What's the right business case for energy storage? Where will the value of energy storage on the grid present itself? What is the value for the consumer in energy storage?

Conventional wisdom tends to look at utility-scale energy storage as the market entry point for storage entrepreneurs. Ionex (lithium-ion batteries), Xtreme Power (advanced lead-acid batteries), and Primus Power (flow batteries) are just a few of the startups targeting that part of the market.

But megawatt-hour-scale energy storage has a host of challenges ranging from technical limitations to lifetime issues to deep regulatory uncertainty.

What if the opportunity in storage is at the other end of the spectrum, in the form of smaller-scale storage behind the meter in commercial applications?

I've encountered two stealthy startups that would seem to be working on just that.

Powergetics calls itself an "intelligent energy storage system." The company has come up in a number of conversations lately, too many times to be ignored. Especially when an ex-CAISO COO is consulting for them -- as well as a number of EPRI employees -- have mentioned them to me in the past few weeks.

The firm has not yet granted interviews to the press, so my information comes from anonymous sources and public information. Powergetics is targeting small businesses and using relatively small-scale lithium-ion batteries to provide ancillary services and value for customers that don't have loads large enough for the wholesale demand response market.

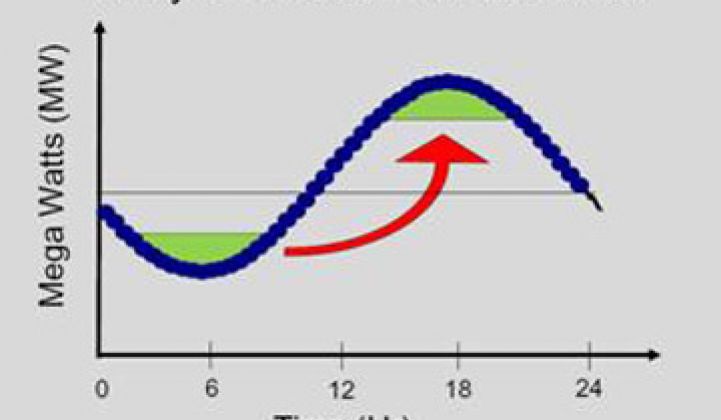

With storage behind the meter, businesses can manage the spikes in demand that drive their power costs to higher tiered pricing. That application doesn't require an enormous amount of energy; something on the order of 50 kilowatt-hours might be functional. An example would be a car wash, where power is steady except for those bursts when pumps or motors go off: energy storage could eliminate those spikes. Peak hour energy can cost utilities 400 percent more than non-peak power, according to Powergetics.

Here's a patent application from Stacey Reineccius, Powergetics' original founder, chairman, and CTO, who appears to have left the firm (involuntarily, one would imagine). The invention "provides systems and methods for control of power charge/discharge from energy storage system [sic]. The invention also provides for power monitoring and management, including power management for a variable generator."

The biographies of the Powergetics team show a strong entrepreneurial streak and record of success, albeit in non-energy-related fields. The firm has been angel funded so far.

Jim Detmers, formerly with the California independent system operator, currently advises a number of energy startups including Powergetics and has noted that "people are developing and funding startups in a vacuum. Some of the new technology does not have the functionality that a customer or the utility or the power system actually need."

The Powergetics storage solution is a standalone hardware (battery) and software (monitoring) package. The battery charges up in off-peak conditions and then applies that energy during the day to lower peak demand and provide emergency backup power. Current client installations in San Francisco have shown that the storage system can reduce peak power demand (kilowatts of concurrent use) for a typical small-medium sized installation by as much as 30 percent, and with savings of as much as 15 percent off the utility billing from peak reduction alone. Powergetics is not a battery maker and appears to be technology-agnostic as to battery type. A number of Asian electronics companies with battery technology such as Samsung, NEC, LG, Sony, and Mitsubishi could be potential partners for Powergetics if, in fact, the startup has carved out a market opportunity. Part of Powergetics secret sauce is the bi-directional inverter needed to get AC into and out of a DC battery.

Another storage company, even deeper in stealth, is the imaginatively named Solar Storage. Funded by NEA, the investor's website describes the firm's technology as "distributed, on-demand solar, with proprietary power and storage technology for 24-hour power from 100 kilowatts to 20 megawatts."

The CEO, Steve Bisset has told me that the firm is doing enterprise and commercial-level solar/storage hybrid systems. Bisset told me they'll reveal details later this year and that he's looking to provide systems for factories and agricultural firms with "three-shift" requirements. The firm is using "1930s-based steam-engine technology," along with a concentrator and "liquid propane gas pressure vessels." He claims the firm is very R&D efficient, very manufacturing efficient, financing efficient and marketing efficient. Capacity ranges from 100 kilowatts to a few megawatts. The firm will be looking to raise a $10 million to $20 million round A in 2011, according to the CEO.

The relative success of these firms versus their utility-scale brethren could serve as a bellwether in the nascent energy storage field.