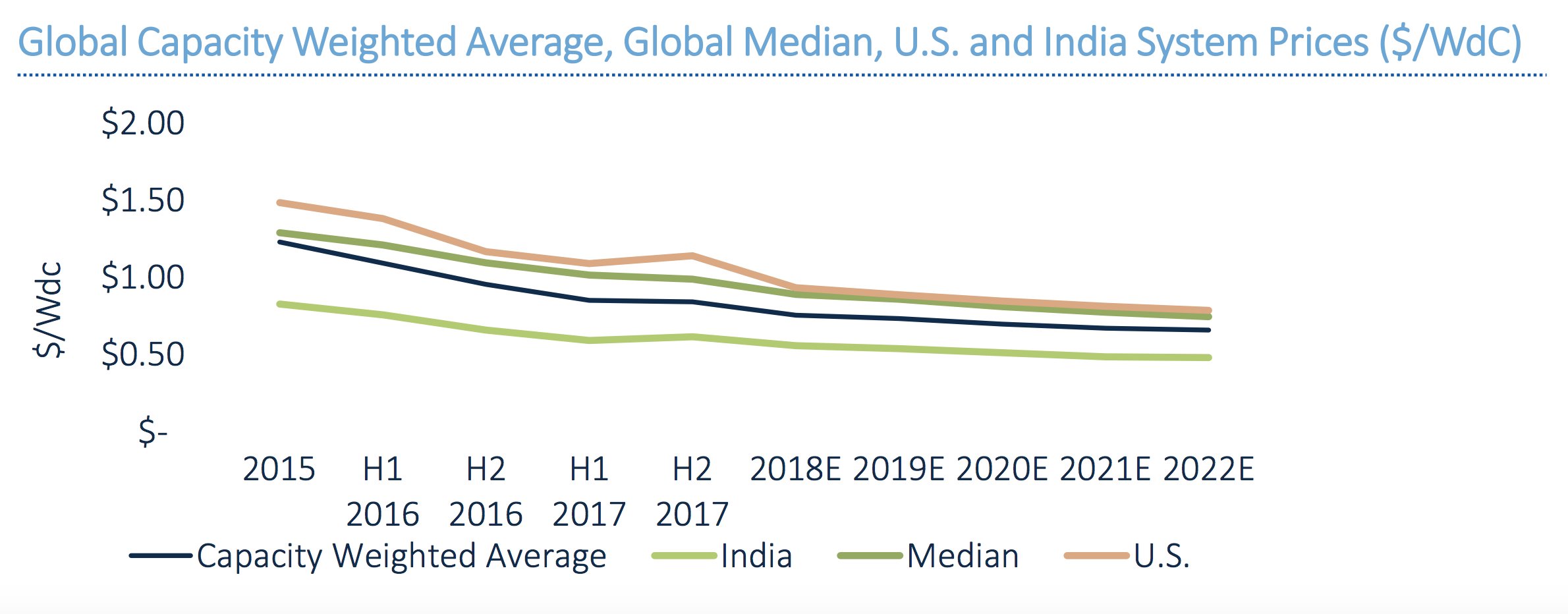

Battery and solar module costs have both dropped precipitously in recent years, leading to a strong reduction in overall system prices. But they can only fall so far.

As the International Renewable Energy Agency noted in 2016, “as equipment costs fall, the importance of addressing balance-of-system costs, improving the performance of the technologies, reducing O&M costs and driving down the cost of capital all start to take on greater importance.”

IRENA’s assessment of solar PV balance-of-system (BOS) costs in 2015 found that costs ranged from just over $500 per kilowatt in China and Germany, to well over $1,500 in Japan.

“Wide variation in balance of BOS costs today now often represents the largest source of cost reduction opportunities,” the report concluded.

BOS costs have come down considerably since then. But new U.S. tariffs on aluminum and steel may slow progress.

This month, President Trump announced a 25 percent tariff on steel and a 10 percent tariff on aluminum -- impacting wind turbine towers, the containers that house battery systems, solar ground-mount posts and tracker torque tubes.

According to GTM Research, the tariffs could raise the levelized cost of energy at wind and solar power plants by 2 to 5 percent. And that's on top of a bunch of other factors: solar tariffs, an uncertain tax equity market and tax credit step-downs.

Solar’s double-whammy tariffs

The good news: Solar system prices will continue to drop through 2022.

GTM Research’s Q4 Solar Executive Briefing -- published before the Trump administration made final decisions on both sets of tariffs -- show a slight bump in U.S. system prices in 2017. That’s expected to smooth out by the end of 2018 and continue falling.

