Over the past few years, Silver Spring Networks, a company best known for networking 22 million (and counting) smart meters for utilities around the world, has been positioning itself as a contender in the "internet of things" (IOT). That’s a pretty broad and nebulous term, but for Silver Spring, it means two essential things: turning its wireless networking technology into an extension of the internet at large and using it to connect as many things as possible.

Like many of its smart metering rivals, Silver Spring has been working on both sides of this equation. On the "things" side, it’s been making a big push into networked streetlights, with citywide projects underway in the U.S. and abroad. It’s also connecting grid controls, smart thermostats, remote sensors, traffic monitors, and other endpoints.

On the internet side, the Redwood City, Calif.-based company has been rolling out enhanced versions of its IPv6-capable technology, as well as chipsets with more flexibility in how they can be programmed to collect, analyze and share data with other devices in the field. The term of art is "distributed intelligence," which refers to using any number of grid-edge devices, or cityscape endpoints, as a networked computer of sorts, with the ability to analyze and act on data much faster than centrally controlled systems can.

In the past several months, Silver Spring has upped the ante on its IOT ambitions, starting with its September hiring of Michael Bell as CEO. The former product development executive with Intel, Palm and Apple has been praising the capabilities of Silver Spring’s “Gen5” technology, released early last year, as a platform for broader IOT uses. Since he’s come on board, Silver Spring has also pushed out software and hardware products to support the company’s new municipal business partners and started talking about the potential to put it all to use for new IOT purposes.

In December, Silver Spring put it all together in the form of Starfish -- a “robust, scalable and secure IOT networking solution” meant to “enable commercial enterprises, cities, utilities, and developers to access a reliable, secure, and scalable IOT network service with service-level agreements that meet their needs.”

To be sure, the launch of Starfish represents an attempt by Silver Spring to rebrand its existing smart meter and streetlight networks as a platform for IOT uses. But last month’s announcement also included some interesting moves beyond these core markets, including a plan to roll out IOT coverage across the city of San Jose, Calif., independent of the Silver Spring AMI infrastructure of utility Pacific Gas & Electric.

Other Starfish network sites include Copenhagen, where Silver Spring is networking 20,000 streetlights; Bristol and Glasgow in the U.K., where streetlights and sensors are being rolled out under the aegis of smart city deployments; Chicago and San Antonio, Texas, where Silver Spring is networking smart meters; and Kolkata, India, where energy company CESC Ltd. is expanding on a smart metering and distribution automation pilot project with Silver Spring.

What’s Starfish? The fundamentals of Silver Spring’s new IOT plan

Just how these customers plan to use the capabilities that Starfish is promising to deliver hasn’t yet been laid out. But in an interview last month, Bell hinted at the possibility of making its existing utility networks available to other parties, although he didn’t provide any specifics.

Utilities have traditionally been very leery of opening their networks to other users. But "as the value of smart cities is becoming more and more apparent, cities and utilities are being pushed to do more with the assets they already have,” he said. Of course, “They want to be assured it won’t have an impact.”

On that front, Silver Spring has "already been serving these customers with secure, reliable, fast networks that cover large parts of the state of California [and] the island of Oahu [including] surrounding volcanoes [and] large swaths of uneven terrain,” he said. “How about we make that available to the public, so you don’t have to be a utility or a city to take advantage of it?”

For a Silicon Valley city like San Jose, an IOT network could become a service for parties beyond city departments, Bell noted. The additional capacity on these networks could be made available as a free service for those who aren’t as concerned about low latency and high reliability. Alternatively, “You can pay for performance and get the same quality that our utility clients get,” he said.

Just how much freedom Silver Spring has to open up that availability will depend on the nature of the underlying network, he pointed out. While all its AMI networks are embedded in other companies’ meters and operated by utilities, Silver Spring does maintain a certain level of operational oversight over the networks at large.

In other cases, including some of its smart streetlight deployments, “We already own the networks” and rent the capacity and capability to the hosts, he said -- “so we don’t need permission to put other stuff on it.”

Notably, Bell didn’t cast the competition as its smart meter rivals, but rather as a newer generation of low-power wide area network startups, such as Sigfox and Semtech, whose systems are purpose-built for connecting large numbers of low-power, distributed devices.

“Our stuff is already more secure, faster and more reliable than what they have,” he said, adding, “Gen5 takes it up a notch." It’s also built on standards-based technologies, including IPv6 networking and the IEEE 802.15.4g wireless mesh radio technology that’s slowly coalescing into standard form, through the work of the Wi-SUN Alliance industry group.

