Another year has come and gone. As I find myself reflecting on past interviews and conference sessions, and the ungodly number of internet browser tabs I’ve had open for months, several key themes emerge on what’s to come for state clean energy policy.

For one thing, renewable portfolio standards continue to drive renewable energy deployments at the state level. A Lawrence Berkeley National Laboratory report found that 56 percent of the renewable energy capacity deployed since 2000 is at least partially driven by renewable energy targets.

Federal-level policy changes such as the tax bill, possible new solar tariffs and the Energy Department’s grid resilience rule will also affect how clean energy technology gets deployed over the next year. And certain federal rules and regulations will overlap with state-level programs.

But states continue to play a central role in shaping energy markets. They’ll tackle a variety of energy policies in 2018, from electric-vehicle infrastructure to offshore wind, energy storage to corporate clean energy programs, and more. Here are three big items on my list of state policy issues to watch for in 2018.

Nuclear subsidies

As Trump’s DOE seeks to shore up coal and nuclear power plants through the DOE’s notice of proposed rulemaking (NOPR), states are taking their own steps to subsidize these large power plants.

In 2016, New York and Illinois adopted rules to incentivize certain nuclear reactors that were in danger of shuttering. Both states implemented zero-emissions credit (ZEC) programs to compensate nuclear generators for the carbon-free electricity they produce, and now both programs are facing legal challenges.

Just this week, the U.S. Court of Appeals for the Seventh Circuit heard oral arguments on the Illinois ZEC program, in a case brought by Electric Power Supply Association and other independent generators, as well as some consumers. Plaintiffs brought the appeal in August, after a lower court upheld the nuclear subsidies.

The New York ZEC program was also challenged and upheld last year, and is now going through the U.S. Court of Appeals for the Second Circuit. The New York case was also brought by EPSA.

“We’ll almost certainly see two federal appeals court decisions about ZECs this year, and if the ZECs are upheld, that could very well motivate other states to take a look at this sort of policy,” said Ari Peskoe, senior fellow in electricity law at the Harvard Law School Environmental Law Program Policy Initiative.

Several states including Ohio, Pennsylvania and Connecticut have also been considering nuclear support programs, but with different structures.

Last October, a bipartisan group of House representatives in Ohio introduced a bill (HB 381) to subsidize the state’s nuclear power plants in North Perry and Oak Harbor through a Zero Emission Nuclear Resource Program, or ZEN. The bill currently sits in committee and could see some action this year.

In Connecticut, Governor Dannel Malloy signed a bill in October that allows state energy officials to modify rules and permit Dominion Energy to sell up to 75 percent of the output from its Millstone nuclear plant in Waterford in a competitive solicitation with other zero-carbon resources. Regulators are currently investigating the finances of the Millstone plant, to determine whether it warrants further support to stay online.

Pennsylvania, home to the second-most nuclear reactors in the state after Illinois, has yet to take legislative action. But both houses in the state legislature approved resolutions in October urging the Federal Energy Regulatory Commission (FERC) to strongly consider the DOE’s NOPR. Should state-level action crop up this year, it’s likely to trigger a vibrant debate, said Peskoe.

“It’s such a big energy state, with so much natural gas in the shale regions, and traditionally such a coal state,” he said. “I’m sure it would be a interesting legislative battle between all of the interests there in Pennsylvania.”

New Jersey could also decide to get on the nuclear subsidy train. Governor Chris Christie toyed with passing a nuclear subsidy bill during his last month in office, before Governor-elect Phil Murphy takes control on January 16.

"I think having nuclear power in the state is an important thing to have, and I think it’s important for our energy security to have it, and I think it’s a positive thing from an environmental perspective to have nuclear here," Christie said at a December press conference.

New Jersey lawmakers held a hearing on nuclear subsidies this week, but the bill was delayed by Assembly Speaker Vincent Prieto. The entire subject could fade quickly once Murphy takes office, given that the state's Democratic governor-elect campaigned on a clean energy plan that supports offshore wind, energy storage, community solar and efficiency. Whether nuclear interests can work their way into that discussion remains to be seen.

Given the mounting pressure on aging nuclear reactors, it’s very likely nuclear players will look for any way possible to support their facilities.

“Low prices are challenging a lot of plants in these markets, so I would expect Exelon and other plant owners will continue to look for reforms that will benefit them,” said Peskoe.

The nuclear debate has very real implications for other low-carbon resources, because more renewables could be deployed to replace retired plants. At the same time, a win for ZECs in the New York and Illinois court cases could also be good for renewables.

