It is not entirely crazy to expect that by 2030 or so electric vehicles will be the default option for new car purchases around the world. Lithium-ion battery costs are steadily declining by 6 percent to 9 percent with each doubling of production -- so we can expect today’s still-a-bit-expensive-for-the-average-person electric cars to become affordable for the majority of new car buyers within the next five to 10 years.

Tesla has made headlines for some time now with the promised Model 3, a car that will have 200+ miles of range and will cost about $30,000 after the federal $7,500 tax credit. This car is expected to be available around 2017, but will probably arrive somewhat later, judging by Tesla’s ability to hit deadlines so far. GM has also suggested it will have a car with similar characteristics ready in the same timeframe. If both of these models come to market as advertised, the EV market may well blossom before 2020, taking the 1 million EVs that will be on the road by the end of 2015 to a few million or more in the next five years.

Regardless of such speculations about the actual timeframe of these developments, it does seem clear that EVs have already passed a critical threshold of market viability. Having a total of 1 million EVs on the road seems to be a pretty good threshold to hang our hat on. My recent column looked at whether lithium supplies can scale up to meet this potentially huge demand for EVs and other battery needs. This column will look at a related question: how will the geopolitical map change as lithium starts to replace oil as the world’s most coveted energy commodity?

How and where is lithium produced?

Lithium for use in batteries and other applications can be produced in two different ways: mining of lithium ores and concentration of lithium brines. The majority of lithium is mined from brines; Australia and China are the only countries that rely heavily on mining of lithium ores.

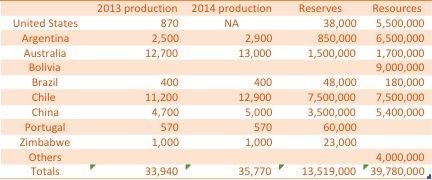

The following chart shows the major proven reserves of lithium around the world, according to the U.S. Geological Survey’s 2015 analysis.

Figure 1: USGS Mining, Reserves and Resources Data (Metric Tons)

Australia and Chile are by far the largest current producers of lithium. Australia, China and Chile are the top three reserves holders, dwarfing the rest of the world’s reserves. Argentina rounds out the top four, with a respectable reserves figure of almost 1 million tons. No other country comes close to these four in terms of reserves. The picture is a little different in looking at resources, with Bolivia and China leading the pack.

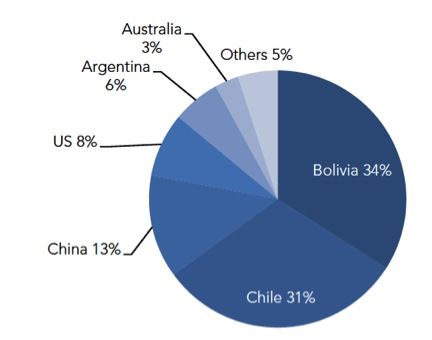

We get a very different picture of reserves from sources other than USGS. For example, the 2013 Fox Market Report cites the signumBOX 2011 reserves estimates for its chart in Figure 2, which shows the percentage allocation of reserves around the world. It’s not clear why Bolivia is omitted from the USGS reserves analysis, but based on the signumBOX report and various other analyses, we should consider Bolivia to be a major player in the future lithium market.

Figure 2: SignumBOX 2011 Reserves Estimates

This kind of substantial disagreement between reserves estimates indicates that the global lithium market is still developing, further highlighting the inability to make any kind of definitive statements about the shape of the lithium market in 10 or 20 years from now. But we can make some broad predictions based on the available data.

Both reports agree that Chile, China, Argentina and Australia are among the top reserves holders.

Some speculation about global lithium production and geopolitics

If lithium-ion batteries start to take significant market share from internal-combustion vehicles by 2030 or so, which is plausible given current growth rates, how will global lithium geopolitics change?

First, it’s necessary to note that lithium is fully recyclable, so it’s not an exhaustible commodity like oil. Accordingly, even if lithium batteries do start to significantly displace internal-combustion engines, we won’t necessarily see a “lithium politics” replace today’s “petropolitics.” That said, if EV demand really does skyrocket in coming years, countries with major lithium resources will have far greater power than they do in today’s economic and geopolitical hierarchy.

Energy resources are not the only source of political power, but they are a very significant factor. The U.S. became the first hyperpower after World War II, when it made up over one-third of the global economy, in large part due to its dominance as the largest oil producer from the beginning of the 20th century until U.S. oil production peaked in 1970, and the fact that its competitors were all reeling after World War II. U.S. power fell in a relative sense from that time until the fall of the Soviet Union in 1991, and then rose again with that historic collapse. It is also relevant that the Soviet Union collapsed in part because the price of oil collapsed in 1986, depriving the Soviets of much of their main source of revenue.

Since 1991, the U.S. has maintained a position of unrivaled dominance in global affairs, but Russia is again rising in prominence. A large part of the new resurgence in Russia’s political power is based on its energy production and exports. Russia has traded back and forth with Saudi Arabia over the last decade for the title of biggest oil producer. Russia is also a major exporter when it comes to natural gas and coal.

The global picture is now changing significantly, again, in various ways, with new tensions between Russia and the West representing just one aspect of this picture. Some of the most important developments in global affairs in recent years are 1) the degree to which U.S. oil production from fracking has increased and the perception of power that this remarkable increase has provided (whether or not the perception is accurate); 2) the rise of a non-Western power structure that is being led by China and Russia, surely the two most serious rivals to U.S. power in the coming decades; and 3) the degree to which electric vehicles and lithium-ion batteries will replace traditional sources of energy in transportation.

