sector has] passed the ‘channel-product fit’ milestone, and some market leaders are approaching and achieving corporate-level profitability."

“That allows them to more easily demonstrate creditworthiness and raise more debt for scaling up their businesses.”

Attia predicts further consolidation in the African market for solar home systems.

“There are growing efforts from market leaders to develop sophisticated analytics platforms to improve visibility into their customer portfolio,” he said. “They have developed software, hardware and sales tools along the value chain. They will likely start to unbundle and license these at a much faster pace.”

“When the market can scale a little bit more without really investing capital or cash, then some of those companies may start securitizing their portfolios…and scale more rapidly,” Attia said.

The coming mini-grid boom

Not all segments of the off-grid market are at the same stage of evolution.

As of the end of 2018, around 80 percent of corporate-level investment into off-grid energy access had gone into the paygo solar home market. But another promising market, soaking up another 15 percent of the total investment, is for mini-grid projects — consisting of "last-mile" infrastructure to connect entire villages in areas cut off from the national grid.

Mini-grids can supply up to 5 megawatts of power alongside other services to households, small business, schools, hospitals and other end users.

Mini-grids are “the cheapest method of electrifying a group of users in rural areas, enabling economic growth,” said Benedikt Lenders, head of mini-grids at Engie PowerCorner Africa.

As a startup within Engie, PowerCorner currently operates 12 mini-grids in Tanzania and one in Zambia, and it’s finalizing agreements for new mini-grid projects in four new African countries.

“We are close to reaching deals for new mini-grids that will boost the number of beneficiaries from 12,500 currently to around 50,000 in the coming 12 months,” Lenders said.

Despite such growth, the company has not yet found a viable business model for mini-grids, as funding for such projects remains difficult to secure. Building last-mile infrastructure on equity financing in a cost-effective manner is challenging.

Instead, Engie is promoting result-based financing to help channel impact funds into mini-grid projects based on specific connection criteria, ultimately helping to raise debt and other finance for the mini-grid sector.

Engie is part of a group of investors pooling $2 billion under management and endorsing mini-grids as a key solution to ending energy poverty in Africa.

In one of the first such financing schemes in Africa's off-grid sector, mini-grid developer PowerGen Renewable Energy in July secured $5.5 million to finance 60 mini-grids in Tanzania.

“We know the mini-grid market is an immature market compared to solar home systems,” Lenders said.

“Mini-grids are by nature capex-intensive, and that’s why we need to find support funds from relevant donors and institutions — ideally through result-based financing — to complement our own share of capex investment.”

“Those support funds allow you to attract the necessary private capital needed for scale-up, even if mini-grids remain a very long-term business, up to 25 years,” Lenders said.

--

Join GTM in London on 2 October for our Off-Grid Energy Access Forum. We'll hear from ENGIE, EDF, Total, Acumen and more at the only conference assessing global investment, market opportunities and technology developments for off-grid energy access at the last mile.