Renewable energy advocates have argued that these decisions could have significant legal implications for the way renewable energy programs are implemented, too. The two cases “will determine the ability and tools available to states to advance renewable energy and energy storage and cleantech policies across the board,” Miles Farmer, clean energy attorney at the Natural Resources Defense Council, told me last year.

Amid all of this, the DOE’s controversial proposal to shore up coal and nuclear power plants continues to advance through FERC, with a decision expected on January 10.

PURPA reform

The Public Utility Regulatory Policies Act (PURPA) was passed as part of the National Energy Act in 1978 as a way to introduce competition in U.S. energy markets. The law requires utilities to purchase energy produced from so-called Qualified Facilities if available at or below the cost of energy from a traditional power plant. As wind and solar costs have declined, PURPA has proven to be the most effective single measure in promoting renewable energy.

But now, in a highly competitive electricity market, utilities are pushing back against their PURPA requirements.

“Across the United States, this is a huge policy battle, and it’s going to be increasing,” said Todd Glass, partner at law firm Wilson Sonsini Goodrich & Rosati, speaking on a panel at Solar Power International in September.

Glass testified on behalf of the Solar Energy Industries Association at a hearing in Washington, D.C. last year. Of the six witnesses that spoke that day, he said five (not including him) were in favor of PURPA reform. The other witnesses included utility representatives and regulators from Iowa, Michigan, Idaho, Minnesota and Colorado.

“Some of them were specifically going after the solar industry,” Glass said.

Lawmakers weren’t much help. According to Glass, several House Republicans said, “Don’t we have enough solar already? Can't we stop this madness and just go back to doing things the other way?" Many House Democrats, meanwhile, had no idea what PURPA means for the solar industry, he said.

At the end of the committee hearing, Rep. Tim Walberg (R-Mich.) announced that he would write the PURPA Modernization Act of 2017. The bill (HB 4476) was formally introduced last November, but hasn't seen any movement since.

