SolarWorld Americas announced Wednesday that its creditors have agreed to lend the crystalline-silicon solar cells and module manufacturer an additional $5 million for operations, as the company seeks to build back to full capacity utilization and profitability.

“With this latest cash infusion, our creditors are demonstrating their confidence in our company and its outlook for growth,” said Juergen Stein, CEO and president of SolarWorld Americas. “We are continuing to serve our customers, as we have done for decades. They should read this update as yet another signal of our stable financial footing.”

SolarWorld's lenders previously extended a loan of $6 million and permitted $6 million in proceeds from the sale of a warehouse building to be used for operations. Those funds helped keep the company operational through the trade case. The latest sum of money will help the company ramp to full capacity and add about 200 employees through the third quarter of 2018.

SolarWorld Americas currently employs around 300 people, down from a high of 800. Headcount dropped dramatically last year as the company coped with financial issues. In May 2017, the manufacturer announced mass layoffs at its Hillsboro, Oregon headquarters. Earlier that month, the American firm's German-based parent company filed for insolvency.

The new $5 million loan comes just over a month after President Trump approved new tariffs on imported crystalline-silicon solar cells and modules in Section 201 trade case brought by SolarWorld Americas, in partnership with manufacturer Suniva. The new funding offers a lifeline for one of the petitioners, but it hardly amounts to the solar manufacturing renaissance some -- including President Trump -- were hoping for.

Still little news of plants reopening

On Monday, Trump said the solar industry is "reopening plants that have been closed for a long time." But that doesn't appear to be the case -- at least not yet.

Suniva has yet to show signs of a rebound. And so far no other defunct U.S.-based solar manufacturers named in the trade case (list) have announced plans to reboot operations in response to the new tariff.

To date, the only companies to announce new U.S. factories are China-based JinkoSolar and the Taiwan-based consortium United Renewable Energy. However, many of the details, including capacity and exact location, still remain unknown.

The fact that foreign companies are looking to set up shop in the U.S. confuses some of the political rhetoric around the solar trade case. In his Monday speech, President Trump called out China for inflicting pain on the U.S. solar industry, while producing lower-quality solar products.

"The 'us vs. them' rhetoric misses the complexity of modern business and manufacturing," said Morten Lund, chair of the Energy Storage Initiative and former Solar Energy Chair at law firm Stoel Rives, in an email. "Much (if not most) of the solar module manufacturing currently in the U.S. is by foreign-owned companies -- Suniva itself is Chinese-owned. Meanwhile, leading U.S. companies have manufacturing facilities in Mexico and elsewhere."

"Similarly, the recent factory announcements are mostly (if not completely) by Chinese companies or other foreign companies," he said. "Many of these factories will be operated using Chinese manufacturing equipment and Chinese management, with cells imported from China."

Given that Trump's tariffs last only four years, and it takes roughly two years to set up a solar cell manufacturing plant, all signs indicate that any new facilities would be for module manufacturing alone. That conclusion in buoyed by the fact that the new trade restrictions allow for 2.5 gigawatts of tariff-free cells, which reduces the need or incentive to build a cell plant on U.S. soil.

Has the market responded to tariffs?

Today's solar module factories are highly automated. Because they do not require many locally sourced full-time workers, "It is unlikely that the quality of modules assembled in these new U.S. facilities will be any different than that of modules assembled in Chinese facilities," Lund said.

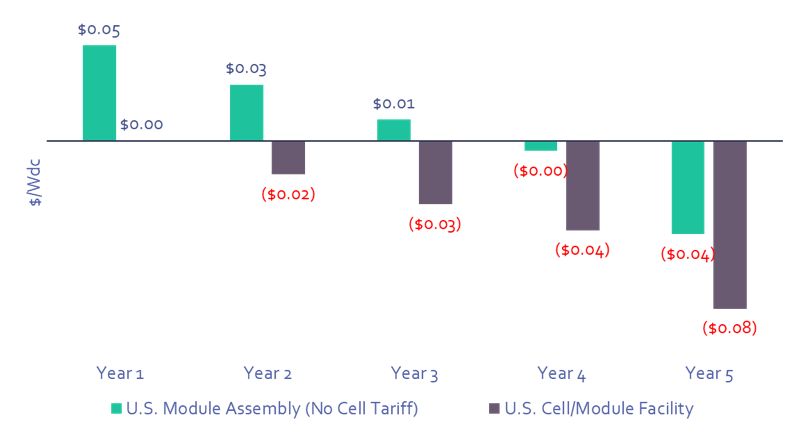

It's also unlikely that there will be many, if any, more U.S. facility announcements. The clock is already ticking on the four-year tariff, which starts at 30 percent and declines 5 percent per year. Pricing data shows that with each month the economic case erodes.

Domestic Manufacturing Price Advantage During and After Tariffs

Source: GTM Research

According to GTM Research, it will take significantly more investment in R&D along with clear, long-term policies in order for U.S. manufacturing to see a healthy recovery.

It's also worth noting that while the trade case focused on solar cell and module manufacturing, the U.S. solar energy industry is diverse and other market segments stand to suffer as a result of the tariffs. There are different kinds manufacturers, such as racking-system makers, as well as installers, electricians, roofers, engineers, developers, salespeople, advertisers, bankers, accountants, investors and more. If the new tariffs cause panel prices to increase and the market to slow, each of those sectors stands to lose.

For its part, though, SolarWorld Americas sees the tariffs as a success. Today's funding announcement shows the company's outlook has improved on the favorable outcome of the Section 201 trade case, according to CEO Stein.

"The market has responded well to the tariffs," a company press release states, "and customers continue to show strong interest in the company’s high-quality, U.S.-made products."

The effectiveness of Trump's tariffs depends on whether that interest translates to orders, and whether orders remain strong despite price impacts.

--

Join us for the 11th annual Solar Summit 2018 in San Diego, May 1-2. Powered by the unique blend of research and economic analysis from the GTM Research team, this year's agenda will feature themes from beyond traditional project finance to innovations in solar and the transformation of electricity.