The tariffs may add a few cents per watt-DC in the short term, but the long-term downward cost trend will continue.

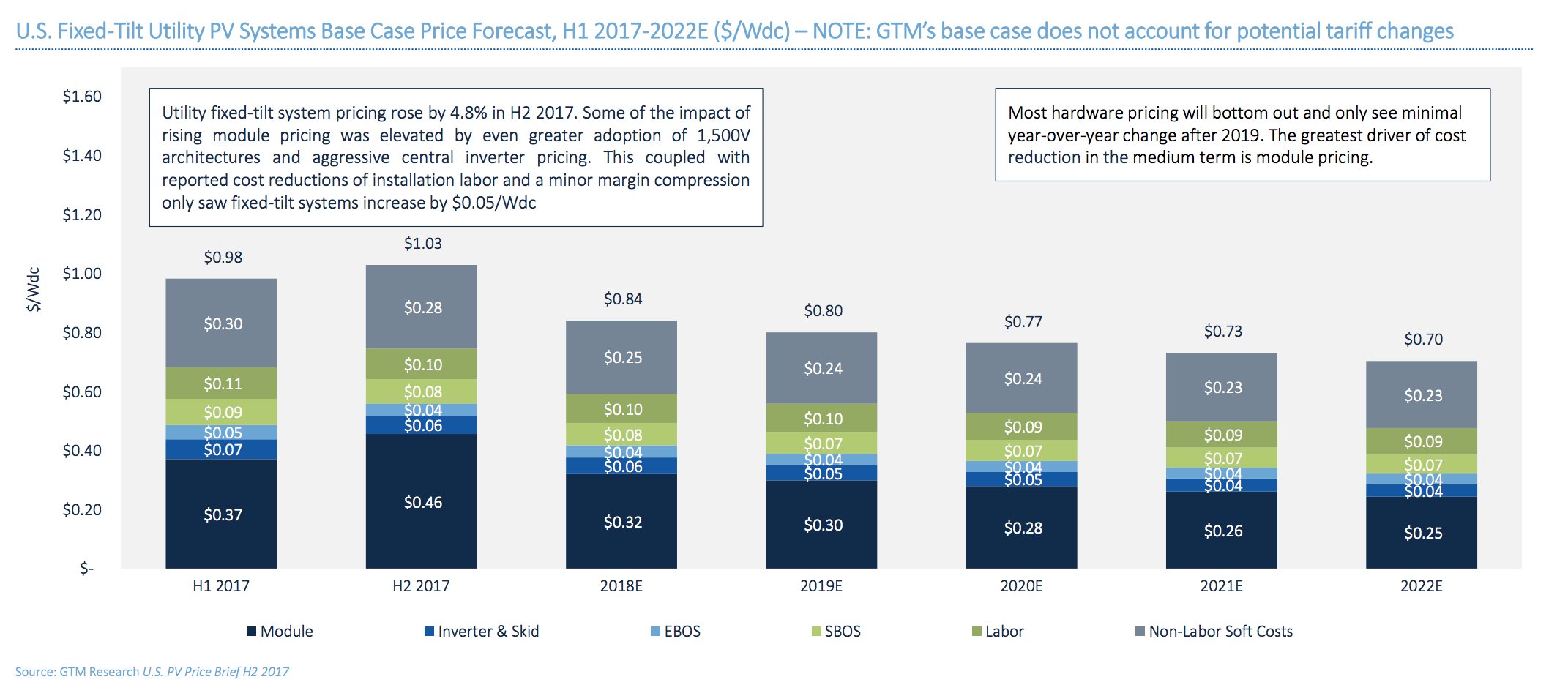

However, the newly announced steel tariffs could have an outsized impact on BOS costs.

“Overall, the module tariffs don't have a direct impact on BOS costs,” said GTM Research Senior Solar Analyst Scott Moskowitz. “There could be some downward pressure from developers who need to squeeze additional costs out of the system, but that will vary project to project. The steel and aluminum tariffs will have a much greater impact, particularly on ground-mount systems, which are usually built on fixed racks or trackers made mostly from steel.”

Under the new steel tariffs, GTM Research estimates BOS costs could rise by 3 to 5 percent.

The threat of tariffs already pushed a $0.01-per-watt tracker cost increase. GTM Research estimates that trackers could increase by up to another 2 cents per watt, with prices paid by customers.

