The newest numbers show that California’s three investor-owned utilities (IOUs) were at 20.6 percent renewables at the end of 2011. With approximately 17 percent at the end of 2010, they fell somewhat short of meeting the state’s 2002 mandate that they obtain 20 percent of their power from renewables by the end of 2010.

Governors Schwarzenegger and Brown and the majority of the state’s lawmakers were encouraged enough to institute a new Renewable Portfolio Standard (RPS) requiring all state electricity providers obtain one-third of their power from renewables by 2020. It will certainly grow California renewables.

But will the new, more ambitious RPS continue to grow the use of wind, solar and other renewables?

The Clean Energy Race; How Do California’s Public Utilities Measure Up?, an analysis of the 2010 numbers from the Union of Concerned Scientists (UCS), showed an even better response to the 20 percent mandate on the part of California’s ten biggest publicly owned utilities (POUs).

POUs generate approximately 25 percent of the state’s electricity but, because they are locally governed, were given flexibility in the 2002 RPS.

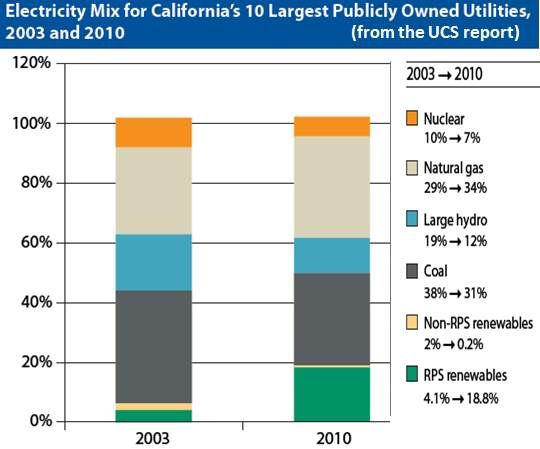

Nevertheless, the POUs outdid the state’s IOUs in the shift to renewables. The combined thirteen biggest utilities -- three IOUs and the ten POUs -- provided 87 percent of California’s retail electricity in 2010. About 52 percent came from fossil sources. The ten POUs cumulatively grew their sales of RPS-eligible, renewables-generated retail electricity from 4.1 percent in 2003 to 18.8 percent in 2010.

Other shifts in the ten POUs’ sources in the same 2003 to 2010 period: Nuclear decreased from 10 percent to 7 percent, large hydro decreased from 19 percent to 12 percent, and coal decreased from 38 percent to 31 percent. Natural gas increased from 29 percent to 34 percent.

To be RPS-eligible, the electricity must come from “wind, sun, geothermal heat, biomass, biogas, fuel cells using renewable fuels, hydropower [of no more than 30 megawatts], municipal solid waste [under certain conditions], or wave or tidal power,” according to the UCS report. It must also come from the Western Electricity Coordinating Council (WECC) transmission region.

.

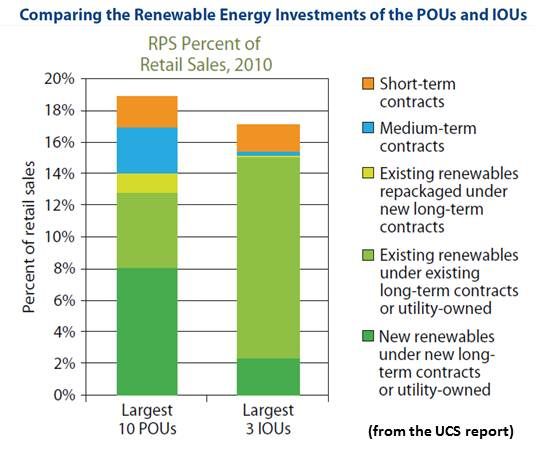

Almost half of the POUs’ renewable additions (43 percent) came from “long-term investments in new renewable energy resources built after the original RPS was enacted,” the UCS reported. But, it pointed out, “the POUs still relied on electricity from fossil fuels for two-thirds of their retail sales.”

The RPS was especially effective at stimulating the growth of solar, wind and biofuels. While much of the geothermal and hydro in the 2010 renewables portfolio was in service before the enactment of the 2002 RPS, the UCS report noted, relatively large quantities of wind, solar and biofuels were added afterwards.

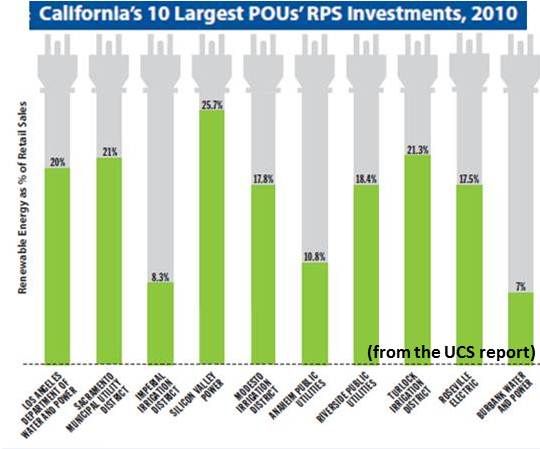

The UCS described Silicon Valley Power, Turlock Irrigation District, and Modesto Irrigation District as “sprinting ahead.”

Los Angeles Department of Water and Power, Riverside Public Utilities, Anaheim Public Utilities, Sacramento Municipal Utility District were “on the right track, but must keep moving.”

Roseville Electric, Burbank Water and Power, and Imperial Irrigation District, according to the UCS report, have had a “false start.”

Because the POUs did better than the IOUs, the UCS recommended three changes in renewables standards that guide their practices.

To give renewables developers the kind of increased certainty intended by a standard, the standard should increase focus on long-term contracts.

Modesto, for instance, obtained nearly all of its 17.8 percent renewable sources through long-term (ten or more years) contracts, whereas Roseville got well over half its 17.5 percent from short-term (less than four years) contracts.

Because renewables projects are not immune to delays and failures, utilities should include assumptions in their planning to account for them. They should, the UCS report advised, “sign contracts for more than the minimum amount of electricity required.”

On the other, the UCS report said, “IOUs had to obtain CEC [California Energy Commission] certification for all their RPS-eligible facilities, while the POUs did not. That means the POUs counted electricity for their RPS programs that the IOUs may not have been able to purchase. In fact, the CEC would not have certified 13 percent of the POUs’ RPS investments in 2010 because the electricity was generated by facilities that were outside the state.” The acceptability of another 15 percent was questionable.

Finally, “transparent reporting leads to accountability,” the UCS reported. Utilities should provide “publicly available plans [and] progress reports that document their investments.”