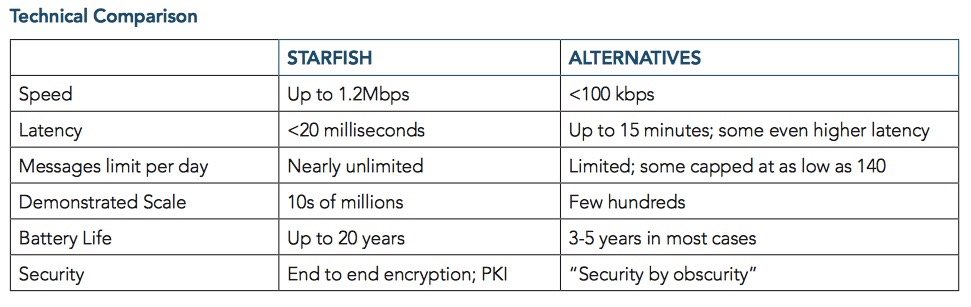

What's more, “having 22 million-plus devices in the field, in some of the harshest conditions in the world, with security requirements,” helps provide operating history to back up the company's claims. Here’s a comparison the company drew up against its IOT competition, with one addendum -- on Feb. 4, it announced that it has doubled the speed of its Gen5 technology to 2.4 megabits per second.

There’s one comparison point that Silver Spring doesn’t include in the chart above, however, and it’s an important one -- price. The low-power, long-range wireless networks being designed specifically to support IOT applications may well make up in low price what they lack in speed, latency and scale. Bell declined to discuss details of how Silver Spring intends to price its Starfish offering, whether as part of a pre-existing network or as a standalone network.

It’s also important to remember that new IOT networking technologies aren’t Silver Spring’s only competition. It’s only one of several smart metering companies jockeying for market share in the still-nebulous IOT market, each coming at it from different angles. We recently covered how Itron is working with Cisco to embed distributed, programmable intelligence in grid devices, smart solar inverters, and electric-vehicle chargers, to name a few examples.

Toshiba-owned Landis+Gyr, Honeywell-owned Elster and ABB’s mesh networking technology from Tropos have enormous fleets of smart meters as well, and are working on similar capabilities. And that’s just some of the top smart meter players.

From smart city applications platform to nodes of programmable edge intelligence

Silver Spring has been working on supporting “smart city” efforts since 2013, when it first announced it was working on software specifically for the municipal and cooperative utility markets. Its earliest successes on this front have been centered on networked streetlights, both through its acquisition of Streetlight.Vision in 2014 and with its networked lighting systems partner Acuity, with big projects now underway in cities including Copenhagen, Paris and Miami-Dade County.

In October, Silver Spring announced Streetlight.Vision 6, an “advanced city management control” software platform, with various improvements to its core streetlighting applications. But “what we’re really excited about is opening an apps store, not just for streetlight management, but for broader smart city applications,” Brandon Davito, the company’s vice president of smart cities, said in an October interview.

In Copenhagen, for example, about half of the city’s residents ride bicycles to work. Using cameras and motion sensors that are part of the overarching streetlighting network, Silver Spring’s platform is analyzing those traffic flows and seeking to link them to the operation of its also-networked traffic lights, to create “green waves” of bike traffic out of formerly congested thoroughfares, he said. In Glasgow, Silver Spring is networking noise, light and air sensors to provide data to residents.

Silver Spring is also bridging its asset management and work order management applications for streetlight maintenance and replacement, and extending them to other networked devices, he said. This is still in the early stages, he noted, which means it’s important for SLV6 to be as open as possible to new or emerging standards for networked parking sensors, pollution sensors, “smart” trash bins, and other smart-city endpoints.

“There is no one single, vertical smart city application set,” he said. “We’ve been working on making sure that our system is as open as possible, through the devices, the network and the data layer.”

In November, Silver Spring added an important piece of equipment to its long list of in-field networked devices: its IOT Edge Router, a Linux-programmable, multi-communications-capable network node. Much like the Cisco Connected Grid Router that serves as the hub of Itron’s Riva platform, Silver Spring’s IOT Edge router offers a lot more flexibility, compared to previous generations of data concentrators or backhaul nodes.

Silver Spring is already tapping its meters as voltage sensors, outage monitors, energy theft detectors, and energy disaggregation, to name a few analytics uses. With the new IOT router, the company is looking at a new set of endpoints like smart parking stations, bicycle rental kiosks, EV charging stations, digital signage, and environmental sensors.

