We live in a world where Amazon Prime delivers everything from crackers to comedy flicks with a thumb tap. American Express pushes notifications to your pocket when you’re somewhere you can pay with points. Yet interacting with a core service provider -- the utility -- can feel like a frustrating step back no matter what the medium.

At least some utilities are painfully aware of how behind the times they are. Others seemingly aren’t aware they are being compared to airlines, telecoms, banks and nearly every other industry that has digitally evolved. Or maybe they just don’t care.

They should. Studies have shown that customers who digitally engage with their utilities are happier with their electric provider than are those who do not. One in five millennials, a generation bigger than the Baby Boomers, exclusively access the internet through mobile platforms. Chances are Grandma has an iPad, too.

To help both utilities that are with it and those that are not, Tendril has launched a new mobile app, MyHome, which is arguably the most forward-looking utility mobile app on the market. That is to say, it doesn’t feel like something a utility dreamed up. The first two clients to market-test it are Duke Energy and American Electric Power. Larger rollouts are expected with both utilities.

Tendril didn’t start by looking at what was in the utility space; it started by looking at best-in-breed practices and technology in other industries, particularly airlines and banking. Utility mobile apps today have low engagement levels and often aren’t comprehensive. The future of mobile in other industries, says CEO Adrian Tuck, is moving toward chat-based systems. Also, push notifications are key.

“Energy is not sexy enough to be entertainment, nor is it scary enough to the get attention of security concerns, nor should it be,” said Tuck. If it’s not Instagram or checking on the safety of your home or money, energy apps are going to need to be sleek and practical with just the right amount of push.

MyHome does not replace any utility backend systems, but rather integrates the utility messaging from disparate utility systems into one place. “It’s meant to be the app of apps,” said Tuck. Feedback from other industries often focused on the need for unification on the app, he added, so that was a focus when building MyHome. Eventually the app is expected to integrate smart thermostats and other key energy use devices, as well as third-party apps through an API.

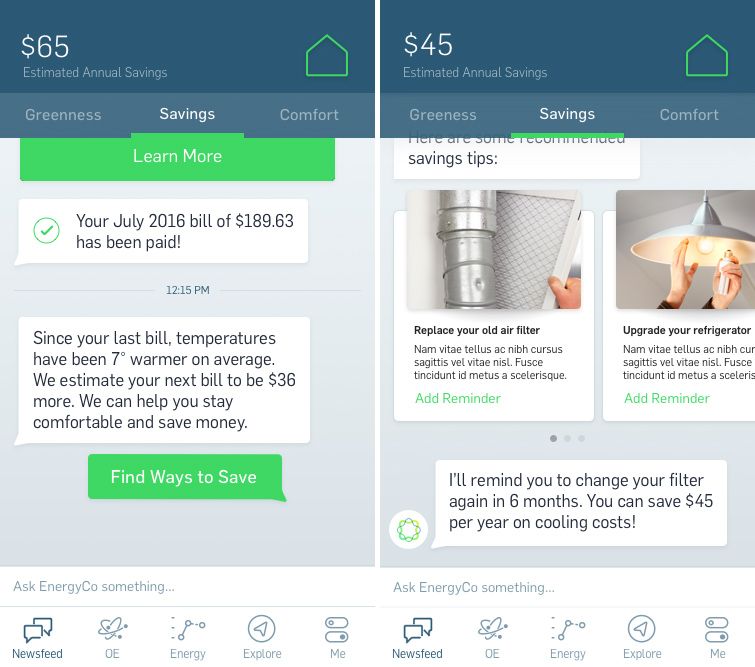

The first goal, however, is simply to get customers using a utility mobile app at all. Based on home characteristics and some initial questions, all asked in chat mode, customers are offered suggestions based on their energy identity, which is developed based on each customer's responses to three common issues pertaining to energy: cost, comfort and environmental concern.

For customers, the app offers notices about outages and high bill alerts, also allowing users to seamlessly pay their bill. Additionally, the app offers chatbot technology. If you can ask a chatbot about how to order shoes on Zappos, there’s no reason you shouldn’t be able to use one to get answers to common questions about your electric bill.

FIGURE: MyHome Screenshots

Source: Tendril

Tendril said competition to develop this mobile solution is not just coming from other players such as Bidgely or Opower, but also likely from utilities trying to build mobile apps in-house.

When speaking to potential customers, Tendril is not trying to go after requests for proposals, but rather to push utilities along into a future they haven’t fully considered. “We’ve stopped giving utilities what they think they want and [started] giving them what we think they need,” said Tuck.

Tendril has battled through years of the slow-moving utility sales cycle and knows how hard it is to stake a future on utilities alone.

Recent news highlights the challenge in growing a business based on selling software to utilities. In May alone, Oracle acquired Opower and EnerNOC put its utility engagement business up for sale.

Tendril said it is seeing substantial growth in its utility business, but even faster growth in targeting other verticals. Tendril also works directly with solar installers and the real estate sector and expects a quarter of its revenue to come from non-utility sources in 2017, up from about 10 percent this year.