As is widely discussed in the energy field, U.S. oil production has almost returned to its 1970 peak in the last few years, an unexpected surge in production that has broken the long-term trend of steadily declining production. Oil production has risen by almost a factor of two in the last five years, and the U.S. is now once again one of the biggest producers of oil in the world. Even with that increase, however, we still import about one-third of the oil we consume because we consume far more than we produce.

It is likely, however, that this spike in unconventional U.S. oil production will be relatively temporary, peaking by the early 2020s or so, according to official energy agency projections. There are even some signs that the decline will come sooner than this, due to the very rapid decline of individual wells and the need to drill more and more wells to replace declining production.

My feeling is that this new oil dynamic is important because of the misperception of energy independence that the recent spike has provided. Many energy pundits and even more foreign-policy pundits have seized on the dramatic increases in oil and natural gas production as certain evidence that the U.S. is headed back to energy independence and all the freedom to act on the world stage that such independence brings. But as mentioned, it’s likely that this increase in production is relatively temporary, and it’s highly unlikely that we’ll see the U.S. become energy independent any time soon, given the amount of oil we consume. Last, we’ve been relatively free actors on the global stage since the fall of the Soviet Union anyway, and it’s far from obvious that enjoying true energy independence would allow much more freedom than we have historically enjoyed.

For example, if we were free to tell the Saudis that we don’t need their oil, we’d still be very active in the Middle East. Oil politics is just one reason that we are heavily involved in that region, alongside a desire to keep Iran contained, keep Israel strong, keep Iraq (relatively) stable and pumping oil, and to generally suppress elements that are hostile to U.S. interests.

In fact, we are already in the process of telling the Saudis that we don’t need their oil, with imports of Saudi oil falling to half of their normal level in recent years, down from 50,000 to 60,000 barrels per day for most of the last decade to 25,000 to 30,000 barrels per day in late 2014 and 2015. We now import four times as much oil from Canada as from Saudi Arabia.

In terms of the second major trend listed above, China and Russia have become increasingly cooperative in recent years on various efforts designed to create a non-Western global power structure. Russia is also using the Chinese yuan in more and more major transactions, suggesting a long-term trend away from the dollar as the default currency in trade, at least in certain parts of the world. These developments come alongside China’s major efforts to create an alternative to the World Bank for financing major infrastructure projects, which has earned the buy-in of a number of European powers.

The current global economic and diplomatic system has its origins in the Bretton Woods system created by the U.S. and U.K. after World War II. The Bretton Woods institutions include the International Monetary Fund and the World Bank Group, which includes five major entities. The United Nations is also important, and was created around the same time, in a process also led by the Western powers. However, the degree to which the U.N.’s pronouncements and resolutions have any real force is almost entirely a function of the degree to which the U.S. and other veto-wielding powers chooses to give them force. The U.S. and its allies were gung-ho on the U.N. as a source of international order until the 1970s, at which time the United States' sway over other nations at the U.N. began to decline, particularly with the rise of the “non-aligned movement” of developing nations. Accordingly, U.S. leaders both right and left politically have generally downplayed the importance of U.N. involvement in questions of international law since that time. President Obama has attempted in some ways to turn this trend around -- but these long-term trends are not easily swayed.

Will lithium production remake the geopolitical landscape?

Now, back to our main focus: the degree to which EVs and lithium-ion batteries may remake the global geopolitical system. Under our current oil-centric energy system, OPEC wields considerable power, and it will likely wield even more power in the future. This is the case because the large majority of global oil reserves are held by OPEC nations like Saudi Arabia, Venezuela and Iran. OPEC’s market share has shrunk somewhat in the last few years as U.S. oil production has climbed (the rest of the world’s production has remained steady or declined), but we can expect this trend to turn around again in the next five to 10 years, as U.S. and other non-OPEC production declines.

It is quite likely that a Lithium Producing and Exporting Countries organization analogous to OPEC will come about as lithium becomes increasingly important in global energy. Of the top five countries for lithium reserves described above, only Australia is particularly friendly to the U.S., though Chile and Argentina are generally friendly. Bolivia is downright unfriendly, based on the policies of its long-time president Evo Morales. China, with the second-largest reserves (based on the USGS estimates), is ostensibly friendly to the U.S. but my feeling is that China and the U.S. will experience more and more friction as China continues to rise on the regional and global stage. (For an excellent overview of modern China’s political, economic, cultural and military might, I recommend David Shambaugh’s book China Goes Global: The Partial Power.)

Will China lead the future LPEC? My guess is yes, based on its huge reserves and its increasing desire for global recognition and leadership, but of course this is early-game speculation. Only time will tell.

The key takeaway from this speculative analysis seems to be that the rise of EVs and lithium-ion batteries may contribute to the rise of China and a non-Western global power structure. I don’t want to make too much of this conclusion because it’s one dynamic amid an ocean of many overlapping and sometimes-competing dynamics. It is also likely that reserves and resources figures will change substantially in the coming years, as is illustrated by the large differences between the reports mentioned in this article.

I argued a few years ago in a similar piece that looked at the geopolitics of hydrocarbon exports (oil, coal and natural gas) that the U.S. should seize its remaining years of global dominance to create a multi-lateral world system in which no single nation can dominate like we have. My analysis here of EVs and lithium production seems to add some weight to that view. While the U.S. has been far from perfect as a global hyperpower, I’m pretty sure either China or Russia would be worse, possibly much worse. In working to strengthen organizations like the U.N., the U.S. would do well to avoid a world dominated by China or a China/Russia alliance.

***

Tam Hunt is a lawyer and writer, owner of the renewable energy consulting company Community Renewable Solutions LLC, and author of the upcoming book The Solar Singularity: Why Our Energy Future Is So Bright.