Shaving BOS costs is already getting difficult. As Moskowitz and GTM Research solar analyst Ben Gallagher previously noted in the executive briefing, “most hardware pricing will bottom out and only see minimal year-over-year change after 2019.”

The tariffs make BOS cost reductions even more challenging. GTM Research forecasts previously showed racking equipment prices falling by 2 cents per watt in the next several years. “Now, with the tariff, that forecast has been completely negated,” said Gallagher.

In a preliminary analysis of utility single-axis tracking systems, Gallagher found that balance-of-system costs rose from a projected $0.58 per watt-DC (or $0.96 with the module and inverter included) without tariffs to $0.61 per watt-DC (or $1.08 with the module and inverter included) with tariffs in Q4 2018.

Those few cents add up. For a 20-megawatt system, that could amount to $2.4 million.

“It’s hard to represent when you’re talking about just dollars per watt -- it doesn’t seem like that much money,” he said. “But if you’re talking about large-scale systems, the impact is quite substantial.”

For storage, it's metal vs. concrete

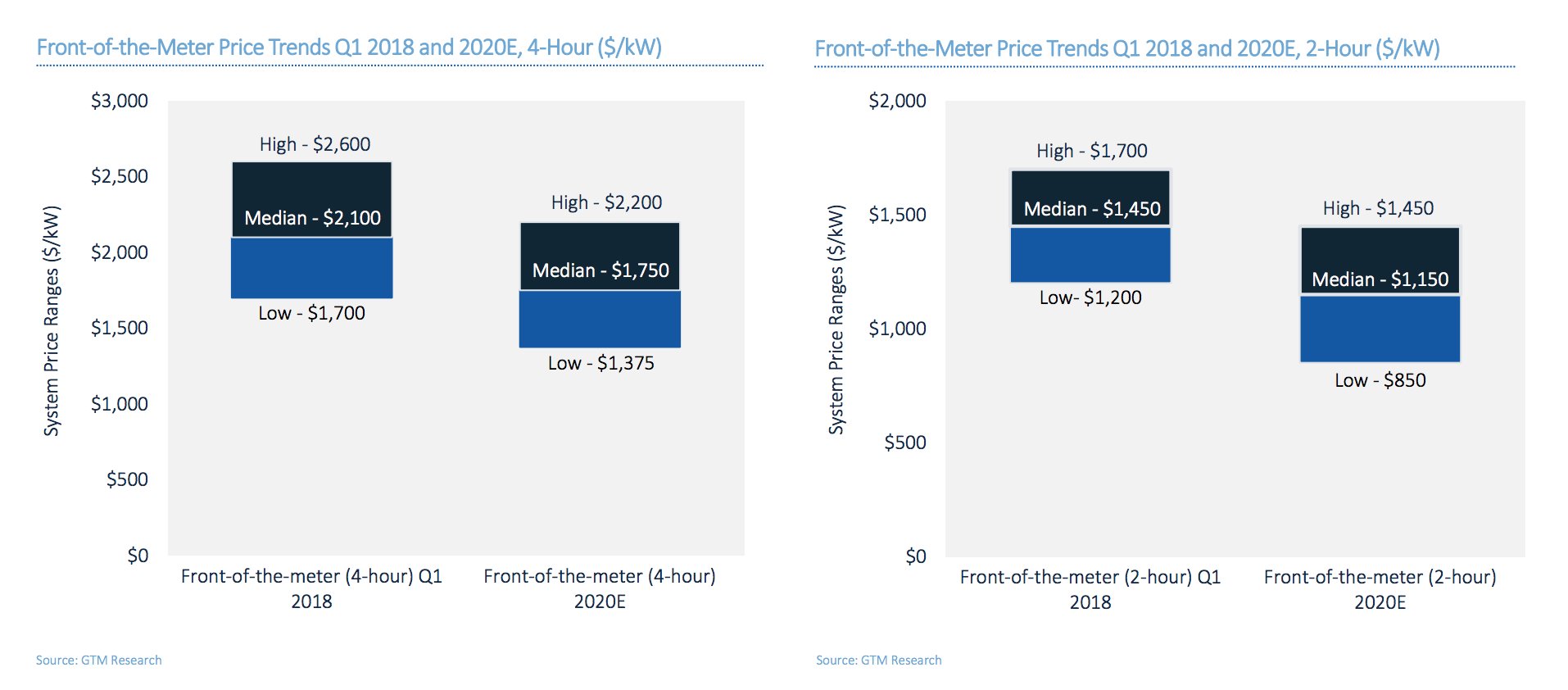

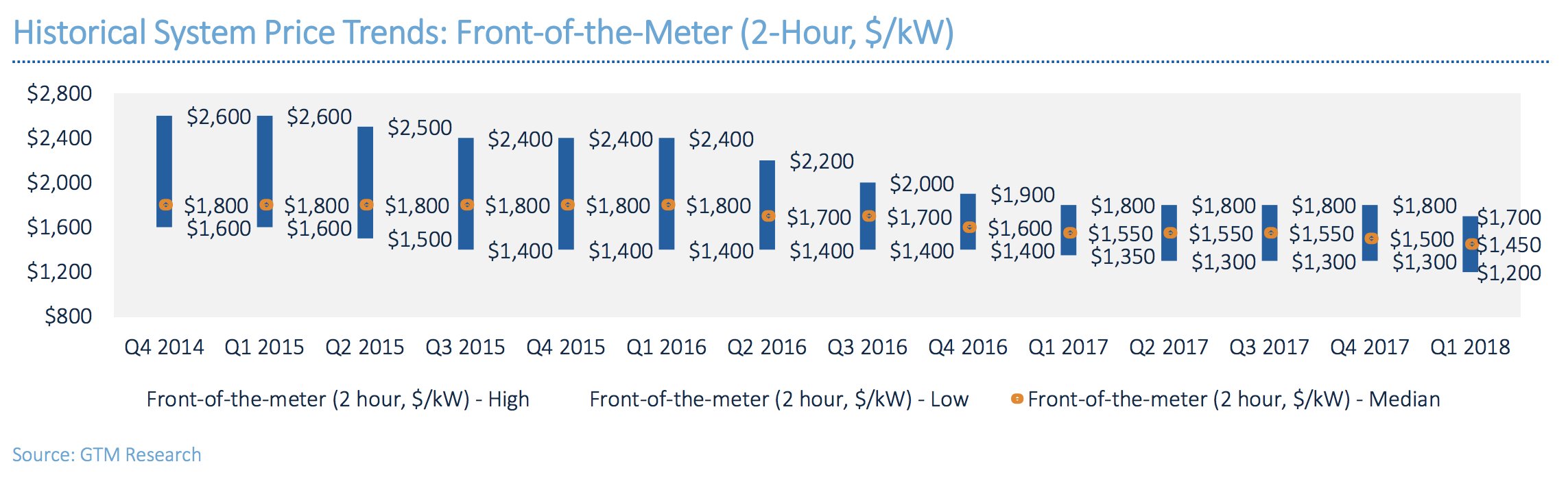

GTM Research expects the latest tariffs to slightly impact storage systems as well, especially for front-of-the-meter applications.

Between 2018 and the end of 2020, GTM analysts projected that median storage system prices in the U.S. would fall by $250 per kilowatt for 4-hour systems, by $300 per kilowatt for 2-hour systems, and by $150 per kilowatt for 30-minute systems.

"System prices do not change linearly with discharge duration, as the cost of some balance-of-system components scale with power while others scale with the energy capacity of the system," noted analysts.