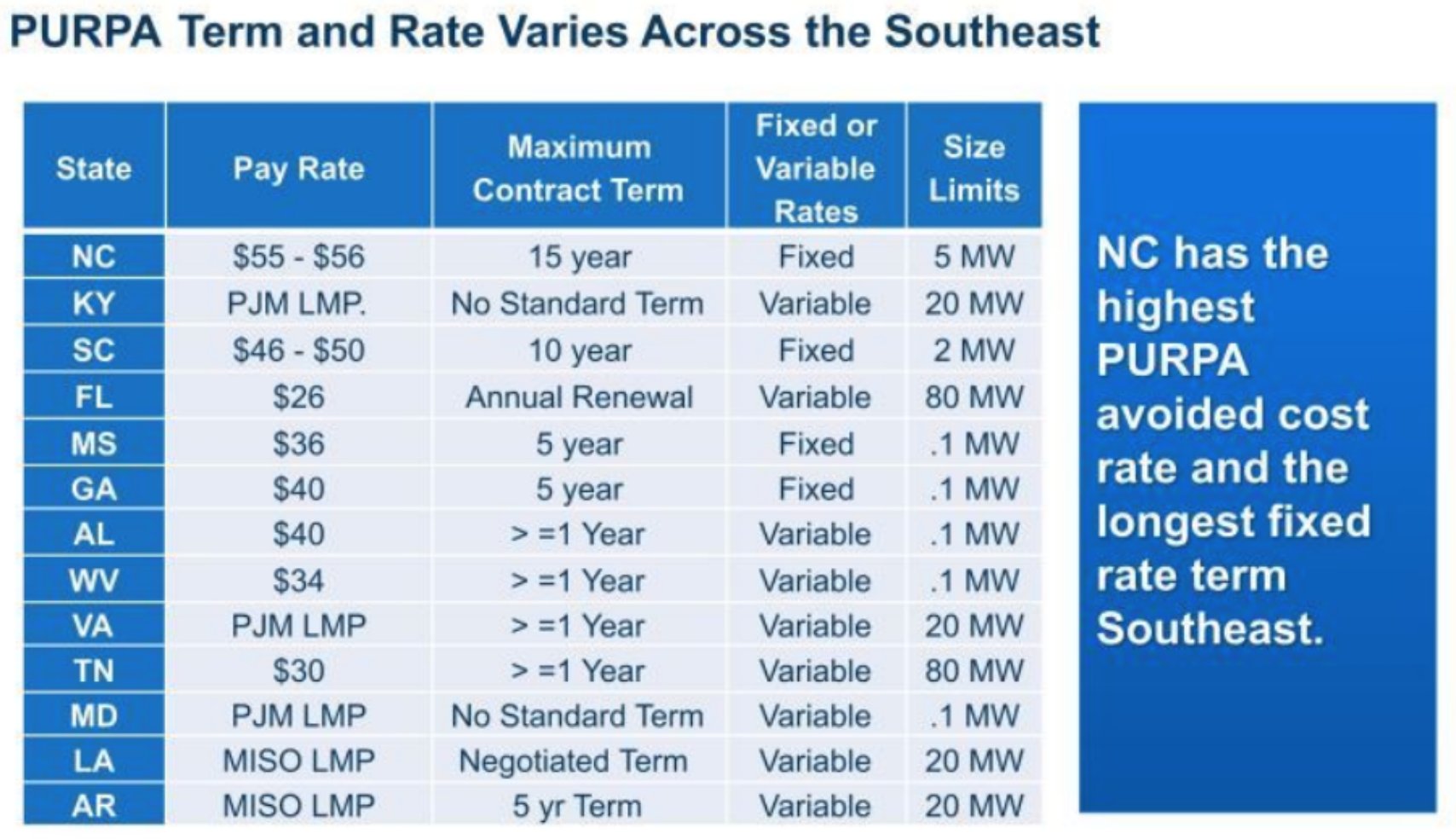

While PURPA is a federal law and a federal issue, states have control over how the policy is enacted. Several states could take up the issue in 2018, or urge federal action.

Last month, the National Association of Regulatory Utility Commissioners weighed in on the issue in a letter to FERC. NARUC members wrote that PURPA rules are causing many states to incur transaction costs, and they asked FERC to “better align PURPA implementation with modern realities.”

Some states have already taken action. North Carolina passed legislation last year that overhauls how utilities procure energy under PURPA. Most notably, the bill (HB 589) lowers the contract requirements for utilities from 15-year contracts for projects up to 5 megawatts, to 10-year contracts for renewable energy projects up to 1 megawatt. These reforms make it much harder for renewable energy projects to pencil out economically.

North Carolina is currently the second-largest solar state in the country and home to more PURPA-driven installations than any other state. Favorable state-level PURPA policies made that growth possible. But it also started to become difficult for Duke Energy to manage.

“In 2018, we're in a situation where we're going to dump power or repurpose it, sell it to somebody, or curtail our solar facilities, the 250 megawatts we own,” said Emily Felt, director of federal energy policy at Duke Energy, speaking at Solar Power International last fall when she held the title of renewable strategy and policy director. “This is a situation that caused us as a constituent in the state to advocate for change.”

Not all states have as much solar or such favorable PURPA policies as North Carolina, and yet they’re also starting to consider reforms.

Source: Emily Felt, SPI presentation, 2017

Oregon, Utah, Wyoming, Michigan and Montana have all recently made or sought modifications to contract lengths and rates, as well as other changes that could complicate project financing for solar developers.

In Michigan, PURPA changes approved in September were modest, while other states have reduced contract durations and lowered avoided costs to the point where renewable project developers say they can barely compete.

When Matt McGovern, CEO of Cypress Creek Renewables, was asked by a utility representative at Solar Power International why PURPA is so important, he said it’s because in the vast majority of regulated utility markets, “if not for PURPA being on the books, [renewables] would have literally zero access.”

PURPA will continue to be a priority for project developers and utilities in 2018 as other states propose changes.

DER rate design

Distributed energy compensation and related rate changes are familiar issues, and they will continue to be significant in 2018.

The most recent 50 States of Solar report by the North Carolina Clean Energy Technology Center found that 41 states and the District of Columbia took some type of solar policy action during Q3 2017. With a total of 142 solar policy actions across the U.S. during the third quarter, Q3 2017 featured the highest number of solar policy actions NCCETC has seen since it started tracking the field.

Twenty-four states considered or enacted changes related to net energy metering (NEM), and 19 states plus Washington, D.C. formally examined or made a plan to examine the value of distributed generation or the costs and benefits of NEM.

Some recent NEM changes are just now going into place. In Indiana, for instance, NEM compensation will gradually decrease this year through 2022, at which point customers will be credited at the utility’s wholesale rate plus 25 percent. Based on current prices, the drop will be from roughly 11 cents per kilowatt-hour to about 4 cents per kilowatt-hour.

Michigan also voted to eliminate NEM, and is now working to establish a new distributed generation program and tariff. Michigan Public Service Commission staff issued a draft report on the tariff and asked for public comments by January 10. The policy debate will play out over the course of the year with the final result ultimately included in utilities’ next round of rate cases.

Ohio adopted new NEM rules last fall, but components of the order may be appealed. The issue is also expected to re-emerge in Phase 3 of the Public Utilities Commission of Ohio's PowerForward initiative, set to begin in the first quarter of 2018.

And in Maine, net metering will begin to phase out in April of this year. However, the Conservation Law Foundation is now legally challenging that decision.

