A just-completed 4-megawatt project and a just-announced 2.4-megawatt project, both on land owned by the city of Lancaster, Calif., are among the first of SolarCity’s commercial projects to involve a partnership with an outside developer.

Topco is the kind of experienced developer that SolarCity’s in-house team saw as being capable of bringing in bankable commercial-scale opportunities.

Topco did all the initial work, according to Erik Fogelberg, SolarCity's VP of commercial development. It found the vacant land, made the deals with the city, created the initial array designs, and opened negotiations on the PPAs with Southern California Edison via SCE's CREST feed-in tariff program. Still, Fogelberg said, the SolarCity team had to vet every detail.

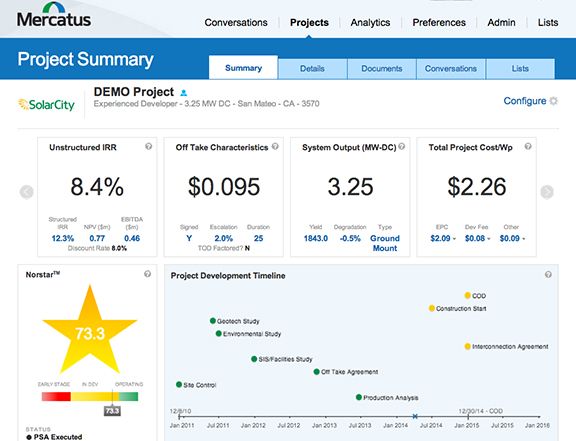

Fogelberg said that prior to the formation of the partnership, he had already begun to suspect that there had to be “a better process” by which to assess the viability of potential projects. Around the same time, he was approached by Mercatus COO Tim Buchner about that company's digital deal room.

“In my four-plus years at SolarCity, we have avoided working with third-party developers, because you can waste a lot of time on deals that will never happen,” Fogelberg said. “But there are also good ones out there.”

Fogelberg and his SolarCity development team, which has built over 1,000 commercial-scale projects in-house, agree that the Mercatus software “streamlined and optimized” the due diligence process. It also allowed them to find opportunities hidden among the many stranded projects in developers’ pipelines.

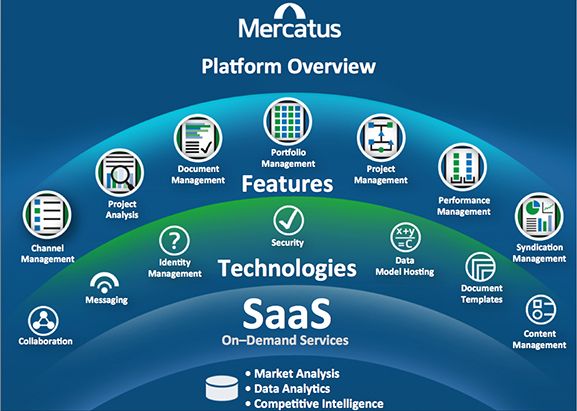

When developers’ financing gets rejected, it is often because they don’t understand how investors assess proposals, according to Mercatus CEO Haresh Patel. The software is “like an online application.” It summarizes “what investors need to know to evaluate a project.” Using the tool’s data to evaluate projects, he said, can subtract three to six weeks from the due diligence process.

SolarCity is now evaluating more than 100 megawatts of commercial deals involving outside developers. “We intend to use Mercatus going forward,” Fogelberg said. "Mercatus is a critical enabler for scaling repeatable execution between SolarCity and developers of solar assets,” said Buchner.

The two new projects, which will earn a CREST tariff rate of $0.0975 per kilowatt-hour for 20 years from SCE, keep Lancaster Mayor R. Rex Parris on track toward his goal of making the city of 156,000 “the solar capital of the universe.” Streamlined permitting and interconnection opportunities have put 110.21 megawatts of solar capacity into operation, development, and planning phases so far. That is over half of the city’s 215-megawatt peak load.

Lancaster's requirement for residential builders to provide an average of 1 kilowatt per new unit was the first such U.S. ordinance. The city currently now has 13.91 megawatts of rooftop capacity.

Installations totaling 1.45 megawatts at five city-owned facilities generated some 100 construction jobs and are cutting an average of $50,000 per year from Lancaster’s electric bill. School installations in Lancaster total 7.5 megawatts, providing 250 jobs, and rechanneling an estimated $325,000 per year in school district electricity costs to other municipal budget items like teacher and law enforcement salaries.

Partnerships with the cities of San Jacinto and Pittsburgh, California; neighboring Kern County; and nearby Edwards Air Force Base also allow Lancaster to export solar. SolarCity is committed to building 200 megawatts of residential and commercial capacity in Lancaster, and companies including Silverado Power, SunEdison, and Canadian Solar are also developing commercial projects in the area. SunPower is partnering with MidAmerican Solar on the world’s biggest solar PV installation, which will be sited nearby.