Last week, over 500 solar industry professionals gathered to attend GTM's 9th annual Solar Summit 2016 conference in Scottsdale, Arizona. During a panel hosted by GTM Research Associate Director Cory Honeyman, attendees voted on a number of questions about the direction of the solar industry, from the future of net metering to the commercial market’s struggles.

Much of the responses highlighted the “boom-bust” trend that GTM Senior Vice President Shayle Kann discussed in his keynote address at the conference. At GTM, we have been tracking the boom of residential solar (>50 percent annual growth in capacity over the last four years), as well as the relative stagnation of the commercial market. Conference attendees remain optimistic about the residential boom, which paved the way for the millionth solar installation in the U.S., which took place earlier this year.

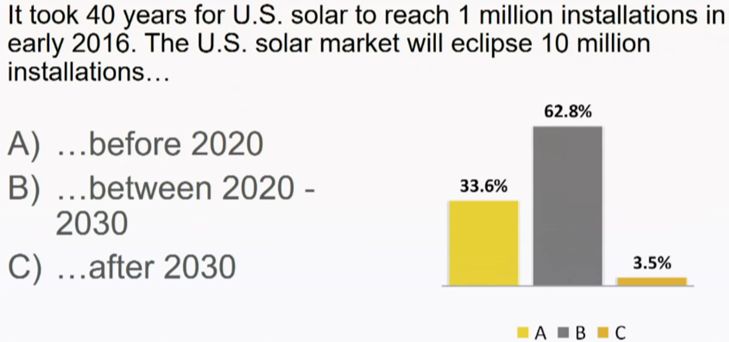

Over a third of attendees voted that the U.S. will reach 10 million solar installations by 2020, a goal that can only be attained with unprecedented growth over the next four years. Given the current state of the market, that would mean an average of 2.25 million installations over each of the next four years. To put this into perspective, there were about 300,000 installations in 2015.

The majority of attendees predicted the 10-million mark will be reached between 2020 and 2030, which is plausible given GTM Research’s near-term growth outlook, but which would rely on favorable net-metering rules in a number of key growth states, such as New York and California.

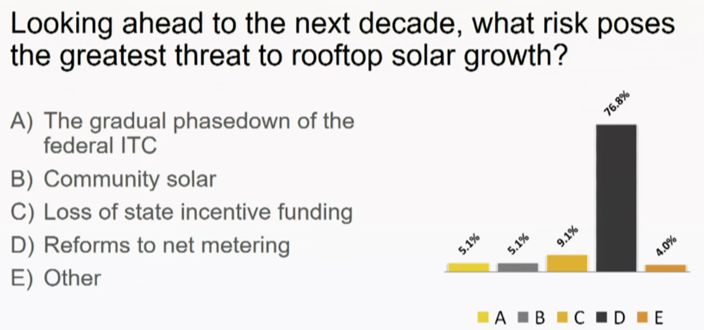

An overwhelming 77 percent of attendees indicated that reforms to net metering pose the greatest threat to rooftop solar growth, more so than the phase-down of the federal Investment Tax Credit, the growth in community solar programs, or the loss of state incentives.

As Bryan Miller of The Alliance for Solar Choice stated during a panel, net energy metering (NEM) is the U.S. solar industry’s “most universal energy policy,” with 42 states currently supporting the policy. There have been more than 70 rooftop solar policy-related verdicts in the past year. Miller stated that 95 percent of these decisions have been favorable to rooftop solar; however, it is clear that reforms in states like Arizona and Nevada have caused pain and worry throughout the industry, as exemplified by the conference attendees’ vote on the issue.

GTM Research's Honeyman has analyzed the role of rate design and NEM policies on “grid parity” -- a term used to indicate the level at which a customer will save on the total cost of energy by going solar. According to his research, there are currently 20 states at grid parity in 2016, and this number is expected to more than double by 2020 under a business-as-usual scenario. However, implementation of increased fixed customer charges and/or demand charges could leave fewer than a handful of states at grid parity, a scenario that would drastically stifle solar growth.

