Spanish infrastructure group Acciona has offered to take over wind turbine supplier Nordex, moving to bolster the company's finances amid market “turbulence” in the wake of rival German supplier Senvion's insolvency.

Acciona merged its own turbine manufacturing business — Acciona Windpower — with Nordex in 2016 amid a wave of industry consolidation. That deal left Acciona, a major global investor in renewables projects through its energy division, with a 29.9 percent stake in Nordex, whose shares trade publicly in Germany.

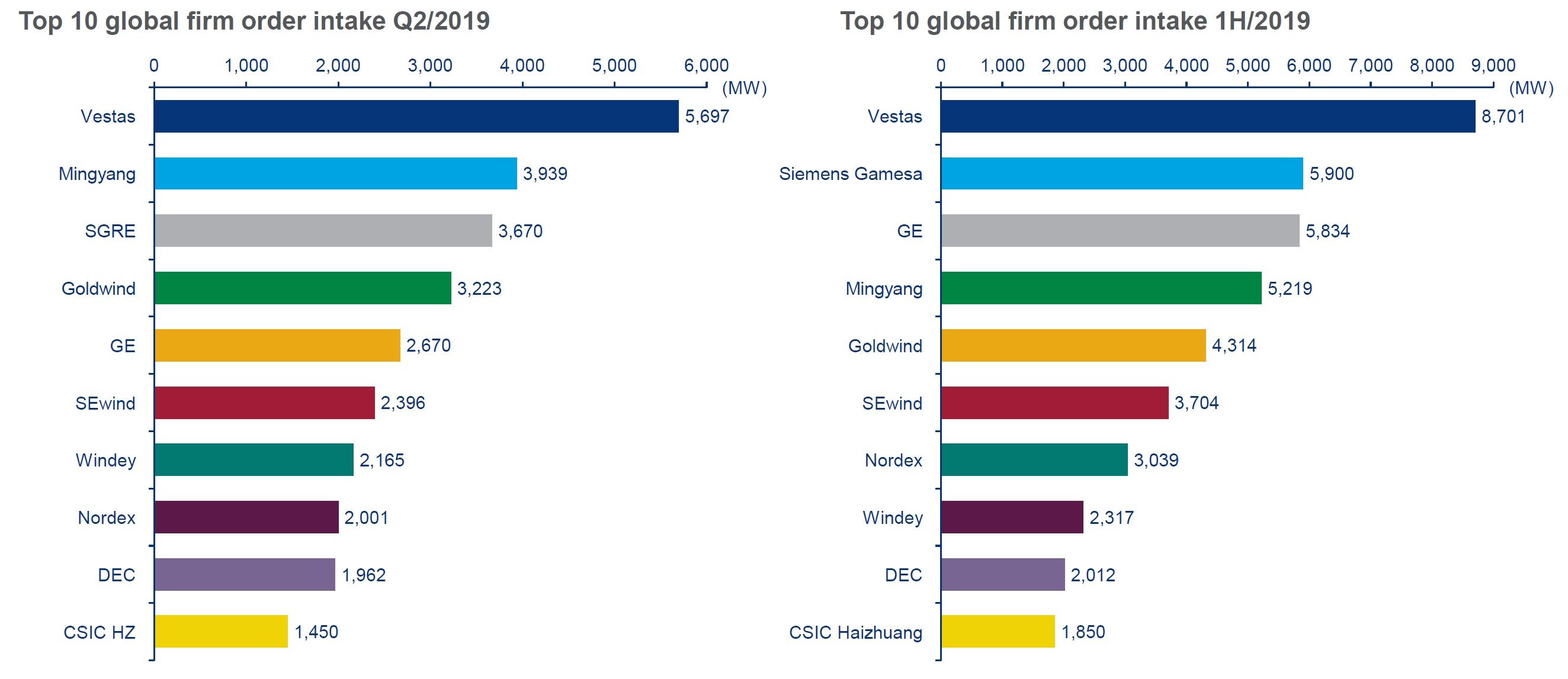

Nordex was the eighth largest wind turbine supplier globally in 2018, and the number-four player outside China, shipping about 2.5 gigawatts. It lags well behind the big three suppliers outside China: Vestas, Siemens Gamesa and GE.

On Monday, Acciona said Nordex’s board of directors had asked it to participate in a €99 million ($109 million) capital increase — an offer it has accepted. In doing so, Acciona’s stake in loss-making Nordex will climb to more than 36 percent, above the 30 percent ceiling that automatically triggers a takeover offer under German law.

“Acciona wants to protect its investment in Nordex,” explained Raimundo Fernández-Cuesta, Acciona’s global director for markets and investor relations, in a conference call Tuesday.

The capital increase will have “a major and immediately visible impact on Nordex’s balance sheet and credit profile,” said Fernández-Cuesta. “This, in our view, should allow the company to navigate the turbulence in the aftermath of Senvion and execute its order book.”

In April Senvion entered voluntary insolvency proceedings, and it recently entered exclusive talks with Siemens Gamesa regarding its service business, suggesting the company may be wound down.

Whether Nordex’s shareholders accept the takeover bid remains to be seen. Acciona’s offer of €10.32 per share, based on the average listed share price over the past three months, values Nordex at €1.1 billion, according to Reuters. That’s a mere 1.8 percent above Monday’s closing price.

Nordex's shares have traded in a wide range between €7.30 and €15.50 over the past year. If the takeover goes through, it would likely be finalized in early 2020, said Fernández-Cuesta.

Wood Mackenzie: Global Wind Turbine Order Analysis: Q3 2019

While the merger of Acciona Windpower and Nordex was intended to allow them to compete in a consolidated industry, the combined company remains relatively small compared to its bigger rivals in a market that increasingly values global scale and reach.

The sharp contraction of Germany’s onshore wind market in recent years has continued putting consolidatory pressure on the industry.

Still, Nordex has shown many signs of strength in recent years, including solid growth in the U.S., now its largest market by far, and positive customer response to its technology developments.

Acciona Energy typically buys turbines from Nordex for its projects, giving the OEM an advantage in the markets where the Spanish infrastructure group operates.

Wind projects are getting bigger in most key markets, putting a strain on smaller suppliers. But Nordex is managing to keep up, said Shashi Barla, principal analyst at Wood Mackenzie.

“Nordex has recently bagged several turbine contracts for 400-megawatt-plus projects in Brazil, Sweden and the U.S.,” Barla said. “Acciona Energy’s balance sheet will help the company to win even larger contracts in the future.”

Earlier this year Nordex launched its first turbine larger than 5 megawatts, part of its Delta4000 platform, which is scheduled to go into series production in 2021. Nordex does not sell offshore turbines, in contrast to Siemens Gamesa, MHI Vestas and GE.

Wood Mackenzie's forecast sees the global wind market putting up powerful growth in 2019 and 2020, reaching record levels of installations ahead of subsidy deadlines in the U.S. and China.

The global market is expected to contract modestly in the early 2020s, but not by much, and it looks set to remain substantially larger through the coming decade than it was in the preceding decades, thanks to a lower levelized cost of energy and growth in the offshore segment.