Southern Company intends to test the proposition that a U.S. utility can reach net-zero carbon emissions by 2050 while still keeping natural gas as a central part of its business, both to generate electricity and to sell to its customers.

That’s a key takeaway from Tuesday’s net-zero carbon plan fleshing out the multistate utility’s May commitment to zero out its net carbon emissions by midcentury.

Like many other utilities with similar decarbonization goals, Southern Company doesn’t yet see a clear path to eliminating natural-gas-fired power plants “unless and until technology emerges that can affordably and efficiently replace it,” CEO Tom Fanning said in a written introduction to the plan. That means Southern Company intends to keep building new natural-gas power plants to meet its supply needs, even as it grows its renewable energy portfolio from 9 gigawatts today to about 14 GW by 2024.

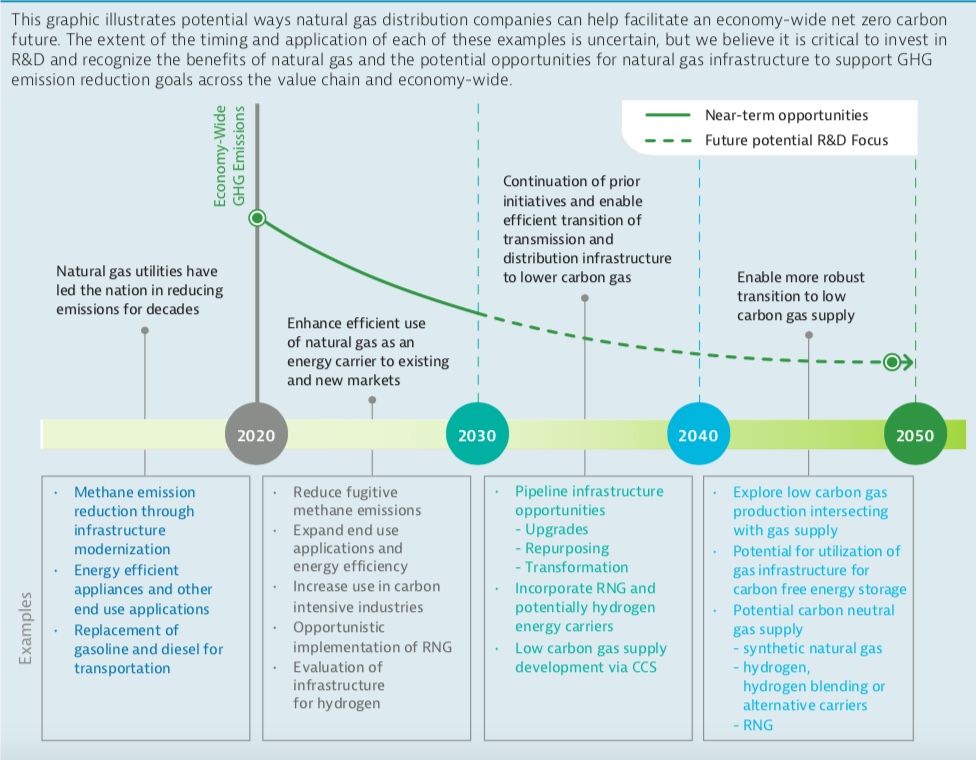

Southern Company also won’t include in its zero-carbon metrics the carbon emissions generated by customers of its natural-gas distribution business burning the fuel it supplies them, although it will move to reduce methane leakage and help customers use the fuel more efficiently.

And to reach its net-zero goals by 2050, Southern Company will rely on alternative fuels such as biomethane, green hydrogen and methane generated via carbon-neutral “power-to-gas” methods to supply its power plants and gas utilities, as well as cost-effective ways to capture, store and reuse the carbon it will continue to emit in decades to come.

“While there are calls by some to eliminate direct use of natural gas altogether, it is our view that such an approach would be an expensive, impractical way to address [greenhouse gas] reduction goals,” the plan states.

