Residential solar and energy storage installer Sunrun delivered its biggest quarterly deployment ever.

After producing a personal-best 91 megawatts in Q2, Sunrun installed 100 megawatts in Q3, the company announced in an earnings report Wednesday. Deployments in 2018 are on track to deliver 15 percent growth over 2017. Cumulatively, the company has installed 1,460 megawatts.

Just a few years back, as the residential market stalled and high-profile players pulled out or went bankrupt, industry watchers questioned the viability of the national installer business model. Sunrun seems determined to prove the critics wrong. Indeed, its direct installation business grew 50 percent year-over-year (Sunrun also works with partner installers).

“The big-picture trend is that we’re giving people what they want, which is clean, affordable, reliable energy,” CEO Lynn Jurich told GTM. “Our advantages are accelerating as we continue to take share and separate ourselves from the rest of the field.”

In particular, she said, Sunrun’s scale makes it attractive to national businesses, like big-box retailers and homebuilders, looking to partner with a solar provider. (It hasn’t announced any homebuilder alliances, but is in talks with some top 10 California builders ahead of the state’s 2020 mandate for solar on new homes.) Scale also helps with supply chain economics, and the 218,000-strong customer base contributes to brand visibility.

For the first time, Sunrun put some hard numbers on its deployment of BrightBox, the solar-plus-storage product for resilient home energy.

The company expects to install nearly 5,000 BrightBox systems by the end of the year, Jurich said, with a doubling in the second half compared to the first half. BrightBox adoption surpassed 25 percent of direct customers in California in Q3.

On the less rosy side, the record-setting quarter nonetheless produced a diluted net loss of $0.02 per share (Q2 saw earnings per share of $0.06). Share prices wavered in after-hours trading after the announcement, settling at 5 percent below the closing price at the time of writing.

The disconnect between the positive deployment news and lackluster earnings per share requires some context.

Sunrun’s leased solar model is tricky to account for in the quarterly earnings context: Installations incur operational expenses now, but pay off over 20 years of contracted revenue, with the possibility of extension. It’s different from selling a gadget and getting paid in full immediately.

“Earnings per share is not a useful metric to understand our profitability,” Jurich said.

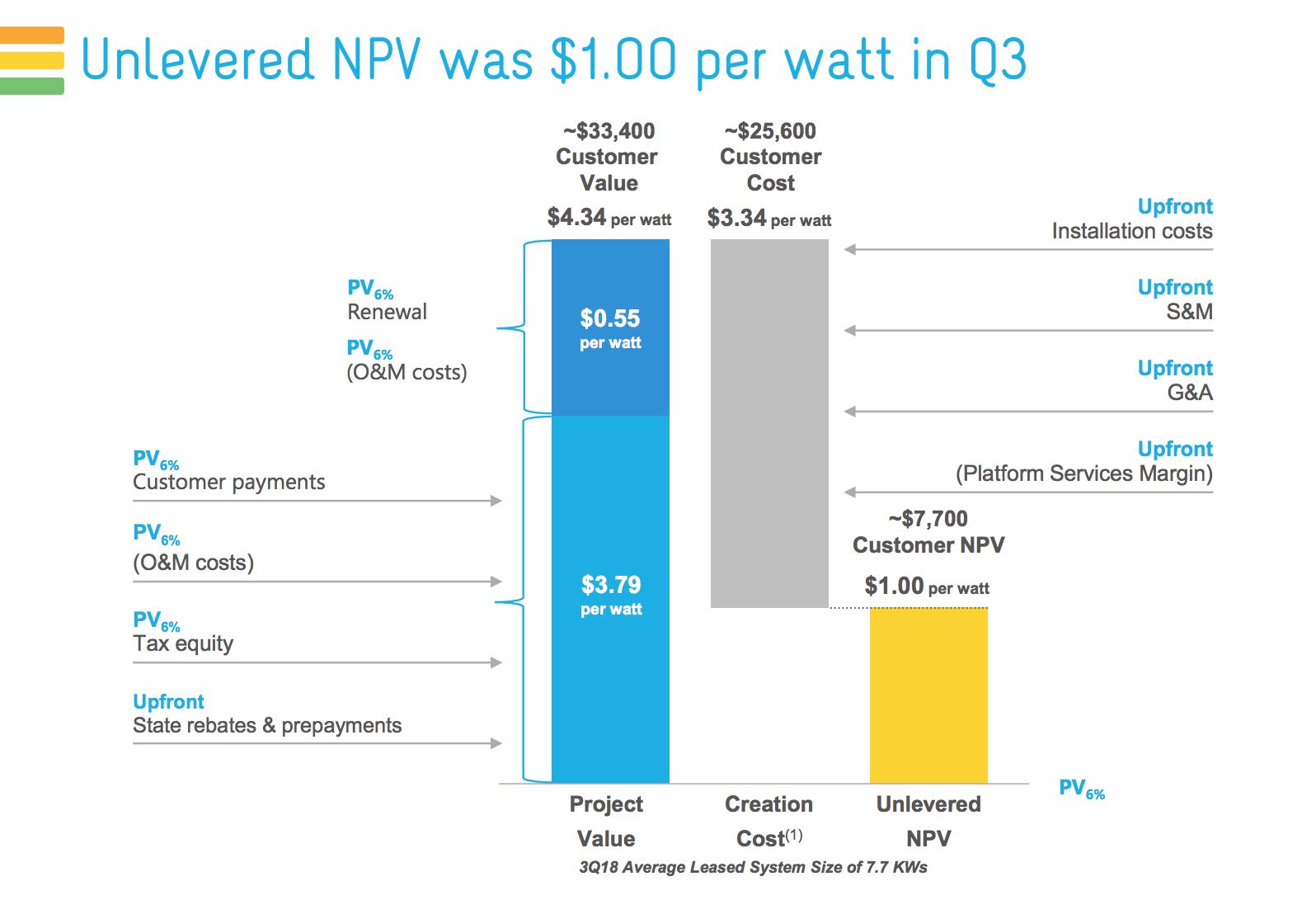

Instead, Sunrun’s leadership likes to point to net present value as an indicator of its financial health. That metric factors in lifetime costs and revenues associated with an installation.

In Q3, Sunrun installed 13,000 solar systems, each of which is worth about $7,700 for the company over its operational lifetime, Jurich said.

Sunrun’s creation cost per watt was $3.34 in Q3, flat over Q3 2017. Within the cost stack, the installation expense decreased by $0.20 year-over-year, even as more batteries made it into the mix, but sales and marketing costs increased by $0.24.

(Image credit: Sunrun)

To be in the money, Sunrun has to earn more from each system than it costs to deliver. The company reported customer value of $4.34 per watt in Q3 (including estimated payments in the renewal period, after the initial 20-year contract runs out). Subtracting the $3.34 per watt gets to $1.00 per watt of net present value.

Overall, Sunrun’s future cash flows, minus associated project debt, yield $1.4 billion in net present value, or $11.50 per share, the earnings report noted. Analysts may differ in how they value the chunk of NPV attributed to renewals after the contract term ($917 million in Q3); Sunrun has been around for a decade, so customers haven't had a chance to come off their contracts yet.

Since that revenue will be collected over many years, Sunrun raises financing in the near term to fund its operations. Financing activities provided $262 million in Q3, and Sunrun ended the quarter with $275 million in cash and restricted cash on its balance sheet, an increase of $5 million from last quarter.