Earlier this week, we reported on some of the positive news in the world of concentrating photovoltaics (CPV): efficiency gains, venture funding, and some decent-sized deployments.

Today we report on some bad news at CPV system vendors Amonix and Soitec.

Amonix plans to lay off 76 employees, according to a filing it made with a state agency, as reported in Dow Jones. We've reported on Amonix's world-record 30-megawatt Alamosa solar farm and the tragic loss of its CEO Brian Robertson in December of last year. The layoff notice came from a Worker Adjustment and Retraining Notification, filed by Amonix with the California Employment Development Department earlier this month.

Amonix has raised approximately $140 million in venture capital from Kleiner Perkins, Adams Street Partners, Angeleno Group, New Silk Route, PCG Clean Energy & Technology Fund, Vedanta Capital, Westly Group, and MissionPoint Capital Partners. The Alamosa CPV site is funded by a $90 million DOE loan guarantee to developer Cogentrix.

Cogentrix is a subsidiary of The Goldman Sachs Group and most of its previous projects have been for fossil fuel plants. Ben Kortlang, the KPCB partner on the Amonix board of directors, spent eight years at Goldman Sachs prior to his investment in Amonix at KP.

In a 2010 interview, the amiable Mr. Kortlang told me, "The denominator in all solar is efficiency," and Amonix is the most efficient solar system available at 25 percent AC efficiency. Kortlang concluded with the observation, "This is cheaper than First Solar."

Amonix doesn't cite a CEO on its website, and onetime interim CEO, Jan van Dokkum, a Kleiner Perkins partner, is no longer listed on the website. Vahan Garboushian, the founder, CTO, and chairman of Amonix, shepherded the firm through its earlier stage of steady organic growth.

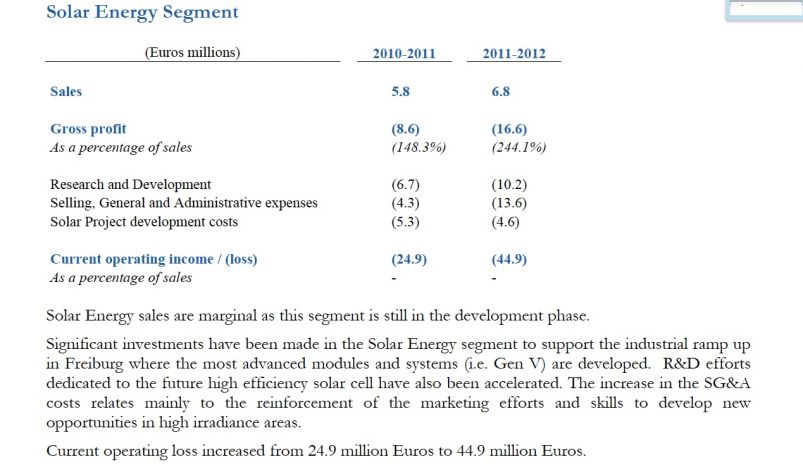

Soitec has large CPV plants in the works, as well as over 150 megawatts of PPAs with San Diego Gas & Electric and a 50-megawatt plant in South Africa. But the firm's solar division (gained from its acquisition of Concentrix) is bleeding cash. With a small increase of year-to-year sales, Soitec's 2011 losses have almost doubled to 44.9 million euros.