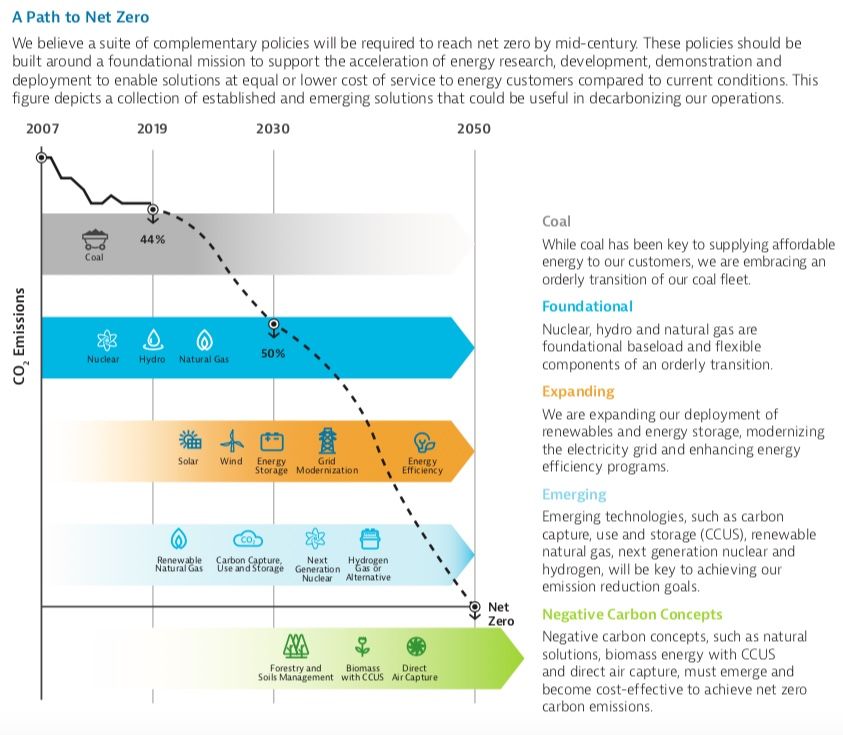

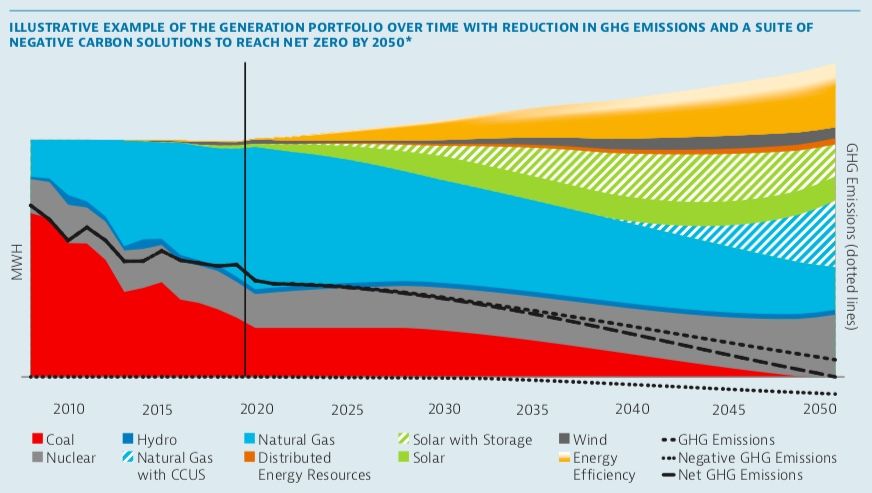

The 35-page plan offers far more detail than Southern Company has previously disclosed on how it intends to decarbonize a 44 GW generation portfolio that’s now about 52 percent natural gas, 13 percent coal, 17 percent nuclear and 18 percent “renewable and other." That includes a recommitment to reaching its 2030 goal of reducing carbon emissions below 50 percent of their 2007 levels, potentially ahead of schedule.

But it doesn’t offer the same kind of alternative benchmarks and pathways as have been offered by other long-range plans from utilities pledging zero-carbon goals such as Duke Energy, Dominion Energy or Arizona Public Service.