NEM has proven to be a simple and effective driver of distributed solar in the U.S. But utilities across the country have argued that the solar incentive increases electricity costs for others, by shifting at least some of the costs of maintaining the grid that should be borne by solar customers onto other ratepayers. NEM is also a blunt tool -- it doesn’t incentivize DER projects where and when they could be of greatest benefit to the grid.

The ways that states decide to design DER rates for the future will be a topic to watch in 2018. Some utilities have sought to address the rise of distributed solar by proposing demand charges or increased fixed fees, often targeted specifically at solar customers. But regulators have rejected those requests far more often than they've approved them.

In Q3 2017, of 26 pending or decided utility requests for fixed charges, only one was granted in full. Regulators have tended to prefer more incremental changes and more sophisticated tariff designs that address issues across the grid.

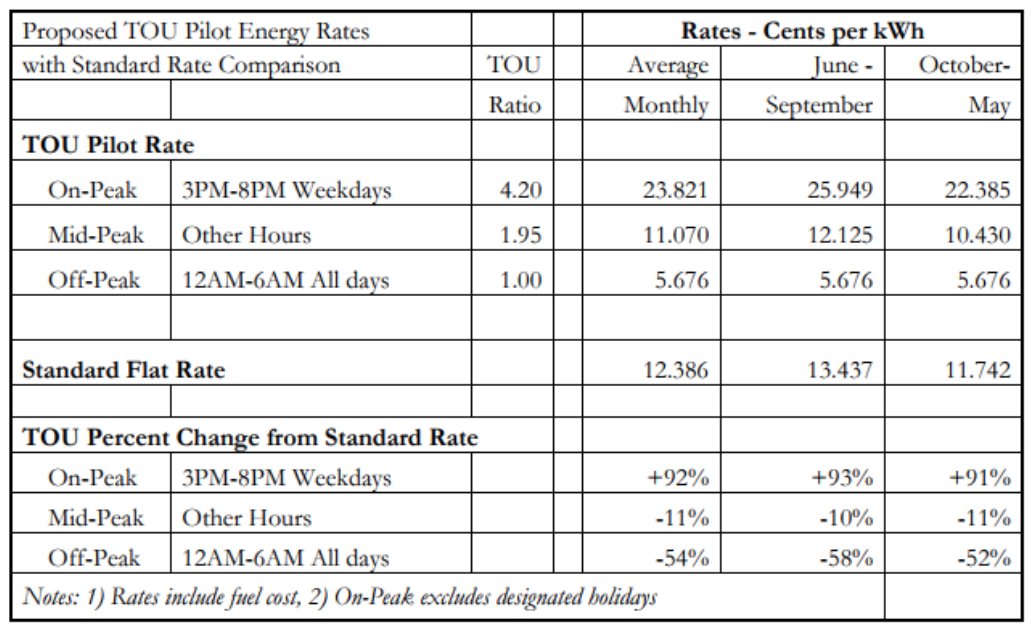

Time-of-use rates are proving to be central in this discussion. In Arizona, TOU rates are now the default scheme for all new Tucson Electric Power customers and optional for existing customers. In California, solar customers are already moving to time-sensitive rates, and all residential customers will move to default TOU rates in 2019. How those rates are structured will be subject to ongoing debate, as regulators establish how to structure the rates and when to set peak hours.

Other states are looking to introduce TOU plans, as well. Xcel Energy in Minnesota is hoping to get approval later this year for a two-year residential time-of-use pilot, which could serve as a model for effective rate design. The program is intended to determine if TOU rates can reduce peak demand across the system, but also to study the implementation and education needs for TOU rates and assess how customers are affected.

Customers will be educated throughout the process on how to reduce their energy use and take advantage of new rates. The pilot will involve 17,500 homes in two areas of the Twin Cities; 10,000 of them will adopt TOU rates and the remainder will serve as a control group on existing rates.

The proposal includes other unique elements, such as bill protection. If a pilot participant's bill increases more than 10 percent in the first year, Xcel will credit them the overages. Low-income participants will have bill protection during both years. The pilot is also being conducted on an opt-out basis, rather than opt-in, to make customer recruitment easier. It also includes a first-of-its-kind methodology designed by Strategen Consulting that incorporates current and forecasted renewable energy penetrations, and incentivizes customers to use energy when there’s excess renewable energy available.

The three-tiered rate design also features a high peak-to-off-peak ratio that’s expected to incentivize peak reduction and the adoption of load management technologies. The program was designed through a highly collaborative process, and has earned widespread praise and support as a result.

With so many states currently evaluating alternatives to NEM and new DER compensation schemes, positive examples will help pave the way for others.