“This product, having a very capable Linux platform, is capable of pushing different protocol support and managing distributed decision-making at the edge,” Davito said in a November interview. That could include supporting protocols like Modbus to connect smart solar inverters, incorporating cellular connectivity at the edge of the network, or adding powerline-carrier protocols to connect devices in places that wireless signals might struggle to reach, he said.

Computing power at the edge also allows for more data processing and analytics, “not just opening up the back office for doing analytics, but running much more real-time operations on the edge,” he said. Take the “green wave” concept in Copenhagen, which matches traffic lights to sensor data, a task that virtually requires edge analysis -- the bicyclists in question may be well past a traffic light before a central server has time to collect data, analyze it, and send back a command.

“You rarely bring in distributed control first,” Davito noted. “The first thing is being able to better understand the data, because of the edge processing. Once that’s really well designed and tested, then the next step is to push that to the edge. The IOT router supports that transition.”

In other words, cities aren’t going to leap right into using these edge intelligence nodes as control points for their critical infrastructure. And when they do, they’re going to require cybersecurity at the edge of the network, according to Davito. “You can push new applications to the edge to make sure you’ve got security all the way down to the NIC [network interface controller], but also the Linux processor involved,” he said.

Security is an issue that’s going to become increasingly important as the internet of things moves from pilot projects to commercial deployments, Bell noted. “You can’t bolt that stuff on after the fact. Silver Spring’s technology itself is secure and designed to be future-proof.”

On the roadmap: Low-power devices and standards for real-world IOT growth

Connecting low-power devices, like sensors that are powered by batteries, is the next step on Silver Spring’s roadmap, Bell said. That’s going to be an important piece to fulfilling the IOT concept, since so many of the devices envisioned to be part of it won’t be hooked up to the grid.

Early last year, Silver Spring unveiled its Milli 5 chipset, which uses one-fifth the power of its typical network interface cards, to support the extension of its network to battery powered devices. But like rival Itron, which is also working on low-power networking, Silver Spring hasn’t yet made this capability available commercially, though it’s busy testing it, he said.

Low-power devices will be important to expanding the use cases of the Starfish network, he noted. For example, “we did a little internal hackathon and put together a methane leak detector” capable of sniffing out natural-gas leaks, he said. A cost-effective version of this kind of technology could be valuable to utilities like PG&E, which is trying to improve the safety of its gas network in the wake of the 2010 San Bruno, Calif. pipeline explosion, and which uses Silver Spring’s networking technology for smart meters.

Bell named other examples, like sensors on top of rooftop air-conditioning units that could detect unusual vibrations that indicate that the unit is running in a way that will lead to a malfunction in the near future.

As for the standards that are going to enable this transformation, Bell pointed to the IEEE 802.15.4g specification, which is the emerging standard for the wireless mesh smart-meter networks being deployed across the world. This specification includes low-power mesh networking, and “it can be a full participant in the mesh, and last the same number of years that everyone else in the low-power field are bragging about,” Bell said.

Silver Spring isn’t the only smart meter networking vendor tapping the enhanced capabilities of this technology. Cisco and Itron are using 802.15.4g wireless for their smart grid and smart city efforts, and Toshiba’s Landis+Gyr is using it for its 27-million-unit smart meter deployment in Tokyo, to name two prominent examples.

As far as Bell is concerned, this move amongst competitors to standardization will allow the IOT market to actually become a reality. On the smart grid and utility side of things, “We already work with other parties to bring our radio technologies in,” whether its in smart meters from other vendors, or grid sensors and switches from various distribution automation partners, he said. “Anyone who wants to get their devices to work on a ubiquitous IOT network -- it’s really extending what we already do on a new scale.”

One of the questions dogging the IOT ambitions of Silver Spring and its utility competitors is whether or not it’s turning to this still-emerging market in order to make up for slow growth in traditional smart meter contracts. Bell pooh-poohed those views, noting that only about 30 percent of U.S. utility customers have received smart meters to date, and opining, “I think it’s going to be 100 percent coverage -- it’s not a matter of if, but a matter of when.”

Even so, with its longstanding emphasis on IP-enabled networking technology, the IOT opportunity is too tempting to pass up, he said. “For someone who has a meter-only network to go into IOT, that does sound like a Hail Mary to me.” But, he added, “We’d hate to see a network out there that didn’t have our security and reliability, and us be the best-kept secret out there.”