To be sure, no U.S. utility has yet fully fleshed out how it intends to eliminate natural-gas power plants from its generation portfolio. That’s because those plants provide critical flexibility to meet peaks in grid demand and deliver power when wind and solar resources may not be reliably producing enough to meet customers’ needs.

The natural gas conundrum

Opponents of new natural-gas power plant construction argue that the falling cost of renewable energy paired with batteries is undercutting the business case for natural-gas-fired peaker plants, leaving them at risk of becoming stranded assets unable to recover the costs of building them.

Much like Duke Energy, however, Southern Company faces wintertime peak electricity demands for heating that are difficult to meet with lithium-ion battery-backed intermittent renewables. That’s a different challenge than that faced by summer-peaking systems that can expect solar power and energy storage to help meet air conditioning demand.

States that have set 100 percent zero-carbon or renewable-energy mandates can force utilities to forgo new fossil fuel projects, as has happened recently in Virginia and New Mexico. But Georgia, Alabama and Mississippi, the states where Southern Company’s electric utilities serve about 4.2 million customers, have not set such mandates.

In the past year, Southern Company’s electric utilities have laid plans for a mix of natural gas and renewable build-outs in their integrated resource plans. Georgia Power’s latest IRP plans to add 2,260 megawatts of wind, solar and biomass generation and 80 MW of battery storage, as well as boost its hydropower capacity, close five coal plants, and bring two new units at its Vogtle nuclear power plant online.

But Alabama Power plans to build 1,900 MW of new natural-gas generation, although it’s seeking up to 400 MW of solar and options for additional energy storage under a just-released request for proposals. And Mississippi Power’s IRP is proposing to retain natural-gas-fired operations at its Kemper plant, the site of a failed coal-fired carbon capture project, and extend operations at its Daniel coal-fired power plant.

Leaving out emissions from natural gas burned by customers

Meanwhile, Southern Company’s net-zero carbon goal only measures direct facility emissions, or “Scope 1” emissions as defined by the U.S. Environmental Protection Agency. That leaves out indirect “Scope 3” emissions from gas burned or otherwise consumed by customers of Southern Company Gas, whose natural gas utilities Atlanta Gas Light, Nicor Gas in Illinois, Chattanooga Gas and Virginia Natural Gas serve about 4 million customers.

Southern Company Gas will reduce its Scope 1 emissions by seeking out renewable natural gas, “minimizing fugitive methane emissions across the natural gas supply chain and reducing GHG emissions for end-use customers, including electric generation.”

But Lila Holzman, energy program manager of nonprofit group As You Sow, called Southern Company’s decision to exclude Scope 3 emissions from its plan an “unacceptable” approach. She also criticized the plan’s lack of detail on the costs and risks of relying on as-yet-unproven technologies to cut the carbon footprint of its natural-gas fleet.

“While Southern refers to concepts like ‘renewable natural gas,’ hydrogen and carbon capture, the company leaves out specifics that would help investors understand the impacts, costs and likelihood that such technologies are anything beyond wishful thinking,” Holzman wrote in a statement released Tuesday.

What the future holds

Over the next three decades, Southern Company has “developed pathways that could allow us to achieve 80 to 90 percent reduction” in carbon emissions, the company says. That’s accomplished through a combination of new solar, wind, energy storage, distributed energy resources like rooftop solar and behind-the-meter batteries, and energy efficiency and demand response, as the “illustrative example” graphic below indicates.

To manage the 10 to 20 percent of its generation portfolio still emitting carbon, Southern Company will need to pursue “a suite of negative-carbon solutions.” Those include the aforementioned carbon-neutral substitute fuels, as well as advances in capturing natural-gas power plant emissions being pursued at the National Carbon Capture Center, which Southern Company operates in partnership with the U.S. Department of Energy.

They could also include next-generation nuclear power plants such as those Southern Company is pursuing with Bill Gates-backed startup TerraPower and long-duration energy storage such as advanced flow batteries, compressed air energy storage and thermal energy storage technologies.