With the new tariffs, container-based system prices could rise by 3 percent, as the price of metal enclosures spikes as much as 15 percent in 2018 and 2019. About 90 percent of storage systems are containerized, according to GTM Research storage analyst Mitalee Gupta.

The increase could impact the materials some manufacturers use for longer-duration systems. The cost difference between metal containers over concrete is slim. With the new tariffs, metal enclosures could be 7 percent more expensive than concrete.

“That being said, several other factors such as flexibility to move or relocate metal containers, achieving compliance with local building codes, experience of EPC vendor, etc. will continue to impact the decision of choosing between metal or concrete enclosure for storage systems,” said Gupta.

Prior to the tariff announcement, GTM Research expected battery system prices to continue dropping as a result of higher deployment and reduction in battery-rack costs.

Materials costs -- in this case, steel -- account for 60 percent of a container's full cost. Gupta said container costs currently make up about 5 to 10 percent of BOS costs in front-of-the-meter systems. But because the increase in container costs are marginal, Gupta said tariffs won’t have a significant impact on the overall downward price trends for storage.

Falling balance-of-system costs “driven by innovation, improvements in system design and engineering and emergence of alternate system architectures,” meanwhile, will continue to drive systemwide price reductions.

This is especially true for short-duration systems, where BOS costs make up half of all system costs. GTM Research, in its latest Energy Storage Monitor report, noted that BOS costs “represent a tremendous opportunity to bring down system-level prices.”

The opportunity stands, even if tempered by tariffs.