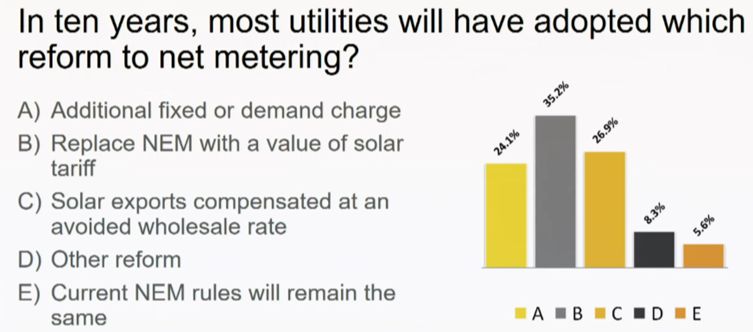

While industry professionals largely agree that NEM and rate reform pose the biggest threats to rooftop solar, there is a variety in opinion about the mechanism by which rates will change. When asked which reform to net metering will be implemented by most utilities in the next decade, a plurality of attendees voted that NEM will be replaced with a value-of-solar (VOS) tariff.

Paul Zummo of the American Public Power Association, a panelist who brought a perspective from the utility side of the debate, noted that the value components in VOS studies are generally the same, with discrepancies stemming from societal and environmental costs. Bryan Miller of Sunrun agreed that carbon is difficult to value, and he went on to state that capacity benefits attributed to rooftop solar also pose a difficulty, as some states are reducing future power procurement based on increased DG penetration. Miller concluded that while VOS studies are often ordered by public utility commissions, they are not often used in the implementation of rate reforms.

The value of solar is difficult to measure, in large part because it differs by individual states and utilities. A strong VOS policy should be both geographically specific and flexible enough to change over time.

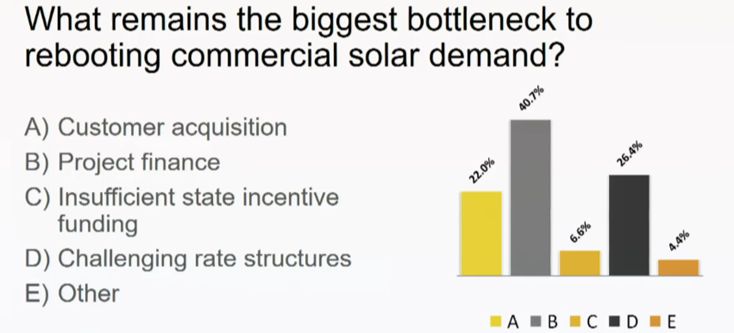

The stagnation of the commercial solar market was a theme resounding throughout the conference, and concerns over rate structure were also echoed in a question about the future of the market. When asked what remains the biggest bottleneck to rebooting commercial solar demand, 26 percent of attendees voted that challenging rate structures, like the widespread use of a large demand charge, are the biggest issues.

The most popular response, though, was project finance, with 41 percent of the vote.

Senior Analyst Nicole Litvak led a conversation on sources of capital for solar projects. Trevor d’Olier-Lees of S&P pointed to NextEra’s YieldCo, NextEra Energy Partners, as an example that not all YieldCos have failed. Dirk Michels of Ballard Spahr went as far as to say that there are few lessons to be learned from the SunEdison demise and warned the industry not to overreact to the situation.

A bigger concern regarding project finance was evident during a discussion led by GTM Research Analyst Austin Perea on project pitfalls. In this discussion, panelists agreed that a large issue in project finance stems from the differentiation of projects and difficulty of risk assessment for unrated project offtakers. Because of this, small commercial developers and even large local ones don’t have direct access to tax equity financing that allows them to take advantage of the federal Investment Tax Credit. Nathan Homan, co-founder and managing partner of Wiser Capital, noted that more education about these issues is necessary in order to make investors more comfortable with the risks.

Only time will tell whether the hundreds of solar professionals at Solar Summit 2016 were correct in their predictions and how the thematic issues of project finance and NEM reform will continue to impact the market. Perhaps by next year’s Solar Summit, we'll have some answers.

[An earlier version of this story incorrectly attributed comments from Bryan Miller at Sunrun to Adam Gerza of Energy Toolbase. The story has been updated to reflect the change.]

***

Want to cast your vote? Be sure to attend Grid Edge World Forum next month.

Allison Mond is a solar analyst at GTM Research, where she covers the U.S. downstream market.