The sun is setting on another record year for the solar industry, and although the dawn of next year sees a consensus that slow-down is inevitable as European feed-in tariffs roll back, two regions are emerging as the backbone for long-term hope: North America and Asia. Powered by a high feed-in tariff in Ontario and a patchwork of state level solar targets in the U.S., North America should see major growth in its still-adolescent PV industry. On the other side of the world, China shows promise that it will pivot its manufacturing dominance into domestic solar installations, and India’s lofty clean energy goals and untapped potential could vault it into a major market in the next couple of years. However, domestic unemployment and unfavorable trade balance scales have caused these emerging solar economies to move towards trade walls and other protectionist policies.

In September, the U.S. Steelworkers Union filed a 5,000-page petition with the Obama Administration alleging that China’s subsidies for renewable energy manufacturing -- including low-interest loans and free land -- came at the expense of U.S. firms and violated World Trade Organization (WTO) regulations on export industries. Now under review by the office of the U.S. Trade Representative, the petition could very well become a formal complaint to the WTO.

Ontario faces similar, though less publicized, criticism. Its domestic content requirements, which will necessitate that 60% of project costs are sourced from Ontario, are under fire from the Japanese government. Japan requested WTO consultations in September, claiming that the domestic content requirements cause “solar panels or other equipment exported by Japanese companies to Ontario [to be] treated less favorably than those locally produced.”

Likewise, India’s ambitious 20 GW by 2022 goals have drawn significant attention from leading solar suppliers, but current global leaders like U.S.-headquartered First Solar and China-based Suntech will be soon locked out as India bars subsidized firms from importing foreign solar products in April. Spokespeople from the U.S. Trade Representative and U.S.-based manufacturers are pushing back, stating that the bans are set up to give Indian companies a monopoly and would “discourage further investors from developing solar projects in India."

But the U.S. is no saint in these fair trade debates. The American Recovery and Reinvestment Act (ARRA), better known as the stimulus package, stipulates that public projects that receive funding must use American “made” products.

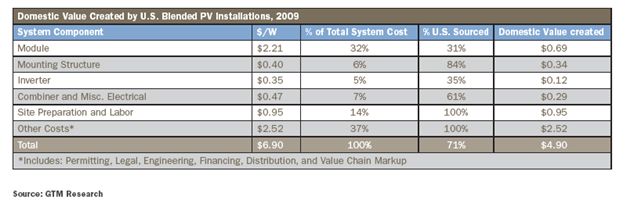

Against this backdrop, 2011 could give rise many fiery debates surrounding protectionist policies and domestic content requirements. While the motivation is clear and understandable, there’s some indication that these policies may end up hurting domestic solar industries more than they benefit them. A recent study released by the Solar Energy Industries Association (SEIA) and GTM Research shows that in 2009, 74% of the value of all U.S. solar installations and 71% of PV projects remained in the U.S., directly benefiting American companies or subsidiaries and their workers. While major PV components like solar modules and inverters are mostly foreign-sourced -- 31% and 35%, respectively -- the balance-of-system components and costs mostly benefit the American economy.

According to SEIA and GTM Research, the typical U.S. PV system in 2009 came at a price tag of $6.90 per watt. Of that total, 71%, or $4.90 per watt, of the value stays in the U.S. Considering that the federal government pays out 30% of the system’s value ($2.07/W), every federal dollar spent through the Treasury Grant program or through tax credits yields more than twice the benefit to U.S. companies. Certainly, projects also required additional public investment through state rebates and incentives, but the data show a strong net benefit for American companies and workers.

It is important to note that of manufactured components, only 42% of the value is retained domestically, with two-thirds of the value of solar modules and inverters sourced from abroad. But the key to a robust domestic industry should come in the form of incentives, not protectionism. While Ontario has seen some foreign investment into its manufacturing facilities, much of this new production comes in the form of contract manufacturing -- a temporary boon, but certainly not a long-term play. And if rumors of FIT cuts next year prove true, foreign suppliers would be able to leave nearly as quickly as they entered the market.

So, which approach does work? First, the U.S. solar industry continues to need strong demand-side incentives, whether that comes from a California PBI, an Oregon volumetric FiT, or a New Jersey SREC; after all, German FITs, not low-interest Chinese loans, sparked the global PV industry. Also, important supply-side incentives, like the recently left out 48C tax credit for cleantech manufacturers, need to be put back in place to encourage long-term domestic manufacturing, especially for newer and more innovative technologies. Despite these incentives, will China and other low-cost manufacturers continue to dominate manufacturing? Of course. But considering that 51% of the PV project costs come in the form of labor or soft costs -- costs that are extremely difficult to outsource -- foreign manufacturing may not be the death knell of a domestic solar industry, especially if it continues to drive solar costs down.

So instead of focusing on protectionism, U.S. policy needs to focus on incentivizing solar to grow the industry into a global leader again. And when we build a robust industry, perhaps the manufacturing will come back, too. And even if it doesn’t, the investment will still create significant benefits in a still-struggling economy; I’m certain the anticipated 24,000 new U.S. solar workers in 2011 would agree.

**Update: France has joined the fray, with Environment Minister Nathalie Kosciusko-Morizet announcing that France's solar energy freeze was enacted primarily to curb Chinese imports on solar modules. France lacks a strong module supply base so any barriers would have to balance opening module imports from other EU countries (certainly to China's ire), account for rises in module prices from domestic content requirements (due to short supply), or curb domestic installations.