Residential railed mounting systems for solar PV have been the standard for decades -- but not for much longer.

As the industry drives out cost, the higher costs of railed products compared to well-designed railless products will make railed systems nearly obsolete.

Why eliminate rails? These long aluminum beams certainly provide strength to the system and a way to attach the PV modules permanently to the roof. However, their material and manufacturing cost, as well as the management of their bulk and weight from manufacturing though installation, is expensive and inefficient. Railless systems can use the inherent strength of the PV module to overcome these disadvantages.

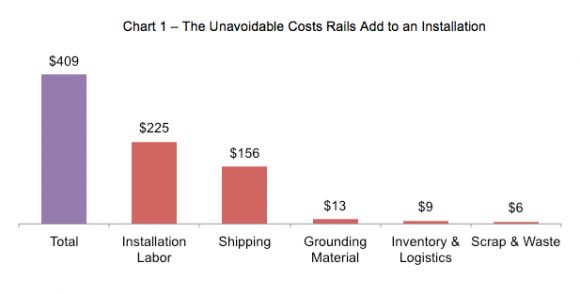

Chart 1 shows an estimate of the penalty that rails impose on the cost of a 20-module, 5,100-watt system. This analysis does not include the material or manufacturing cost of the rails themselves, just the cost to manage the rails from the rail factory, through the channel and ultimately onto the roof.

Why is this measure important? These are the unavoidable costs that rails impose on a system. For an average installation, this amounts to over $400 per system, or about $0.08 per watt.

Where do these additional costs come from?

- Installation labor comes from three primary areas: the time needed to move and install the rails on the roof, the time for grounding rows of modules together, and the time to clean up the roof after cutting the rails.

- Shipping includes the cost to move the raw aluminum material to the manufacturing plant and to transport the finished rails from the manufacturing plant to the installation location. This requires multiple freight moves. Finished rails frequently go first to the rail company, or a distribution point, and then to the contractor’s location.

- While most mounting-system companies are working to integrate grounding and bonding, railed systems still typically require bonding across rows. Railless systems can be designed to form a “mesh” grounding scheme that allows for a single ground connection from the array to the junction or combiner box. This approach reduces wire and grounding connector costs.

- Inventory and logistics include the time to order the rails and to pick and prepare the rails for shipment, the warehouse space to store the rails, and the time to maintain inventory records.

- Scrap and waste captures the material loss when rails are cut to length at the end of a row of modules to neaten up the appearance of the system, as well as for occasional miscuts.

Unfortunately, not much more can be done through innovation, efficiency improvements or cost reduction to mitigate these costs. Railed system companies have been reducing costs over the years, and at this point, there will be diminishing returns. It’s more likely that the costs will increase over time as labor, shipping and material costs rise.

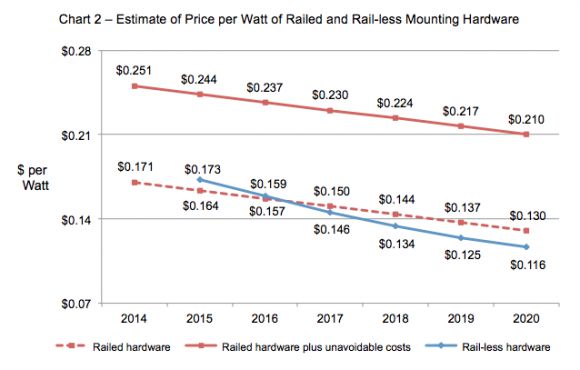

Chart 2 shows how we think railed hardware pricing will compare to railless hardware pricing in the coming years. Railed hardware average selling prices (ASP), the dashed red line, can decline over time if manufacturers benefit from more scale, improve operating efficiencies and reduce their margins. Also, watts per module will continue to increase, which helps reduce cost per watt.

It is doubtful that much more material -- a key cost driver -- can be removed from rails. A comparison of current rail weights shows that, except for a few specialty products designed for low-load areas, most companies have a very similar weight per linear foot. This makes sense, as the railed community has had many years to optimize its designs to meet strength and code requirements.

On top of the hardware price, contractors have to recognize the cost burden shown in the first chart. The solid red line shows the predicted price of railed hardware, including the $0.08 per watt of unavoidable costs shown in Chart 1.

Railless hardware ASP, the blue line, should easily be able to beat railed hardware prices in the near future. Railless hardware prices may be a bit higher today. But as products mature and achieve scale over the next two to three years, costs will be wrung out and prices will fall.

With smart engineering, material use in railless products can be reduced by around 50 percent compared to railed systems. Less material and reduced weight mean lower cost. And the use of common manufacturing equipment and methods will allow for rapid global scaling with little capital investment.

Some may wonder why railless hardware will be priced below railed hardware given the many benefits of railless systems. We believe that to accelerate railless adoption, contractors need lower hardware costs and labor costs. If railless hardware is priced above railed hardware, contractors will be less likely to invest in converting their operations to railless products. Capturing real labor savings can be challenging, especially for smaller contractors, but all can take advantage of lower hardware costs.

Also, the industry expects innovation and cost reduction from new products. Railless systems can meet this expectation. New entrants may have an added advantage because they will be able to build their organizations and operations around lower cost-per-watt revenue without having to transform legacy railed businesses.

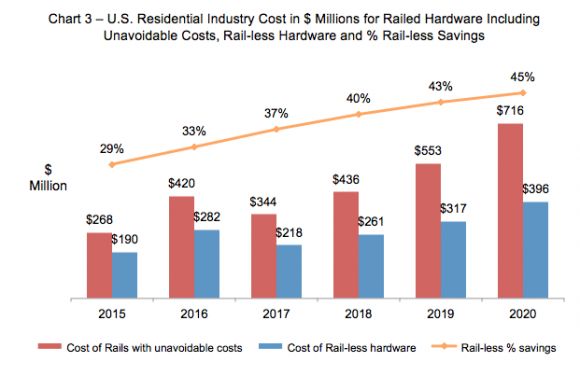

Chart 3 shows the potential savings that railless hardware can deliver to the U.S. residential industry. For this estimate, the total available market does not include SolarCity’s megawatts, because that company has already converted to railless with Zep Solar.

Using the cost reduction curves in Chart 2, we estimate that U.S. industry annual savings could grow from over $130 million in 2016 to about $320 million in 2020. The percent savings are significant as well -- contractors are likely to convert to stay competitive.

It will be interesting to see which companies create successful railless products. The coming railed-to-railless shift reminds us of the string-inverter-to-microinverter shift that began in 2009. For many reasons, the string inverter market leaders did not accept that microinverters would be popular, and few had the corporate DNA to add a new product that would compete with their successful core products. This decision has proven to be very costly for former market leaders. If the railed companies behave this way, the door will be open for innovative startups to quickly take significant market share.

So will the use of railed mounting systems die off? Not immediately, but over the next five years, we think the market will transform, and railed systems will become a minor part of the residential landscape. We expect the residential railed mounting businesses will either innovate and survive or consolidate, as is typical when an older technology is replaced by a newer one.

***

Glenn Harris has been in the solar industry for 15 years and is the CEO of SunCentric, an industry consulting firm. He also serves on the board of advisors of Pegasus Solar, a rooftop mounting systems company.