The third-party ownership of solar, a business model already driving unprecedented growth in the industry, just got a $630 million boost with Sunrun’s announcement of three new funds.

“These three funds, closed over the last few months, are for the installation of $630 million in solar facilities,” explained Sunrun co-CEO Edward Fenster. “There are three transactions with at least three investors, two of which are JPMorgan and U.S. Bank.”

While U.S. Bancorp (NYSE:USB) has been a big supporter of residential solar, this is the first entry for JPM Capital Corporation, a subsidiary of JPMorgan Chase & Co. (NYSE:JPM), Fenster said. “It is the largest and most consistent provider of capital to renewables, but until now most of their investments have been in wind. This is a watershed moment.”

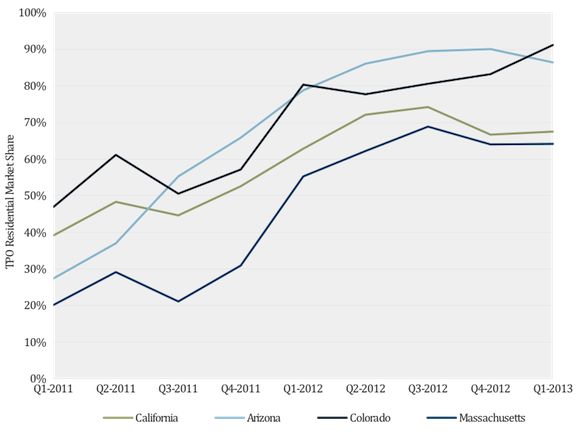

The third-party ownership (TPO) business model has driven solar growth in the last three years. TPO employs a lease or lease-like arrangement to provide homeowners and businesses with rooftop installations without burdensome upfront investments or ownership responsibilities. TPO was started by Sunrun and is championed by SolarCity, Vivint, Clean Power Finance, NRG (NYSE:NRG), Sungevity, SunEdison (NYSE:SUNE), and SunPower (NASDAQ:SPWR).

Source: U.S. Solar Market Insight Report, Q1 2013

Fenster declined to disclose the relative stakes taken or name other participants in the new Sunrun funds, but said he would identify them later. He did say none of the investors are a utility.

The JPMorgan share is “a material investment,” Fenster said, “and it is great to have an organization with such deep capital and tax capacity take residential solar seriously.”

The transactions incorporate both tax equity and traditional debt investments, Fenster said, though he declined to detail the proportions of each.

Taken together, the money adds to Sunrun’s “committed pool of capital,” Fenster said.

To place systems in service every day, it is vital to have an uninterrupted supply of capital, he said. That means having several funds available at all times. As banks, Fenster noted, JPMorgan and U.S. Bank may choose to hold the capital themselves or not. “We open the funds and draw from them as we place systems in service.”

Of the $630 million, Fenster said, “100 percent of it will be invested in residential solar.”

That means no move for Sunrun into the burgeoning commercial and industrial sector. “We built our company from the ground up to service homeowners,” Fenster said. “We are more of a homeowner service company than we are a solar company.”

But does this infusion of capital offer Sunrun the opportunity to apply other resources in the pursuit of SolarCity (NASDAQ:SCTY), its chief competitor, into another homeowner service market?

“If we were to expand our business, it would be to sell additional things, energy efficiency for instance, to homeowners, as opposed to providing solar to other people,” Fenster said. “I’m not saying we are going to do that. We have been focused historically on delivering a great solar offering to homeowners. But the core competence of the company is in servicing homeowners, not solar.”