Can distributed solar continue to grow in the U.S. when the ITC ratchets down and net energy metering gets trimmed? GTM Research VP Shayle Kann explored solar finance scenarios with the experts at last week's DOE SunShot Summit in Anaheim, California.

“We are sitting amid an infinite amount of capital,” said Jeff Weiss, co-chair and managing director of Distributed Sun. “The question is how to unlock it.”

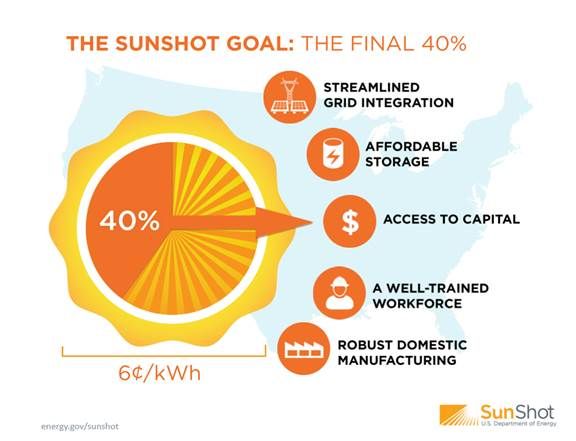

Weiss laid out a number of key facts about the current state of solar. First, DOE’s SunShot program is 60 percent of the way toward achieving its target of bringing the price of distributed solar to $0.06 per kilowatt-hour by 2020. Second, without the ITC, the average solar PPA rate would have to increase by $0.06 per kilowatt-hour. Third, the cost of capital for an established asset class comparable to solar is now 5.5 percent to 6 percent, while investors require a 9 percent return from solar. That is largely because perceived risk is higher than actual risk and there is no straightforward rating process.

“When we get to that 6 percent cost of capital,” Weiss said, “it more than makes up for the $0.06 per kilowatt-hour increase in the PPA rate that will come with the loss of the ITC.”

“We are building bridges to capital,” said Bert Hunter, CIO for the Connecticut Green Bank. “The bank is part of the shift that says you can’t use incentives to drive the market indefinitely. There has to be a better approach.” The Green Bank is using resources to back solar leases for a wider set of qualified installers. That has increased private sector funding for solar. “Our first lease product, in 2008, was leveraged one to one. Today, for every dollar of green bank capital, projects are getting five dollars of private capital.”

The bank has also worked out a C-PACE (Commercial Property Assessed Clean Energy) program. Through it, solar third-party ownership and energy-efficiency upgrades can be financed and secured by a property lien. It is also working on solar ownership, solar third-party ownership, and energy-efficiency upgrades through residential PACE and utility-on-bill repayment plans.

But the goal is that bridge to cheaper capital, Hunter reiterated.

Cisco DeVries, CEO of Renewable Funding LLC, pioneered the financial products that Hunter’s bank uses. “Municipal PACE programs, utility-on-bill financing, and unsecured loans for residential solar together make up about 20 percent to 30 percent of solar financing,” DeVries said.

To increase that, DeVries has worked to get financing for ownership of solar and energy efficiency “into the vanilla ice cream that institutional investors will buy.” He continued, “Long-term leases and PPAs are incredibly useful, but not the most efficient way to finance solar because of limits on the tax equity that finances them and because of transaction inefficiencies." His firm's three ownership products are designed to become asset-backed securities.

“After three and a half years of brutal effort, the products have been rated, and we have a $100 million credit facility with Citi. We are right now crossing the threshold of the low-cost capital, the 6 percent capital, because we created that vanilla ice cream,” DeVries said.

“Securitization is the most important thing that is going to happen for solar,” he added, “because it leads to a post-incentive world.”

“We were looking for new ways to raise capital with the security and liquidity investors need,” explained Lee Bailey, U.S. Renewables Group managing director. Common Assets, which Bailey and partners recently sold to SolarCity, was created to help make that happen.

The online platform makes financial instruments backed by renewables assets accessible to private and institutional investors “away from traditional project vehicles,” Bailey said. But it is not crowdfunding, because it bypasses SEC rules and regulations. “Crowdfunding is a way to get people to talk about financing solar, but it will not get the industry closer to financing levels where the loss of the ITC won’t have an impact.”

“Only about $15 billion was invested in solar in the U.S. last year,” Weiss said. “From a capital markets-Wall Street perspective, that is statistically zero.”

“What we want is a $50 billion-plus primary market,” Weiss said. “These early securitization conversations are all dysfunctional. It’s great that they are happening, but they are the firsts. We need to move beyond them.”