Electric-car maker Tesla just issued its Q1 financial results based upon producing a record 7,535 Model S Sedans this quarter (slightly above guidance). The company delivered 6,457 units and lost $50 million while making its first deliveries into China. The company seized upon the opportunity of a strong stock price to raise $2.3 billion in convertible notes offerings in Q1 as well.

Tesla CEO Elon Musk suggested that the firm would ship 7,500 units in Q2 and is on track for more than 35,000 Model S deliveries in 2014.

Takeaways from Tesla Q1 shareholder letter and earnings call

-

Increasing factory capacity to support increase in Model S production later this year

-

Introduction of Model X next year; production design prototypes ready in Q4

-

Delivered the first cars to China in April and has plans to rapidly expand there; firm believes "the country could be one of [its] largest markets within a few years"

-

Accelerating the opening of new stores and service centers by 75 percent in 2014

-

Regarding the company's controversial direct-to-consumer sales model, Musk had this to say: "While consumers and the vast majority of jurisdictions have overwhelmingly welcomed our direct-sales model, there are still a few states in the U.S. where we face resistance. In those states, we continue to fight to protect our customers’ ability to buy directly from Tesla. We believe strongly in the fairness of our position, which has been supported by a long list of consumer activists, economists and influential policymakers."

-

Launching the right-hand drive Model S in the U.K., Japan and Hong Kong later this year

-

Production is now at almost 700 vehicles per week, rising to 1,000 vehicles per week by the end of 2014

-

Gross margin improved to 25.4 percent despite a $2 million reserve for underbody shield retrofits. Gross margin is anticipated to reach 28 percent in Q4.

-

"The Giga factory project is on course to begin battery cell and pack production in 2017."

-

The company expects to be "marginally profitable" in Q2

-

Tesla has signed a letter of intent with Panasonic to partner on the Giga Factory. Musk said he expects to break ground on the first of the multiple sites as soon as next month. California is back in the running but "improbable" according to Musk. Governor Brown is pushing for the Giga Factory but "time of completion" is crucial and California doesn't make it easy or fast to get a factory built.

-

Musk cited conversations with mining companies to reduce cost on nickel or cobalt precursor materials.

The stock is down almost 9 percent this morning, with investors possibly spooked by weak EPS guidance.

Investment bank Baird comments, "TSLA's quarter was good, beating Street estimates, but the stock will likely be under pressure against a market that dissects high multiple stocks. With that said, our long-term thesis remains intact as TSLA progresses on all fronts including Model S sales, infrastructure build-out, and new model developments. We would be aggressive buyers of the stock." The bank writes, "Demand [is] still not an issue and deposit growth accelerated sequentially. Bears argue demand is slowing, but customer reservations accelerated during Q1 and increased 21 percent quarter-on-quarter."

Morgan Stanley has predicted a decline in North American deliveries in 2014.

***

Some details on the proposed Giga Factory from previous GTM reporting:

Tesla founder and CEO Elon Musk is soon to announce the location of the firm's $5 billion Giga factory, the immense complex where the EV maker's next-generation battery packs will be built. We've reported on the deep politics in Texas, Arizona, Nevada and New Mexico as politicians in these states vie for the promise of manufacturing jobs.

Musk is naming two sites, according to Bloomberg, saying, "What we’re going to do is move forward with more than one state, at least two, all the way to breaking ground, just in case there are last-minute issues."

It will leave one state very disappointed when the final decision is made, but it's being done to "minimize the timing risk," according to Musk. It also maintains leverage on the municipality all the way to ground-breaking. This factory will build the battery packs for the company's next-generation, $40,000-price-range vehicle, looking to begin production in 2017.

California didn’t make the short list because of the potential for regulatory and environmental delays. Nevertheless, last week's editorial in California's The Desert Sun quotes Carl Stills, energy manager of the Imperial Irrigation District, as saying, "We just got notified yesterday that Tesla is now back to considering Imperial Valley because of the location close to the potential lithium," while he was at the Coachella Valley Economic Forecast conference last week. Stills was referring to the availability of lithium in the Salton Sea, currently being extracted by Simbol Mining, a startup getting lithium carbonate from geothermal brine at the John L. Featherstone geothermal plant.

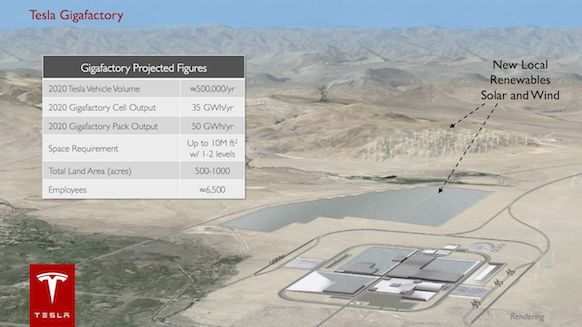

Giga Factory Facts and Figures

-

Tesla announced a $1.6 billion convertible debt offering. Tesla looks to offer $800 million of convertible senior notes due in 2019 and $800 million due in 2021 to build the world's largest battery factory.

-

Elon Musk predicts that the new factory will produce batteries for 500,000 vehicles by 2020.

-

Tesla expects to send the kilowatt-hour price of batteries down by 30 percent.

-

The plan is for construction to start in 2014, with production beginning in 2017.

-

The facility will hold more than 6,000 workers in 10 million square feet of factory space.

-

The plant will provide recycling capability for old battery packs.

-

Musk also said that Panasonic, currently supplying hundreds of millions of cells to Tesla, would likely join in on the new factory, but no commitments have been made.

Here's a rendering of the proposed plant: